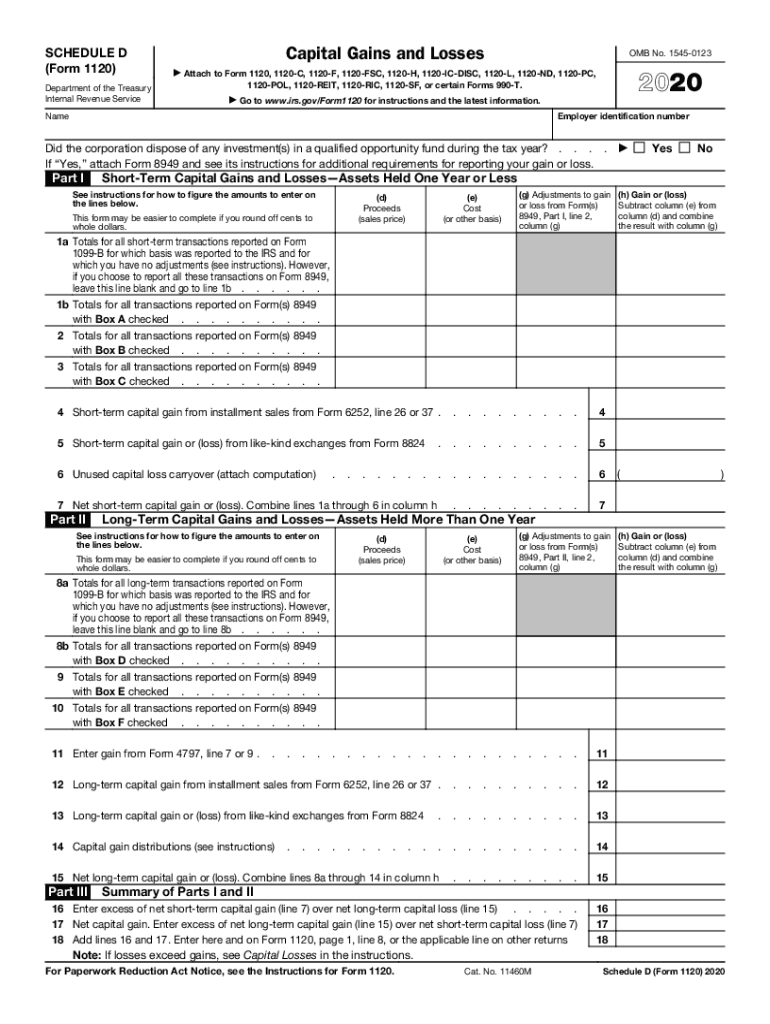

Definition and Meaning of Schedule D

Schedule D is a tax form utilized by individuals, partnerships, and corporations in the United States to report capital gains and losses incurred during the tax year. This form details the gains and losses from the sale of capital assets, such as stocks, bonds, and property. It serves as an essential component of an individual's or business entity’s tax return, particularly in conjunction with Form 1040 for individuals or Form 1120 for corporations.

The form is divided into two primary sections:

- Short-term capital gains and losses: This section addresses assets held for one year or less, which are typically taxed at the individual’s ordinary income tax rate.

- Long-term capital gains and losses: This part covers assets held for more than one year and may be subject to lower capital gains tax rates.

Accurate completion of Schedule D is crucial as it ensures compliance with IRS regulations and helps taxpayers avoid penalties related to misreporting of income.

Steps to Complete the 2020 Schedule D

Completing the 2020 Schedule D accurately is vital for reporting capital gains and losses. Follow these steps for proper completion:

-

Gather Documentation: Collect all relevant documentation such as sale agreements, purchase statements, and any prior year records that reflect carryover losses.

-

Fill Out the Top Section: Identify the type of capital gains or losses (short-term or long-term) you are reporting.

- For short-term assets, list all transactions (sales, exchanges) in Part I.

- For long-term assets, complete Part II, which will also require you to provide sale proceeds and cost basis.

-

Calculate Total Gains or Losses:

- Subtract the total costs from sales proceeds to determine the net capital gain or loss for each transaction.

- Utilize the carried over losses from prior tax years, if applicable.

-

Transfer Totals to Your Tax Return: After completing the calculations, transfer the net amounts to your main tax return, either Form 1040 or Form 1120.

-

Attach the Schedule D: Ensure that Schedule D is attached to your filed tax return, as the IRS will use it to verify your calculations.

Additional forms may be required based on your specific investment transactions, such as Form 8949 for reporting transactions separately before summarized on Schedule D.

Important Terms Related to the 2020 Schedule D

Understanding key terminology related to Schedule D is essential for proper utilization:

- Cost Basis: The original value of an asset, which is critical in calculating capital gains or losses upon sale.

- Capital Gain: The profit made from the sale of an asset compared to its original cost basis.

- Capital Loss: The loss experienced when selling an asset for less than its cost basis.

- Carryover Losses: Losses from previous years that can be used to offset capital gains in future tax years.

- Net Investment Income Tax (NIIT): An additional tax imposed on investment income over certain thresholds, relevant when calculating taxable gains.

Familiarizing yourself with these terms can facilitate a clearer understanding of the reporting requirements and implications of capital transactions.

State-Specific Rules for the 2020 Schedule D

State tax treatment of capital gains and losses can vary significantly across different jurisdictions. It's important to understand how your state treats these losses, as this can impact your overall tax liability. Here are some aspects that differ by state:

- State Tax Rates: Some states tax capital gains as ordinary income, while others have specific capital gains tax rates.

- Exemptions and Deductions: Certain states offer exemptions or additional deductions for specific types of investments, which can affect the overall tax calculus.

- Carryover Rules: The ability to carryover unused capital losses into future years can also differ, with some states having more restrictive guidelines than the federal level.

Reviewing state-specific tax codes or consulting a tax professional can ensure compliance with local laws while maximizing potential deductions.

IRS Guidelines for Schedule D

The Internal Revenue Service provides comprehensive guidelines for completing Schedule D, ensuring that taxpayers understand their obligations. Key points include:

- Documentation: Retain records of all transactions for at least three years after the tax return is filed. This includes purchase records and any documentation that clarifies the nature of the transactions.

- Attribution Rules: Certain transactions may categorize under different regulations, such as wash sales, which could alter the way gains or losses are reported.

- Real Estate Transactions: Specific considerations exist when reporting gains or losses arising from real estate dealings, including primary residences versus investment properties.

- Filing Deadlines: Schedule D must be submitted by the same deadline as your main tax return—typically April 15 unless extended.

Staying updated on IRS rules surrounding Schedule D is crucial to avoid audits or penalties associated with improper reporting.

Examples of Using the 2020 Schedule D

Utilizing Schedule D involves various scenarios reflecting how individuals and businesses engage in capital transactions, including:

-

Individual Investor: A taxpayer sells shares of stock held for two years at a profit. They must report this transaction on Schedule D, categorizing it under long-term capital gains.

-

Business Sale: A small business that sold a piece of equipment can deduct the loss from that sale, reporting it on Schedule D if the equipment was not fully depreciated.

-

Real Estate Sales: An individual selling their home may need to report capital gains; however, they might be eligible for an exclusion if they meet certain residency requirements.

These examples illustrate the form's application across various contexts, emphasizing the importance of recognizing the type of asset and duration of ownership for accurate reporting.