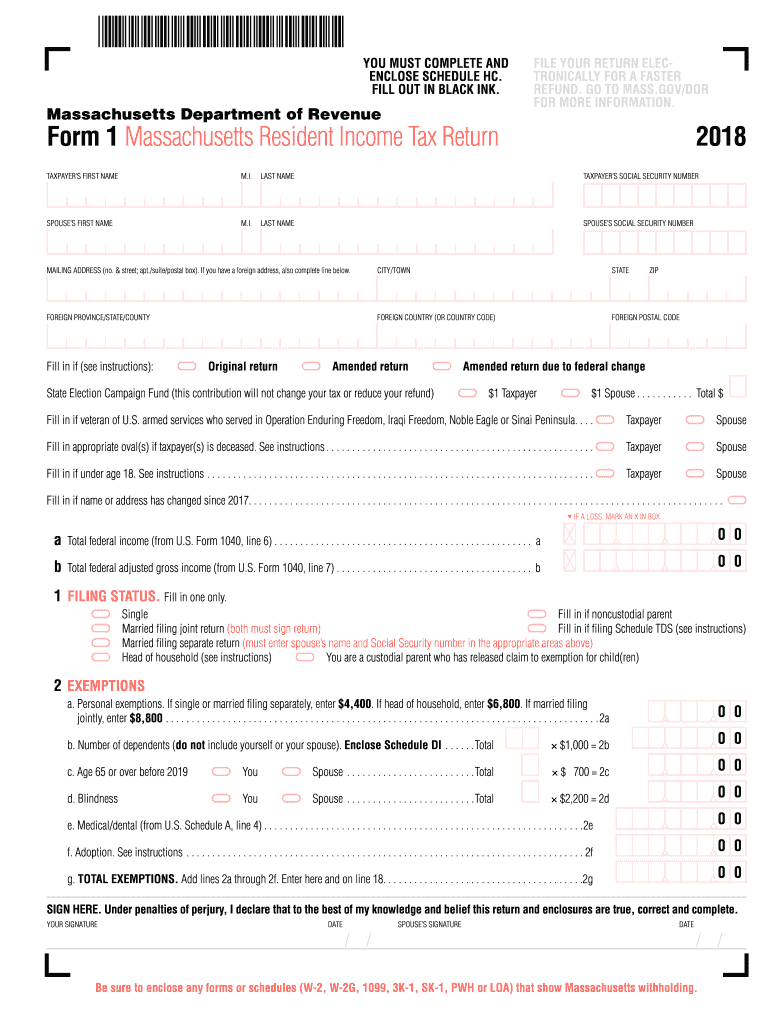

Definition and Purpose of the Massachusetts Resident Tax Form 2018

The Massachusetts Resident Tax Form 2018 is formally known as Form 1 and serves as the primary income tax return for individuals who are residents of Massachusetts. This form is designed to report income, calculate tax liability, and allow residents to claim various deductions and credits. It encompasses sections for reporting all sources of income, including wages, interest, dividends, and capital gains, as well as adjustments to income and specific Massachusetts deductions. The proper use of this form is essential for compliance with state tax laws and to ensure that taxpayers are accurately reflecting their financial situations to the Massachusetts Department of Revenue.

Key Components of Form 1

- Taxpayer Information: Includes personal details like name, address, and Social Security number.

- Income Reporting: Captures all taxable income from various sources such as employment, investments, and additional earnings.

- Deductions and Exemptions: Allows taxpayers to reduce their taxable income through applicable deductions, including those for dependents.

- Tax Credits: Provides opportunities to reduce tax liability with various credits that apply to specific situations, such as educational expenses or eligible renewable energy investments.

- Health Care Coverage: Compliance with Massachusetts health insurance mandates is documented, which may involve submitting Schedule HC.

How to Obtain the Massachusetts Resident Tax Form 2018

Obtaining the Massachusetts Resident Tax Form 2018 can be done through multiple methods, ensuring accessibility for all residents.

Available Channels for Acquisition

- Massachusetts Department of Revenue Website: The most direct method is to download Form 1 from the official Massachusetts Department of Revenue website, where the form is available for free in PDF format.

- Tax Preparation Software: Many tax software programs, including TurboTax, H&R Block, and others, automatically incorporate the Massachusetts Resident Tax Form 2018, making it easy to complete online.

- Local Post Offices and Libraries: Physical copies are often available at various community locations such as post offices and public libraries.

Steps to Complete the Massachusetts Resident Tax Form 2018

Completing the Massachusetts Resident Tax Form 2018 requires careful attention to detail. Here is a structured approach that can aid taxpayers in successfully filing their return.

Detailed Completion Process

- Gather Documentation: Collect all necessary documents, including W-2 forms, 1099s, and any documents supporting deductions or tax credits.

- Fill Out Personal Information: Enter your key identifying information, ensuring that names and Social Security numbers are accurate.

- Report Income: Include all wages, interest, dividends, and other income sources clearly, adhering to the corresponding line numbers on the form.

- Claim Deductions: Identify relevant deductions to reduce taxable income, such as those related to student loan interest or health insurance premiums.

- Calculate Tax Liability: Use the Massachusetts tax rates to compute total tax owed or refunds expected based on the income reported and deductions claimed.

- Review and Sign: Carefully proofread the completed form. Confirm all information is correct before signing the form, certifying that all provided information is true and complete.

Important Terms Related to the Massachusetts Resident Tax Form 2018

Understanding specific terminology associated with the Massachusetts Resident Tax Form 2018 can enhance the accuracy of the submission process. Here are key terms to familiarize with:

- Adjusted Gross Income (AGI): This is the total income minus specific deductions, which determines tax liability.

- Tax Exemption: A specific amount that taxpayers can deduct from their taxable income for themselves and eligible dependents.

- Tax Credit: An amount that can reduce the tax liability dollar-for-dollar, making it a more beneficial option compared to deductions, which only lower taxable income.

- Schedule HC: Health Care Information form that verifies compliance with Massachusetts health insurance mandates.

Filing Deadlines for the Massachusetts Resident Tax Form 2018

Timeliness in filing is crucial under Massachusetts tax law to avoid penalties. The filing deadline for the Massachusetts Resident Tax Form 2018 aligns with federal tax deadlines, providing clear timelines for taxpayers.

Essential Dates to Remember

- Standard Filing Deadline: Typically, April 15 of the tax year.

- Extended Filing Option: Taxpayers can apply for an automatic six-month extension, extending the filing deadline to October 15. However, any taxes owed must still be paid by the original deadline to avoid penalties.

Understanding these critical elements regarding the Massachusetts Resident Tax Form 2018 allows taxpayers to navigate their filing obligations efficiently while maximizing potential returns.