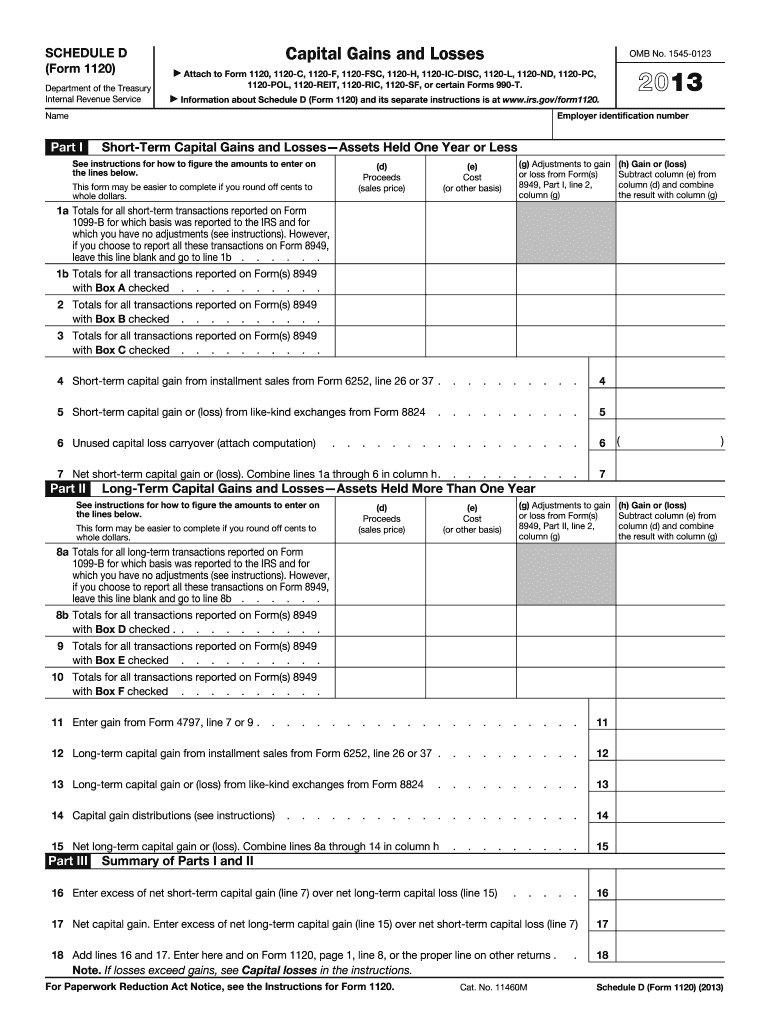

Overview of the 2013 IRS Schedule D Form

Schedule D (Form 1040) is essential for U.S. taxpayers who need to report capital gains and losses from the sale of assets. This form provides a detailed summary of transactions, helping taxpayers calculate their overall gain or loss for the tax year. It includes sections for both short-term and long-term capital gains, which are crucial for accurate tax reporting as they are taxed at different rates.

Purpose of the 2013 IRS Schedule D Form

The primary objective of Schedule D is to assist taxpayers in reporting gains or losses associated with the sale of capital assets. Understanding how to fill out this form correctly is vital to ensure compliance with IRS regulations. The form not only tracks sales of stocks and real estate but also encompasses other investments, clarifying both net profit and losses for accurate tax calculations.

How to Obtain the 2013 IRS Schedule D Form

Taxpayers can access Schedule D (Form 1040) through several avenues:

- IRS Website: It is available as a downloadable PDF from the official IRS site, which also provides instructions for filling it out.

- Tax Preparation Software: Many online tax preparation tools automatically include this form when filing, streamlining the process.

- Tax Professionals: A certified tax preparer can provide this form and assist with its completion.

Steps to Complete the 2013 IRS Schedule D Form

Completing Schedule D requires several methodical steps:

- Gather Documentation: This includes any records of sales, purchase dates, amounts, and adjustments for each capital asset.

- Input Sale Information: Report each transaction accurately, distinguishing between short-term and long-term gains or losses.

- Short-term Transactions: Assets sold within one year of acquisition.

- Long-term Transactions: Assets held for more than one year before sale.

- Calculate Gains or Losses: Determine the gain or loss by subtracting the purchase price and associated costs from the selling price.

- Complete the Form: Transfer the calculated figures into the correct sections of Schedule D, ensuring accuracy in reporting.

- Carryover to Tax Return: The totals from Schedule D should be transferred to the appropriate lines on your Form 1040.

Important Terms Related to the 2013 IRS Schedule D Form

Understanding common terminology is crucial for correctly completing Schedule D:

- Capital Asset: Generally, any property held for personal or investment purposes.

- Adjusted Basis: The original cost of an asset plus any improvements, minus depreciation, which is crucial in calculating gains or losses.

- Holding Period: The time an asset is owned before sale, determining whether a gain is classified as short-term or long-term.

Filing Deadlines and Important Dates

Generally, the due date for filing the IRS Schedule D coincides with the annual individual tax return deadline, which is April 15 for most taxpayers. If this date falls on a weekend or holiday, the deadline shifts to the next business day. Taxpayers should remain aware of any changes announced by the IRS to ensure timely filings.

Penalties for Non-Compliance

Failure to accurately report capital gains or losses on Schedule D can lead to significant penalties. Potential consequences include:

- Fines: Monetary penalties for incorrect filings or failure to file.

- Interest on Underpayment: Additional interest accrued on unpaid taxes resulting from inaccuracies.

- Audit Risks: Incomplete or misleading information may lead to increased scrutiny from the IRS.

Software Compatibility

Various tax software products, including TurboTax and H&R Block, support the 2013 IRS Schedule D form. These programs often provide built-in guidance to simplify the reporting of capital gains and losses. By using tax software, individuals can efficiently navigate the complexities of the form while ensuring compliance with IRS regulations.

Taxpayer Scenarios Using Schedule D

Different taxpayer categories may utilize Schedule D in distinct ways:

- Investors: Individuals trading stocks or mutual funds report gains or losses from their transactions.

- Real Estate Owners: Individuals selling real property must report capital gain or loss due to changes in property values.

- Small Business Owners: Business owners selling business assets will also need to document gains or losses using this form.

Understanding these nuanced applications ensures that all potential scenarios are accounted for when filling out Schedule D, allowing for accurate and compliant tax reporting.