Definition and Purpose of Form 943

Form 943, known as the Employer's Annual Federal Tax Return for Agricultural Employees, is designed for employers who hire agricultural labor. This form is necessary for reporting federal income tax withheld and both employer and employee shares of Social Security and Medicare taxes. Understanding this form is crucial for ensuring agricultural-specific payroll compliance with the Internal Revenue Service (IRS) guidelines. Employers are required to provide details concerning total wages paid to their agricultural workers and the corresponding taxes withheld, making this form an essential component of their annual filing responsibilities.

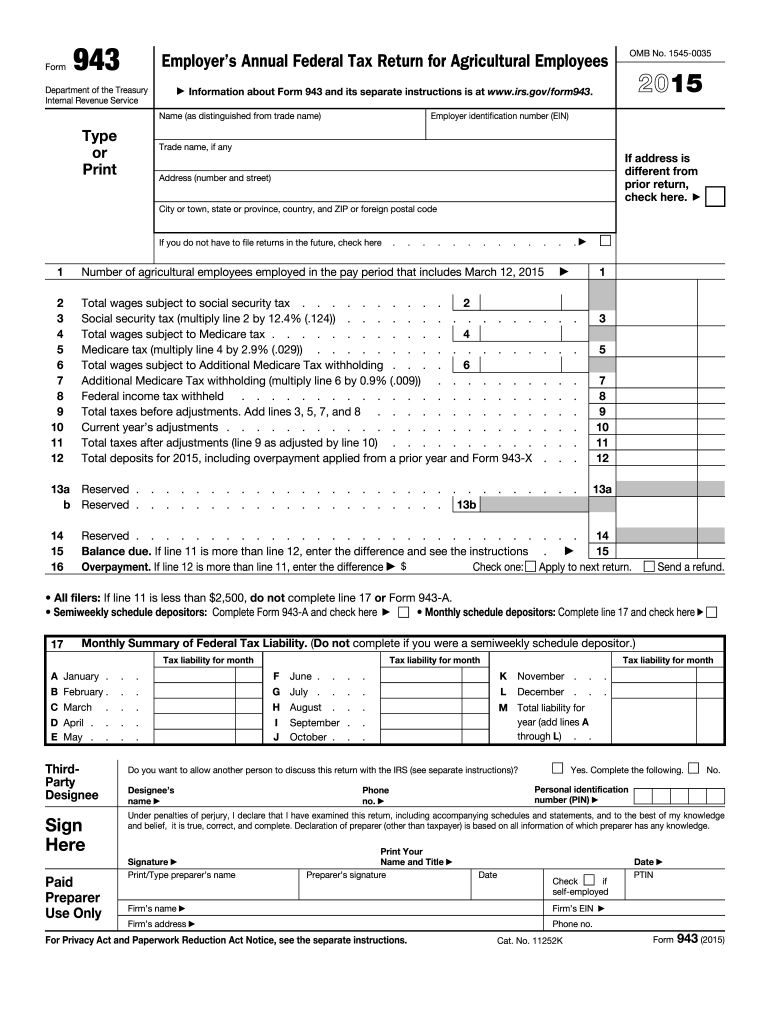

How to Use Form 943 for the Year 2015

Using Form 943 for the 2015 filing requires employers to accurately report wages and taxes for that year. Employers should ensure they have all wage statements and have calculated the appropriate Social Security and Medicare contributions. This form must capture all employee details and withholdings applicable for the calendar year 2015. It is crucial to confirm that the calculations reflect the correct rates for that year, noting any changes to tax rules or thresholds that might have been implemented in 2015.

Steps to Complete the 943 Form 2015

- Employer Identification: Enter the employer identification number (EIN), name, trade name, and address.

- Total Wages: Report total cash wages paid to agricultural employees.

- Calculate Taxes: Detail both employer and employee portions of Social Security and Medicare taxes.

- Tax Deposits and Due: Report any tax deposits already made and calculate the remaining balance due.

- Signature: Ensure that the form is signed by an authorized individual, validating the information provided.

These steps must be followed carefully to ensure that the submission is accurate and complete, reflecting all the relevant tax liabilities and payments for the specified year.

Important Terms Related to Form 943

- FICA Tax: Federal Insurance Contributions Act tax, which encompasses both Social Security and Medicare taxes.

- EIN: Employer Identification Number, a unique identifier for businesses, required for form submission.

- Agricultural Employees: Workers hired in farming activities, whose income must be reported using Form 943.

- Withholding: The amount of income tax an employer withholds from employees' wages and salaries.

Understanding these terms is fundamental for effectively completing and filing Form 943, as they relate directly to the computations and requirements of the form.

Filing Deadlines and Important Dates for 943 Form 2015

The Form 943 for the year 2015 was due by January 31, 2016. If all taxes were deposited on time, with no unpaid tax liability, the deadline was extended to February 10, 2016. It is essential for employers to meet these deadlines to avoid late fees and penalties, which the IRS assesses for any forms or payments not submitted on time.

IRS Guidelines for Form 943

To comply with IRS guidelines, employers must ensure all wage and tax calculations align with federal rules. Changes to tax legislation that occurred during 2015 must be acutely reflected in the form's completion. Utilizing IRS-provided publications, which explain the specifics of tax withholding and employer contributions, can greatly aid in accurately adhering to these guidelines.

Penalties for Non-Compliance with Form 943

Failing to file Form 943 or misreporting tax information can lead to significant penalties. The IRS applies fines for late submissions, inaccurate reporting, and any underpayments of tax liabilities. Employers should ensure their records are complete and accurate, and that any discrepancies are promptly addressed with the IRS to mitigate possible penalties.

Form Submission Methods: Online, Mail, and Manual

Employers can submit Form 943 online through the IRS e-file system, which offers an efficient and secure transmission. Alternatively, forms may be mailed directly to the IRS. It is important to decide on a submission method early in the process to ensure all filing requirements are met by the respective deadline, and that proper documentation accompanies the submission.

This comprehensive guide ensures all relevant aspects of using and filing Form 943 for 2015 are covered, promoting compliance and accuracy in reporting.