Definition & Meaning

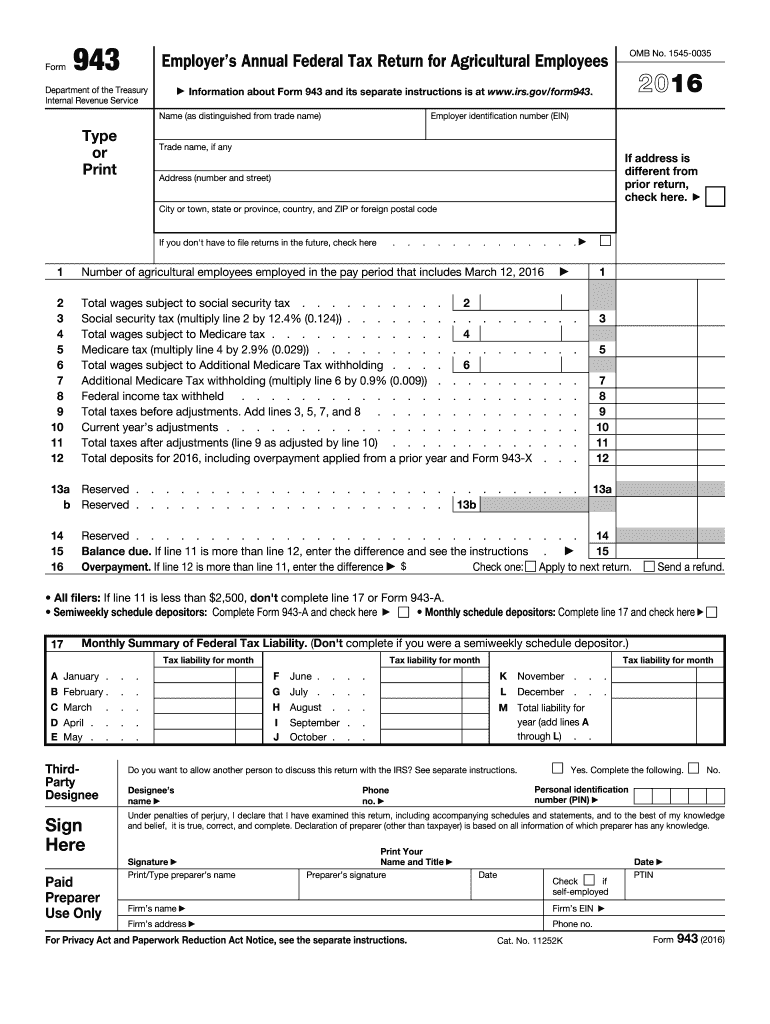

Form 943, officially titled "Employer's Annual Federal Tax Return for Agricultural Employees," is utilized by employers to report agricultural employment taxes. This specific form is designated for use in the 2016 tax year. It requires employers to detail wages paid to agricultural workers and the respective Social Security and Medicare taxes withheld.

Agricultural employers must use this form to keep accurate accounts of their yearly tax obligations. It serves as a critical record-keeping instrument for the Internal Revenue Service (IRS) and plays an essential role in ensuring employers fulfill their tax responsibilities pertaining to employees classified within the agricultural sector.

How to Use Form 943 for 2016

Employers need to complete Form 943 annually to declare Social Security, Medicare, and withheld income taxes drawn from their agricultural employees' wages. The process involves accumulating data over the year, ensuring that all taxable wages and withholdings are accurately calculated and reported.

- Gather Employee Information: Begin by collecting relevant data for each agricultural employee, including total wages paid and taxes withheld.

- Calculate Taxes: Utilize the accumulated wage data to determine the Social Security and Medicare taxes due. Special calculations may be necessary for employees exempt from these taxes.

- Complete Form Fields: Fill out each section of the form with the relevant calculations and details about the employer and employees.

- Sign and Date: Ensure the form is officially signed and dated before submission to authenticate the filing.

Steps to Complete Form 943 for 2016

Follow these steps to accurately fill out Form 943 for 2016:

- Employer Information: Enter the employer's identifying information, including the Employer Identification Number (EIN), business name, and address.

- Total Wages Reporting: Report the sum of all wages paid to agricultural employees during the year.

- Tax Computations: Use the IRS tax tables to calculate the total amount of Social Security and Medicare taxes due.

- Adjustments: Account for any adjustments necessary for sick pay, tips, or group-term life insurance.

- Payment Reconciliation: Match the taxes due on the form with deposits or payments already made.

- Signature: The employer, or an authorized representative, should sign and date the document to validate the submission.

IRS Guidelines and Filing Deadlines

The IRS mandates that Form 943 be filed annually by employers of agricultural workers. It is critical to adhere to the deadlines to avoid penalties.

- Annual Filing Deadline: Typically, employers must submit this form by January 31 of the year following the tax year being reported.

- Guidelines for Amendments: Amend any errors on the initial submission by filing Form 943-X, ensuring all corrections are fully documented per IRS standards.

Who Typically Uses Form 943 for 2016

Form 943 is predominantly used by businesses that employ workers for farming activities, including:

- Farms and Ranches: Employing labor for tasks like planting, harvesting, or livestock management.

- Nurseries and Greenhouses: Engaging individuals in the cultivation and selling of trees, plants, or flowers.

- Orchards and Vineyards: Utilizing seasonal workers for fruit and grape production.

Organizations involved in these sectors rely on Form 943 to maintain compliance with tax reporting obligations specific to agricultural employment.

Key Elements of Form 943 for 2016

Form 943 includes several crucial sections that require accurate completion:

- Employer Identification: This includes the EIN and basic business identification details.

- Wage Reporting: Summing all taxable wages specific to agricultural laborers.

- Tax Calculations: Details on Social Security and Medicare tax computations.

- Signatures: Proper authorization is required for validation.

Each of these elements plays a pivotal role in ensuring that the employer's tax obligations are clearly and accurately communicated to the IRS.

Penalties for Non-Compliance

Failing to accurately complete and file Form 943 can result in significant penalties:

- Late Filing: Penalties may accrue for each month the form is overdue.

- Underpayment of Taxes: Additional charges might apply if the reported taxes are less than what is owed based on IRS calculations.

- Accuracy-Related Penalties: Incorrect reporting of data or miscalculations can lead to further financial repercussions as mandated by IRS regulations.

Timely and precise completion of Form 943 is essential to avoid these costly penalties, ensuring compliance with federal tax laws.

Digital vs. Paper Version

Employers have the option to file Form 943 either digitally or via paper submission:

- Digital Filing: Offers convenience and a potentially faster processing time. Tools such as IRS e-file services enable online submissions, often minimizing errors through automated checks.

- Paper Filing: Traditional method for those without reliable computer access or preference for physical documentation. Requires mailing the completed form to the designated IRS address.

Both methods require meticulous entry of information, though digital filing typically offers more safeguards against inaccuracies.