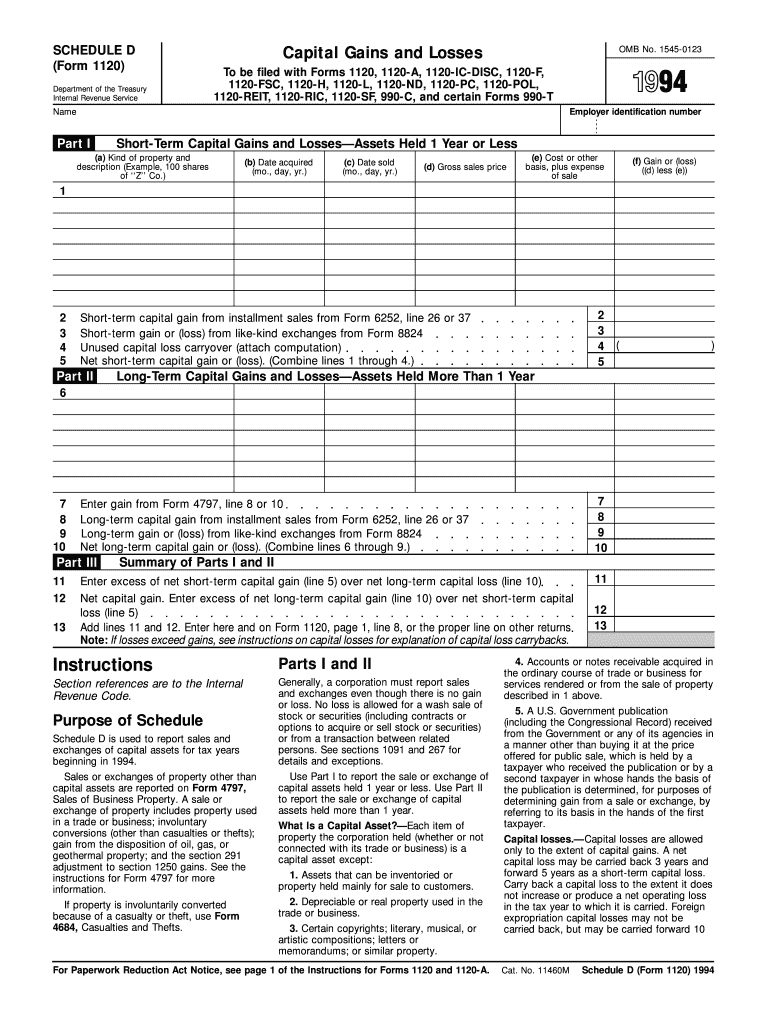

Definition & Meaning of the 1994 Form 1120

The 1994 Form 1120, known as the U.S. Corporation Income Tax Return, is a federal tax form that corporations in the United States must file to report their income, gains, losses, deductions, and credits. This form captures a corporation's financial activities for the tax year and ultimately determines its tax liability. It is vital for ensuring compliance with tax regulations while providing the IRS with essential financial data about corporate operations.

Corporations utilizing the 1994 Form 1120 typically include entities formed under state law, such as C corporations, that operate for profit. The form requires detailed financial information, including income derived from various sources, allowable deductions, and total tax payable. Understanding how to correctly fill out and file this form is crucial for organizations to avoid penalties and ensure accurate tax reporting.

Key Elements of the 1994 Form 1120

The 1994 Form 1120 consists of several key sections that require comprehensive reporting. These include the following elements:

-

Income Section: Corporations report all sources of income, including gross receipts or sales, dividends, interest, rents, and royalties. Accurate reporting of all income sources is crucial, as it forms the basis for determining the total taxable income.

-

Deductions: This section outlines allowable business expenses, such as salaries, advertising, and costs of goods sold. Deductions directly affect overall taxable income, enabling corporations to reduce their tax burden.

-

Tax and Payments: After calculating the total tax due based on the income and deductions, corporations report any estimated tax payments made throughout the year.

-

Schedule C: This section allows for the reporting of specific information relating to corporations with net operating loss carryovers from previous years or various credits the corporation may qualify for.

Understanding these elements is essential for accurate completion of the form. Each section must be filled in detail to reflect the corporation's financial situation completely.

Steps to Complete the 1994 Form 1120

Filling out the 1994 Form 1120 requires several methodical steps to ensure accuracy and compliance:

-

Gather Financial Records: Collect all necessary financial documents, including income statements, balance sheets, and prior tax returns.

-

Fill Out Basic Information: Begin with the corporation's name, address, and Employer Identification Number (EIN). Ensure this information is accurate to avoid processing delays.

-

Report Income:

- List all income sources.

- Ensure that gross sales and receipts are reported before any deductions.

-

Document Deductions:

- Carefully document all business-related expenses.

- Categorize expenses accurately to comply with IRS regulations.

-

Calculate Taxable Income: Deduct total expenses from total income to determine the taxable income, which will then be used to calculate the tax owed.

-

Complete Schedules: If applicable, complete additional schedules detailing carryovers, credits, or even specific deductions.

-

Review for Accuracy: Double-check all figures and ensure that all schedules are included.

-

File the Form: Submit the completed form by the required deadline to avoid penalties.

Following these steps diligently will help ensure that the form is completed accurately and submitted on time.

How to Obtain the 1994 Form 1120

Corporations can obtain the 1994 Form 1120 from several sources. The primary methods include:

-

IRS Website: The form can be downloaded directly from the IRS website. It is available in a PDF format and can be printed for completion.

-

Tax Preparation Software: Many commercial tax software programs, such as TurboTax and QuickBooks, provide the 1994 Form 1120 as part of their filing packages. These platforms often include guided walkthroughs for completion.

-

Local IRS Office: Corporations can also visit local IRS offices to request a physical copy of the form.

Using these methods ensures that filers have the most current version of the form, which is critical for compliance with federal regulations.

Important Terms Related to the 1994 Form 1120

Familiarity with essential tax terms is vital for completing the 1994 Form 1120 accurately. Key terms include:

-

Tax Liability: The total amount of tax a corporation is required to pay based on its taxable income.

-

Net Operating Loss (NOL): A situation where a corporation's allowable deductions exceed its taxable income. This can affect tax filings in future years if the loss can be carried back or forward.

-

Estimated Tax Payments: Prepayments made towards expected tax liabilities for the current year to avoid underpayment penalties.

-

Tax Credits: Reductions in the tax amount that a corporation may qualify for based on certain activities or investments.

Understanding these terms allows corporations to navigate the tax reporting process effectively while ensuring accurate completion of the 1994 Form 1120.