Definition and Meaning

The 1040 Form for 2018 is a document used by U.S. taxpayers to file their annual income tax returns with the Internal Revenue Service (IRS). This form is fundamental for individuals to report their income and calculate whether they owe additional taxes or are eligible for a tax refund.

Key Elements of the 1040 Form 2018

- Filing Status: Options range from single, married filing jointly, married filing separately, head of household, to qualified widow(er) with a dependent child. Choosing the correct status impacts deductions and tax rates.

- Personal Information: This includes your name, Social Security number, and address. Ensure accuracy to avoid processing delays.

- Income and Adjustments: Compiled from various sources such as wages, dividends, capital gains, and other income streams.

- Deductions and Credits: Itemizing deductions versus taking the standard deduction can greatly impact taxable income.

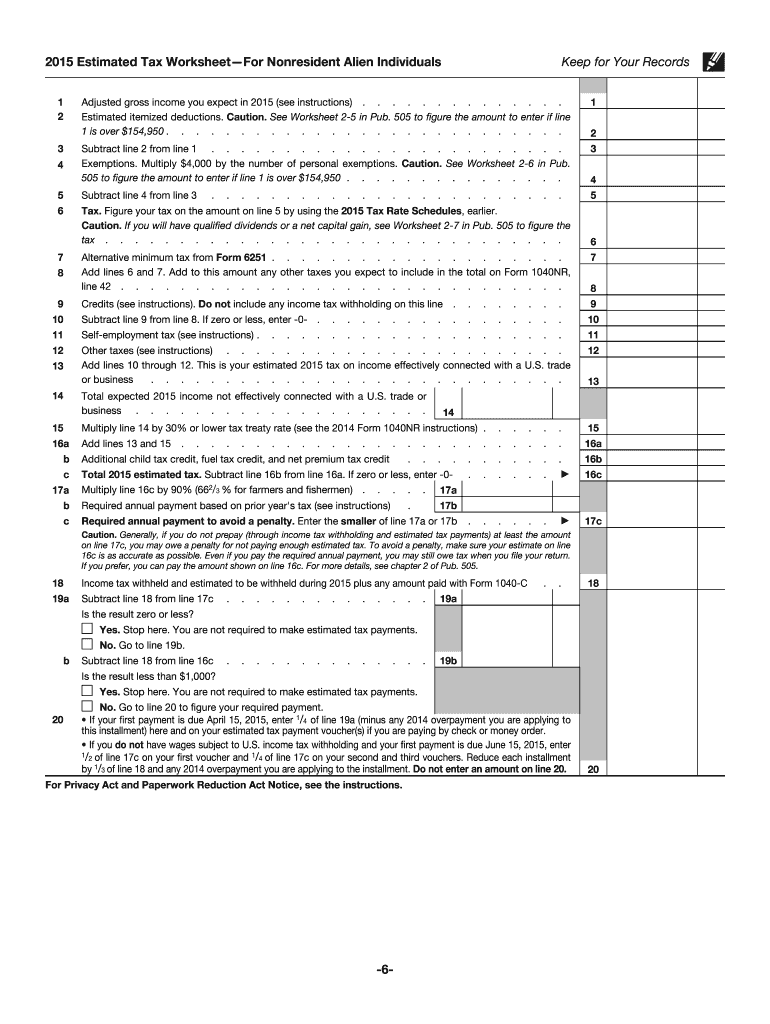

- Tax Computation: Determines the amount owed or refund due, considering withholding and estimated tax payments.

Steps to Complete the 1040 Form 2018

- Gather Documents: Collect W-2s, 1099s, previous year's tax return, receipts for deductible expenses, and records of estimated tax payments.

- Identify Filing Status: Analyze your household situation to select between the five filing statuses.

- Report Income: Input income from all sources, adjusting for any applicable exemptions or exclusions.

- Claim Deductions and Credits: Compile expenses to determine if itemizing surpasses the standard deduction.

- Calculate Taxable Income: Subtract deductions from total income; use tax tables to find corresponding tax liability.

- Review Payment and Refund Status: Compare withheld taxes and estimated payments against total owed tax.

Examples

- Single filers earning under $24,000 should review whether the standard deduction meets their financial advantage over itemization.

- Families with dependents may be eligible for additional credits reducing their overall tax liability.

How to Obtain the 1040 Form 2018

The IRS provides several avenues for accessing the 1040 Form:

- Download from IRS website: Available in PDF for easy print and completion.

- Request by Mail: Call the IRS or request online to receive a physical copy.

- Local Libraries and Post Offices: Often stock tax forms during the filing season.

Why Use the 1040 Form 2018

Utilizing the 1040 Form is critical for complying with federal tax obligations:

- Legal Obligation: Failure to file can lead to penalties.

- Financial Planning: Offers insight into financial status, influencing savings and expenditure decisions.

Important Terms Related to 1040 Form 2018

Familiarity with certain terms enhances form accuracy:

- Adjusted Gross Income (AGI): Total income minus specific adjustments, foundational for calculating taxable income.

- Tax Credits: Direct reductions from tax owed, such as the Earned Income Tax Credit.

- Standard Deduction: A fixed amount reducing taxable income, its value varying by filing status.

IRS Guidelines for 1040 Form 2018

Adhering to IRS guidelines ensures accurate completion and aids in avoiding filing complications:

- Filing Deadline: Typically April 15, but can extend if date falls on a weekend or holiday.

- Extensions: Available by filing Form 4868, granting up to six more months for submission.

- Accuracy: Double-check numbers and calculations; errors can trigger audits or amend forms requiring correction.

Filing Deadlines and Important Dates

Knowing crucial dates is essential to remain compliant:

- Regular Filing Deadline: April 15, 2019. Falling on a weekend or legal holiday shifts the deadline to the next business day.

- Extended Filing: File an extension by the April due date to extend filing until October 15, 2019.

Required Documents for 1040 Form 2018

Preparation minimizes delays and errors:

- W-2 Forms: Capturing wages from employers.

- 1099 Series Forms: Documenting miscellaneous income types, including interest and dividends.

- 1098 Forms: Reporting mortgage interest and potential educational tax benefits.

Form Variants (Related and Older Versions)

Understanding variations of the 1040 Form can clarify appropriate use:

- 1040A and 1040EZ: Simpler versions for taxpayers with less complex financial circumstances. Discontinued after 2018 reforms.

- 1040-SR: Tailored for older taxpayers with simplified filing needs.

- 1040-NR: Used by nonresident aliens obligated to report U.S. income.

Who Typically Uses the 1040 Form 2018

The 1040 Form is the most versatile tax tool for:

- Employees and Contractors: Reporting wages, salaries, and independent work.

- Self-Employed Individuals: Declaring income and expenses from business operations.

- Investors: Reporting dividends and capital gains from investments.

Incorporating a comprehensive understanding of the 1040 Form 2018 ensures accuracy in filing, maximizes potential refunds, and maintains compliance with IRS regulations.