Definition and Meaning of the 1120 Schedule D

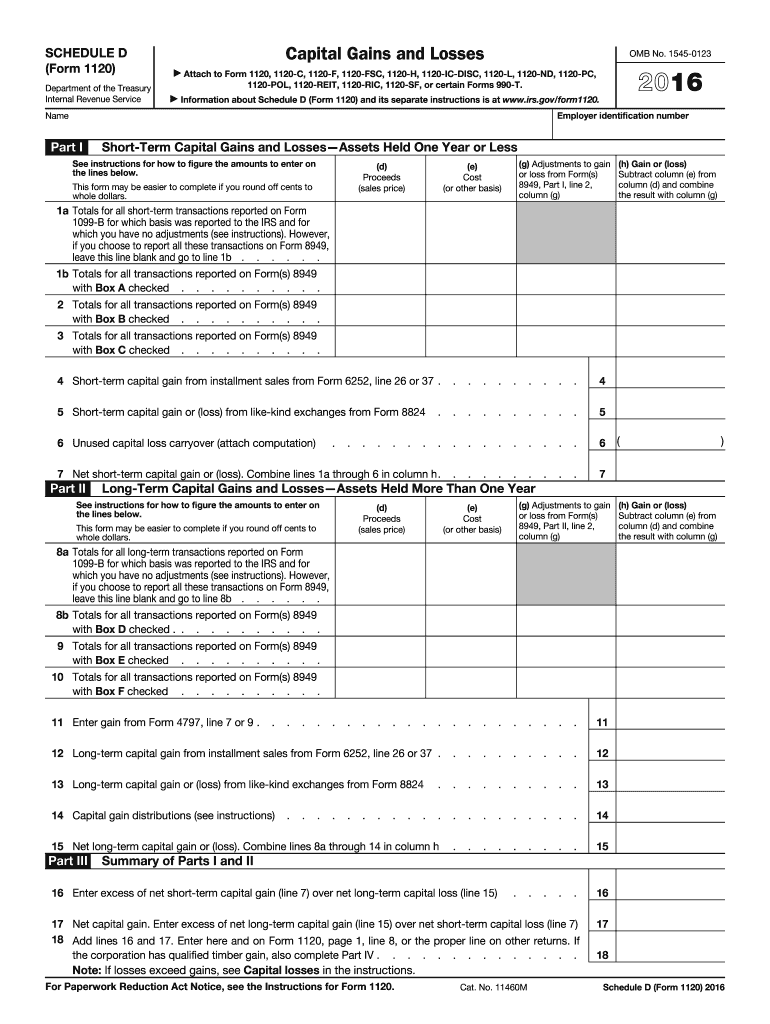

The 1120 Schedule D is a crucial tax form utilized by corporations in the United States to report capital gains and losses. This form is integral to the overall reporting process for corporations, as it specifically monitors income derived from the sale or exchange of capital assets.

- Capital Gains: These occur when the selling price of an asset exceeds its original purchase price. Corporations must report both short-term and long-term capital gains on this form.

- Capital Losses: These are losses incurred when an asset is sold for less than its purchase price. Reporting these losses can offset gains and potentially reduce the corporation's overall tax liability.

The 1120 Schedule D is part of the specific tax obligations for corporate entities and should be filed annually in tandem with the standard Form 1120.

How to Use the 1120 Schedule D

Using the 1120 Schedule D involves several steps to accurately report capital gains and losses. Understanding the structure and requirements of the form is vital.

- Determine your transactions: Identify all capital asset transactions, including sales, exchanges, and losses. This encompasses stocks, bonds, real estate, and other investments.

- Complete the form sections: The form typically includes sections for both short-term and long-term gains and losses. Fill in the relevant details for each transaction as specified.

- Calculate totals: Sum up all gains and losses from the respective sections to determine your overall capital gain or loss for the reporting period.

- Transfer to Form 1120: Use the totals from Schedule D to report the findings on your Form 1120, ensuring consistency and accuracy across your tax submissions.

Each corporation may have different types of transactions, and ensuring thorough and accurate reporting is necessary for compliance.

Steps to Complete the 1120 Schedule D

Completing the 1120 Schedule D requires diligence and attention to detail. The following steps outline the process:

- Gather Documentation: Collect all relevant documents, including sales records, purchase receipts, and transaction statements.

- Categorize Transactions: Separate transactions into short-term and long-term based on the holding period of the assets.

- Short-Term: Assets held for one year or less.

- Long-Term: Assets held for more than one year.

- Fill out the Form:

- Part I: Report short-term capital gains and losses.

- Part II: Report long-term capital gains and losses.

- Calculate Net Gains or Losses: Determine your net short-term and net long-term gains or losses. If required, detail each individual transaction if you have numerous entries.

- Transfer Relevant Figures: Input your calculated totals into Form 1120, ensuring all sums are accurate and reflect the transactions reported on Schedule D.

These steps ensure that your reporting is concise, accurate, and compliant with IRS regulations.

Important Terms Related to the 1120 Schedule D

Familiarity with specific terms related to the 1120 Schedule D can enhance understanding and ensure proper reporting. Here are several critical terms:

- Capital Assets: Assets held for investment, such as stocks and real estate, that can appreciate in value.

- Basis: The cost of acquiring an asset, which is used to measure gain or loss upon sale.

- Holding Period: The duration for which an asset is owned. It is crucial for determining if gains or losses are classified as short-term or long-term.

- Net Capital Gain: The total capital gains minus any capital losses. This is the amount subject to taxation.

Understanding these terms can assist in navigating the completion of the 1120 Schedule D with greater ease and precision.

IRS Guidelines for Using the 1120 Schedule D

The IRS provides specific guidelines for completing and filing the 1120 Schedule D. Adhering to these guidelines is essential for compliance:

- Filing Frequency: The Schedule D must be submitted annually with the main Form 1120, which aligns with the corporation's tax filing.

- Accuracy: Corporations must ensure the accuracy of all calculations and reporting to avoid penalties.

- Record Keeping: Maintain detailed records of all transactions, including receipts and documentation for the assets sold. The IRS recommends retaining records for at least three years.

- Special Circumstances: Certain transactions, such as installment sales or like-kind exchanges, have specific reporting requirements that must be followed as outlined by the IRS.

Being aware of these guidelines fosters adherence to tax obligations and helps minimize the risk of audits or penalties due to improper filing.

Filing Deadlines for the 1120 Schedule D

Understanding when to file the 1120 Schedule D is critical for compliance. Here are the general deadlines:

- Annual Deadline: The 1120, along with Schedule D, must be filed by the 15th day of the fourth month following the end of the corporation's tax year.

- Extensions: Corporations can file for an extension, allowing an additional six months. However, any taxes owed are still due by the original deadline to avoid interest and penalties.

Timely submission of the 1120 Schedule D is vital to ensure that the corporation remains in good standing with the IRS.