Definition & Meaning

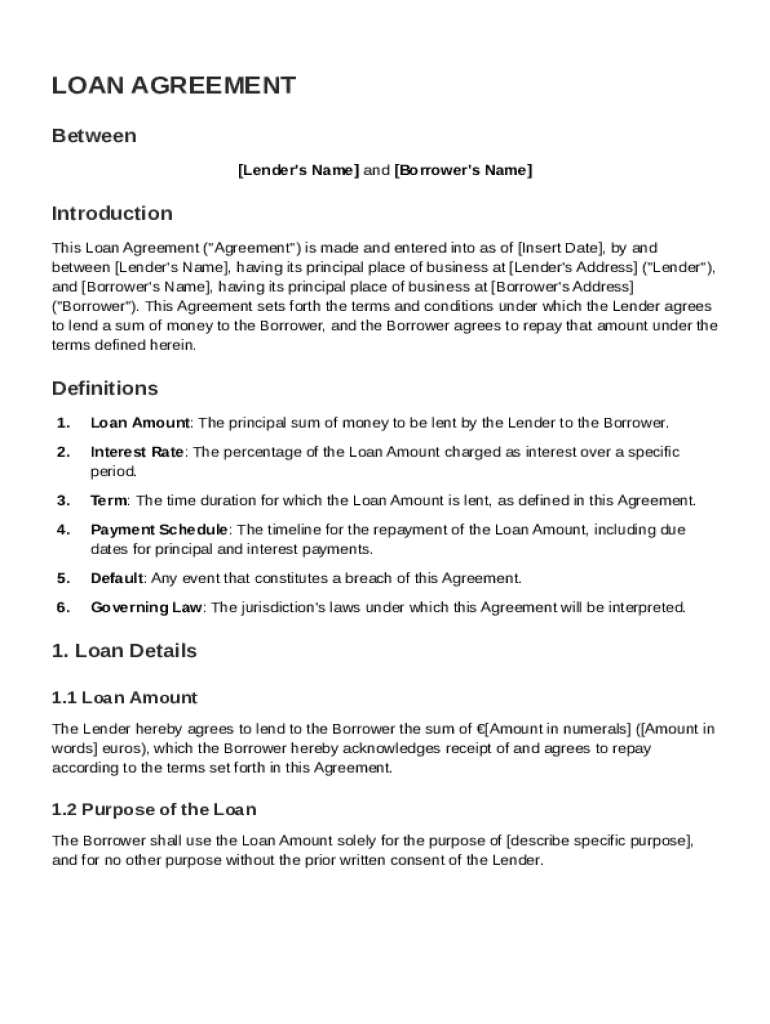

The Loan Netherlands Agreement Template is a formal document that outlines the contractual terms between a lender and a borrower. This legal instrument specifies key components such as the loan amount, interest rate, repayment schedule, and conditions under which the loan is offered. By clearly defining the rights and obligations of both parties, the agreement ensures that the borrower understands their responsibilities, and the lender is protected against potential defaults. It serves as a binding legal document that provides clarity and security within the scope of Dutch financial laws.

Key Elements of the Loan Netherlands Agreement Template

Understanding the fundamental components of the Loan Netherlands Agreement Template is essential for both parties involved:

- Loan Amount and Purpose: Specifies the principal amount and what the funds will be used for.

- Interest Rate: Details the cost of borrowing, expressed as a percentage of the principal amount.

- Repayment Terms: Provides the timeline and method for repaying the loan, including frequency and amounts.

- Security: Identifies any collateral or guarantees required to secure the loan.

- Default and Remedies: Outlines what constitutes a default and the remedies available to the lender.

These elements collectively form the backbone of the agreement, ensuring a smooth transaction and clear expectations.

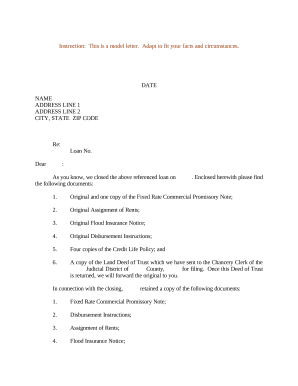

How to Use the Loan Netherlands Agreement Template

Using the Loan Netherlands Agreement Template involves several steps to tailor the document to specific needs:

- Download the Template: Obtain the template from a trusted source, such as a document management platform.

