Definition and Meaning of Form 943

Form 943, known as the Employer’s Annual Federal Tax Return for Agricultural Employees, is a document required by the Internal Revenue Service (IRS) for employers who actively engage in agricultural activities and hire agricultural workers. This form is used to report federal tax obligations, including Social Security and Medicare taxes that have been withheld from the wages of farm employees. Understanding the significance and requirements of this form is crucial for those operating in the agricultural sector, as it ensures compliance with federal tax regulations.

Key Components of Form 943

- Wages Reporting: Employers must provide detailed information about all wages paid to agricultural workers.

- Tax Withholding: Both Social Security and Medicare taxes withheld from employees’ wages should be reported.

- Tax Credits: Any available tax credits that relate to agricultural labor must be included.

How to Use Form 943

Employers in the agricultural sector should use Form 943 to annually report their federal tax contributions for their employees. It is essential for maintaining legal compliance and avoiding penalties. This form is applicable for farms, ranches, and other entities involved in agricultural production where workers earn wages subject to Social Security and Medicare taxation.

Step-by-Step Instructions

- Gather Information: Collect data related to the wages paid to agricultural employees and taxes withheld.

- Tax Calculation: Use IRS guidelines to calculate the correct amount of tax to report.

- Form Completion: Fill in all necessary sections of the form accurately.

- Double-Check Details: Ensure all figures and personal information are correct before submission.

How to Obtain Form 943

Form 943 can be easily accessed through several platforms to facilitate its acquisition.

Methods to Acquire the Form

- IRS Website: Download the form directly from the IRS official website.

- Local IRS Office: Obtain a physical copy by visiting a nearby IRS office.

- Tax Software: Some tax preparation software also includes Form 943.

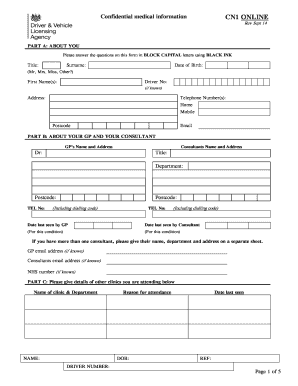

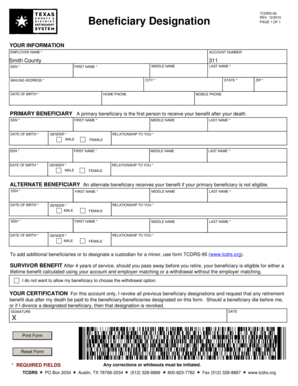

Steps to Complete Form 943

Completing Form 943 requires careful adherence to IRS instructions to ensure all required information is reported accurately.

Detailed Procedure

- Identify Employer Information: Fill in the employer’s name, address, and employer identification number (EIN).

- Report Wages: Enter total agricultural wages paid.

- Calculate Taxes: Calculate and enter the total Social Security and Medicare taxes.

- Adjust for Credits and Overpayments: Include any credits that apply and adjust for overpayments if necessary.

- Sign and Date: Ensure the form is signed and dated by an authorized person.

Who Typically Uses Form 943

The use of Form 943 is specific to agricultural operations employing individuals in this industry. Employers who pay wages to farm workers use this form to report and manage their tax obligations.

Common Users

- Farm Owners: Both large-scale farms and smaller family-run operations.

- Ranches: Ranchers employing workers for livestock care.

- Agricultural Partnerships and Corporations: Entities structured as partnerships or corporations involved in agriculture.

Key Elements of Form 943

Several critical elements within Form 943 are necessary for completing the document correctly and ensuring compliance with tax regulations.

Essential Sections

- Employer Information: Must be completed with precision to avoid processing errors.

- Total Wages and Deposits: Accurate figures are necessary to avoid discrepancies with the IRS.

- Tax Liability and Payment History: Provides a comprehensive overview of the year’s tax details.

IRS Guidelines for Form 943

Adhering to the IRS guidelines for Form 943 is essential for accurate completion and timely submission.

Important Points

- Filing Requirements: Understand the IRS thresholds for filing.

- Guidance and Instructions: Follow the step-by-step instructions provided by the IRS.

- Payment Procedures: Be aware of payment methods and deadlines.

Filing Deadlines and Important Dates

Staying informed about filing deadlines is crucial for preventing penalties and ensuring that all tax-related responsibilities are met.

Critical Timelines

- Annual Deadline: Form 943 must be filed by January 31st following the year for which you are reporting.

- Payment Dates: Any taxes owed should be paid by the filing deadline to avoid penalties.

- Extension Requests: Learn how to request an extension if additional time is needed.

Penalties for Non-Compliance

Failing to file Form 943 or comply with its requirements can result in significant penalties.

Potential Consequences

- Late Filing Penalties: Fees imposed for missing the filing deadline.

- Inaccuracies: Additional penalties for misreported figures.

- Interest on Unpaid Taxes: Charges accrue on unpaid taxes from the due date.

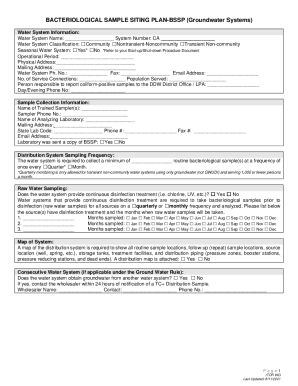

Required Documents for Form 943 Submission

Submitting Form 943 requires certain supporting documents to verify the information reported.

Necessary Documentation

- Payroll Records: Essential for confirming wage figures.

- Tax Deposit Receipts: Provide proof of fulfilled tax deposits.

- Employer Records: Maintain a record of all wages paid and taxes withheld.

By offering a comprehensive understanding of Form 943, employers in the agricultural sector can ensure they meet federal requirements, therefore maintaining their business operations smoothly without disruptions from tax-related issues.