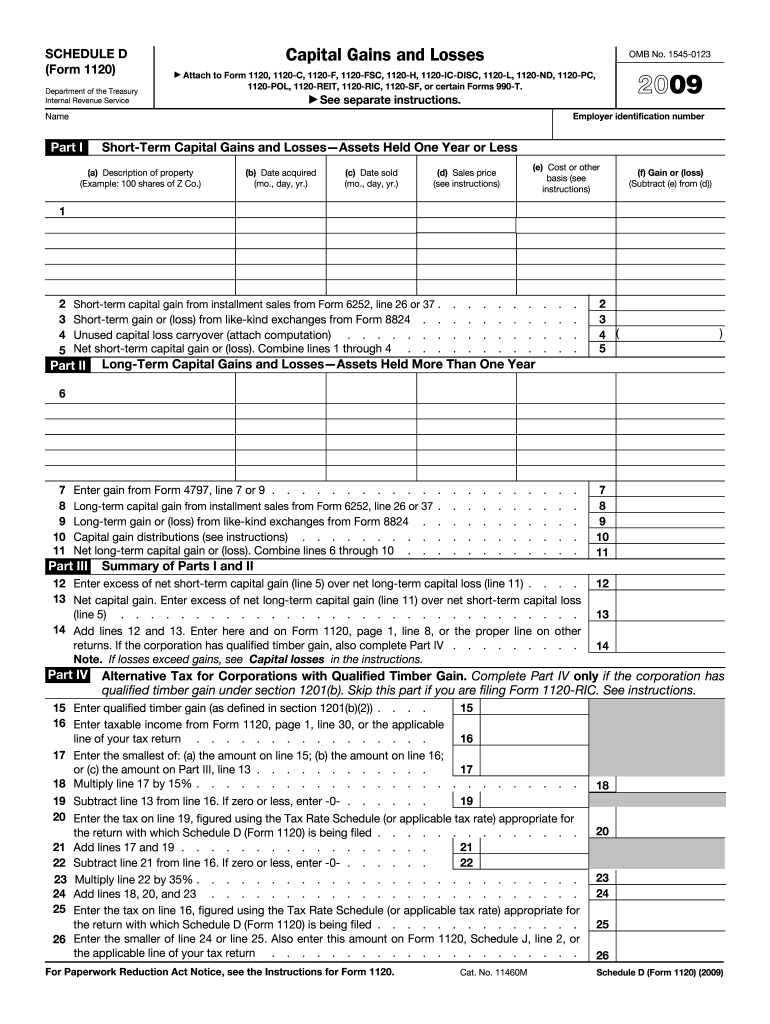

Definition and Purpose of the 2009 Form 1120

The 2009 Form 1120, officially known as the U.S. Corporation Income Tax Return, is a federal tax form used by corporations to report their income, gains, losses, deductions, and credits for the tax year. The form is primarily designed for domestic corporations operating in the United States and is essential for the IRS to assess corporate tax liabilities. Filing this form accurately is crucial, as it forms the basis for calculating the corporation's income tax obligation.

Key features of the 2009 Form 1120 include:

- Reporting Corporate Income: Corporations use this form to declare all income earned, including revenues from sales, services, and any other income sources.

- Deductions and Credits: The form allows companies to list eligible deductions and tax credits, which can significantly reduce the total tax liability.

- Balance Sheet Information: Corporations must provide information on their assets, liabilities, and shareholders' equity, helping the IRS gain a comprehensive view of the corporation’s financial situation.

- Tax Payments: It serves as a basis for calculating the tax due, and corporations must pay any tax owed when submitting the return.

The 2009 Form 1120 functions not only as a reporting tool but also as a formal declaration of financial health for businesses.

How to Obtain the 2009 Form 1120

Acquiring the 2009 Form 1120 is straightforward. Corporations can obtain the form through several channels:

-

IRS Website: The official IRS website provides the 2009 Form 1120 as a downloadable PDF. This ensures that businesses can access the latest version as well as any instructions necessary for proper completion.

-

Tax Preparation Software: Many tax preparation programs and applications, such as TurboTax and H&R Block, incorporate the 2009 Form 1120 into their systems, allowing users to fill out the form directly through the software.

-

Local IRS Offices: Physical copies of the form can also be obtained at local IRS offices if a corporation prefers in-person assistance.

Steps to Complete the 2009 Form 1120

Completing the 2009 Form 1120 requires meticulous attention to detail. The following steps outline the process:

-

Gather Financial Information: Collect all necessary financial data, including income statements, balance sheets, and records of business expenses. This data is essential for accurate reporting on the form.

-

Fill in Basic Information: Begin by entering the corporation's name, address, and Employer Identification Number (EIN) at the top of the form. Ensure accuracy to avoid processing delays.

-

Report Income: Complete Part I of the form by reporting gross receipts and any other types of income, such as interest or dividends. Each source of income should be reported separately.

-

Calculate Adjusted Gross Income: Deduct allowable expenses, such as cost of goods sold (COGS), to determine the corporation's taxable income.

-

Complete Deductions and Credits: Fill out the relevant sections for deductions and tax credits, ensuring to include only eligible items according to IRS guidelines.

-

Review and Sign the Form: Once all sections are completed, review for accuracy and ensure that the authorized person in the corporation signs the document. An unsigned return may lead to penalties.

Important Terms Related to the 2009 Form 1120

Understanding the terminology associated with the 2009 Form 1120 is essential for accurate filing. Key terms include:

- Gross Receipts: Total income from all sources before any deductions are made.

- Tax Credits: Amounts that can reduce the tax owed on a dollar-for-dollar basis, often tied to specific activities or expenses.

- Taxable Income: The amount a corporation is taxed on, calculated by subtracting allowable deductions from its gross income.

- Built-in Gains Tax: A tax imposed on S Corporations if they convert to a C Corporation and sell appreciated assets within a specific period.

Familiarity with these terms can aid in accurately filling out the form and understanding the corporation’s tax obligations.

Filing Deadlines for the 2009 Form 1120

Timeliness is critical when filing the 2009 Form 1120. The traditional deadline for corporations to file is:

- March 15: Corporations operating on a calendar year are generally required to submit their return by this date.

Extensions can be requested, which allow corporations to file up to six months later (September 15), but taxes owed must still be estimated and paid by the original deadline to avoid interest and penalties.

The importance of adhering to these deadlines cannot be overstated, as late filings may incur significant fines and could lead to scrutiny from the IRS.

In summary, comprehensively understanding the facets of the 2009 Form 1120 ensures compliance and can ultimately benefit the corporation by maximizing its eligible deductions and credits while minimizing potential penalties.