Definition and Meaning of Compleatable Massachusetts State Income Tax Forms 2009

The term "completable Massachusetts state income tax forms 2009" refers to the official documentation that Massachusetts residents were required to use for filing their state income taxes for the year 2009. These forms are designed to capture essential taxpayer information, deductions, and credits to calculate state income tax liability accurately. Key forms within this category typically include the Massachusetts Resident Income Tax Return (Form 1) and its accompanying schedules.

These forms serve several purposes:

- They ensure compliance with state tax laws.

- They allow for accurate self-assessment of taxes owed or refunds due.

- They provide the state with necessary financial data to fund public services.

Utilizing these forms properly aids in streamlining the tax submission process, thus avoiding issues related to non-compliance or inaccurate filings.

How to Use the Compleatable Massachusetts State Income Tax Forms 2009

Proper usage of the completable Massachusetts state income tax forms is crucial for an accurate tax filing. Here's how to utilize them effectively:

-

Gather Required Information:

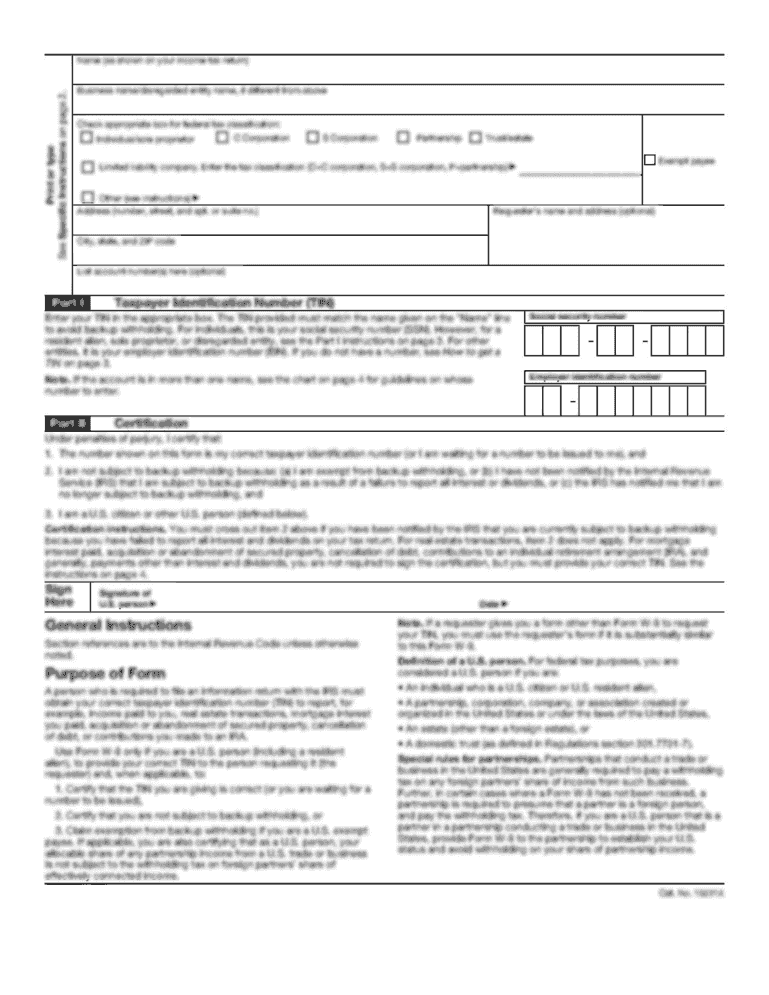

- Personal details such as name, address, Social Security number, and filing status.

- Documentation of income sources, such as W-2s, 1099s, and other earning statements.

- Information regarding deductions and credits that may be applicable, such as for student loan interest or mortgage interest.

-

Accessing the Forms:

- Forms can typically be obtained from state tax department websites or tax preparation software that includes state tax features.

-

Filling Out the Forms:

- Start with basic personal information and move sequentially through income, deductions, and credits. Each section needs to be filled out meticulously to avoid discrepancies.

- Use clear and legible handwriting if filling out forms by hand, or navigate through required fields if using an electronic version.

-

Double-Check Entries:

- Ensure all fields are completed accurately. Minor mistakes can lead to delays in processing or issues with tax agency notifications.

-

Submit on Time:

- Follow submission methods and deadlines strictly to avoid late fees or penalties.

How to Obtain the Compleatable Massachusetts State Income Tax Forms 2009

Obtaining the completable Massachusetts state income tax forms for 2009 can be done through various means:

-

State Department of Revenue Website: Residents can download the required forms directly from the Massachusetts Department of Revenue’s website. This method allows taxpayers to access the latest version of the forms.