- Review and Customize: Thoroughly read the template, ensuring all sections align with the terms agreed upon by both parties.

- Insert Specific Details: Fill in the necessary information, such as names, addresses, loan amount, and repayment schedule.

- Seek Legal Advice: Consult a legal professional to ensure the document complies with Dutch law.

- Sign and Distribute: Once finalized, both parties need to sign the document to make it legally binding.

Legal Use of the Loan Netherlands Agreement Template

The legal enforceability of the Loan Netherlands Agreement Template requires compliance with Dutch statutes governing financial and contractual obligations. Key considerations include:

- Legislation Compliance: Ensures the agreement adheres to national regulations.

- Authenticity: Involves correct identification of parties and genuine consent.

- Document Registration: Necessary for certain high-value loans or secured agreements.

Adhering to these legal guidelines guarantees the document's validity, offering protection to both lender and borrower.

Who Typically Uses the Loan Netherlands Agreement Template

The Loan Netherlands Agreement Template is commonly utilized by:

- Financial Institutions: Banks and credit companies offering loans to individuals or businesses.

- Private Lenders: Individuals providing personal loans to acquaintances or relatives.

- Businesses: Companies seeking financial assistance for operational expansion or capital investment.

These entities benefit from the template as it facilitates clear, enforceable agreements that reduce the risk of misunderstandings.

Steps to Complete the Loan Netherlands Agreement Template

Completing the Loan Netherlands Agreement Template is straightforward when approached systematically:

- Gather Information: Compile necessary personal, financial, and loan-specific details.

- Fill in Personal Information: Include names, addresses, and contact information for all parties.

- Specify Terms: Clearly state the loan amount, repayment schedule, interest rates, and any security or collateral details.

- Review for Accuracy: Ensure all information is correct and the document reflects the agreed terms.

- Sign and Execute: Finalize the document with signatures from all involved parties ensuring it is legally binding.

Important Terms Related to Loan Netherlands Agreement Template

Familiarity with important terms used in the Loan Netherlands Agreement Template enhances comprehension and negotiation of its terms:

- Amortization: Schedule detailing the periodic repayment of principal and interest.

- Principal: The initial amount of money borrowed, excluding interest.

- Covenant: A clause outlining certain actions that the borrower must adhere to or refrain from.

- Grace Period: The time allowed for payment without incurring penalties.

- Acceleration Clause: Allows the lender to demand full repayment upon certain triggers.

Understanding these terms will enable more effective communication between parties and reduce the possibility of disputes.

Software Compatibility

For those leveraging technology to manage financial documents, the availability and compatibility of digital solutions play a vital role. Popular software like DocHub supports formats such as PDF, DOC, and XLS, making it efficient for users to edit, manage, and sign Loan Netherlands Agreement Templates. Compatibility with cloud storage services ensures flexibility and ease of access, streamlining the loan agreement process.

Examples of Using the Loan Netherlands Agreement Template

Real-world scenarios illustrate the versatility of the Loan Netherlands Agreement Template:

- Personal Loans: An individual borrows money from a friend to fund a home renovation, formalizing terms with the template.

- Business Expansion: A company needing capital for new equipment uses the template to secure a loan from a financial institution.

- Vehicle Financing: Consumers purchasing vehicles on finance agreements benefit from transparent terms using the template.

These examples highlight the practical applications of the template across different loan types, ensuring clarity and legal protection for all parties involved.

Versions or Alternatives to the Loan Netherlands Agreement Template

While the Loan Netherlands Agreement Template is comprehensive, there may be variations or alternatives better suited for specific scenarios:

- Simple Loan Agreement: For straightforward personal loans with fewer terms.

- Secured Loan Agreement: Includes provisions for collateralized loans.

- Revolving Credit Agreement: Suitable for businesses with variable borrowing needs.

Selecting an appropriate version aligns the agreement with the complexity of the transaction and the risk profile of the lending involved.