-

Tax Preparation Software: Many tax preparation software solutions will include the ability to access and complete state-specific forms, including those for Massachusetts for the year 2009.

-

Local Tax Offices: Taxpayers can visit local tax offices or libraries where physical copies of these forms may be available.

-

Requesting by Mail: Individuals may also request forms be mailed to them by contacting the Massachusetts Department of Revenue directly.

Steps to Complete the Compleatable Massachusetts State Income Tax Forms 2009

Completing the 2009 Massachusetts state income tax forms involves a step-by-step approach:

-

Read Instructions: Begin by reviewing the instructions provided with the forms to understand specific requirements and line-by-line guidance.

-

Input Personal Information:

- Fill in basic taxpayer information, including filing status.

-

Report Income:

- Enter all income sources, ensuring that amounts from W-2 and 1099 forms are accurately transcribed.

-

Deductions and Credits:

- Identify and input any eligible deductions or credits. Use corresponding schedules if necessary to calculate these amounts.

-

Calculate Tax Due or Refund:

- Follow the provided tax tables or calculators included with the forms to determine overall tax liability or potential refund.

-

Sign and Date the Form:

- Don’t forget to sign and date the completed forms before submission.

Important Terms Related to Compleatable Massachusetts State Income Tax Forms 2009

Understanding key terms associated with the 2009 Massachusetts state income tax forms is essential for accurate filing:

-

Filing Status: Refers to the classification (e.g., single, married filing jointly) that determines tax rates and the amount of standard deduction.

-

Deductions: Specific eligible expenses that can be subtracted from gross income to reduce taxable income.

-

Credits: Amounts that can be deducted directly from the total tax owed, often reducing tax bills more significantly than deductions.

-

Social Security Number (SSN): A unique number assigned to U.S. citizens and eligible residents, crucial for identification on tax forms.

-

Tax Liability: The amount of tax that one owes to the government based on taxable income.

By being familiar with these terms, taxpayers can navigate their obligations with greater confidence and ease.

Important Dates and Deadlines for Filing 2009 Massachusetts State Income Tax Forms

Certain deadlines must be adhered to when filing taxes for the year 2009 in Massachusetts:

-

Filing Deadline: The standard deadline for filing individual income taxes is typically April 15 of the following year. For 2009 tax filings, this deadline would have been April 15, 2010.

-

Extension Requests: Taxpayers could apply for an extension, allowing until October 15, 2010, to file. However, any taxes owed were still due by the original filing deadline to avoid penalties.

-

Refund Claims: Taxpayers claiming a refund typically must file within three years of the original due date for their tax return to receive that refund. Therefore, for 2009, claims must be made by April 15, 2013.

Understanding these important dates helps ensure compliance and avoid unnecessary penalties or interest.

Form Submission Methods for the Compleatable Massachusetts State Income Tax Forms 2009

Individuals filing the 2009 Massachusetts state income tax forms have several submission options:

-

By Mail:

- Completed forms can be mailed directly to the Massachusetts Department of Revenue. Ensure forms are sent via certified mail to confirm delivery.

-

Electronic Filing:

- Many taxpayers opt to use e-filing services, which streamline the submission process, often leading to quicker processing times and refunds.

-

In-Person Filing:

- Taxpayers can also file their forms in person at designated local offices if preferred.

Considerations should be made regarding processing times based on the selected submission method, with e-filing often providing the quickest feedback regarding any issues.

Penalties for Non-Compliance with Massachusetts State Income Tax Reporting in 2009

Failure to comply with Massachusetts state income tax regulations can result in significant penalties for individuals:

-

Late Filing Penalty: Taxpayers failing to file by the designated deadline may incur a penalty equal to a percentage of the unpaid tax amount, increasing the longer the delay persists.

-

Late Payment Penalties: Incurring penalties for failing to pay taxes owed by the due date, which also accrues interest.

-

Interest on Underpayment: Interest is charged on any unpaid balance, accumulating from the original due date.

Maintaining awareness of these penalties underscores the importance of timely and accurate filing.

Examples of Using the Compleatable Massachusetts State Income Tax Forms 2009

Several scenarios can illustrate the usage of the completable Massachusetts state income tax forms:

-

Self-Employed Individuals: A small business owner would need to report business income, taking advantage of specific deductions for related expenses such as office supplies and travel.

-

Students: Students earning income may be eligible for particular credits, such as the education credit, significantly impacting their overall tax scenario.

-

Married Couples: A couple filing jointly must consolidate their income streams effectively, potentially qualifying for a higher standard deduction than filing separately.

These examples underscore the broader applicability of the tax forms and demonstrate how various taxpayer circumstances can affect tax filings.