Definition and Meaning of the Capital Loss Carryover Worksheet

The capital loss carryover worksheet is a financial tool used to track and calculate the net capital losses that can be applied to future tax years. This concept is particularly beneficial for taxpayers who sell investments at a loss, allowing them to offset those losses against future capital gains, thereby reducing their tax liability. In the context of U.S. tax regulations, the IRS permits individuals and corporations to carry over excess capital losses when they exceed capital gains, facilitating continuous tax relief across tax periods.

Understanding the capital loss carryover concept is important, as taxpayers can use the losses to reduce taxable income in subsequent years. A capital loss occurs when the selling price of an asset is less than its purchase price. By documenting losses accurately with a worksheet, taxpayers can calculate how much can be carried over, which is typically limited to offsetting only up to three thousand dollars of ordinary income each year for individuals.

How to Use the Capital Loss Carryover Worksheet

The capital loss carryover worksheet serves as a systematic approach for taxpayers to keep detailed records of their capital losses across tax years. To effectively utilize this worksheet:

-

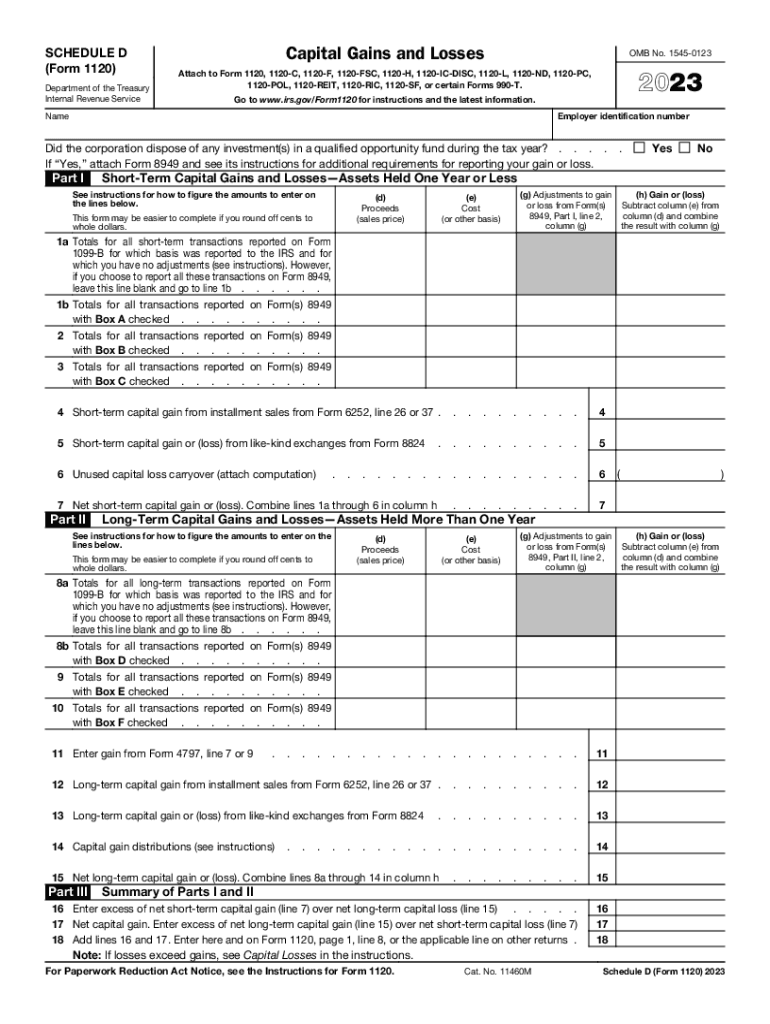

Initial Calculation: Determine total capital gains and losses for the current tax year using Schedule D (Form 1040). Any losses that exceed gains should be noted as carryover.

-

Fill Out the Worksheet: Input your total losses from the current tax year into the worksheet. Include any carryover losses from previous years as well.

-

Netting Process: Subtract the capital losses from capital gains, if applicable. If there’s still a loss remaining, it may qualify for carrying over to future tax years.

-

Documentation for Future Years: Maintain records of the worksheet calculation for future reference. The worksheet will assist in determining your tax obligations in upcoming years by showing prior losses.

-

Seek Assistance if Necessary: If calculations become complex, consulting a tax professional can provide clarity and ensure compliance with IRS regulations.

Steps to Complete the Capital Loss Carryover Worksheet

Completing the capital loss carryover worksheet involves several clear steps to ensure accuracy and compliance:

-

Gather Financial Records: Collect all documents related to transactions involving capital assets, such as sales of stocks or property.

-

Calculate Total Capital Gains and Losses:

- Refer to Schedule D (Form 1040) to summarize total gains and losses for the pertinent tax year.

- Ensure all transactions are accounted for, and categorize them into short-term and long-term.

-

Identify Remaining Carryover Losses:

- If total losses exceed gains, note down the excess amount. This figure represents the loss that can be carried to the next tax year.

-

Document on the Worksheet: Input the calculated figures on the capital loss carryover worksheet. Remarks on previous years' losses will guide you in the proper carryover.

-

Finalize and Save: After completing the worksheet, save it with your tax documents. This will serve as essential documentation for future tax filings.

Important Terms Related to the Capital Loss Carryover Worksheet

Familiarizing oneself with key terms enhances understanding and efficiency when using the capital loss carryover worksheet. Here are some significant terms:

-

Capital Gains: Profits from the sale of capital assets, which can be classified as either short-term or long-term based on the holding period.

-

Capital Losses: Losses incurred from the sale of capital assets below their purchase price, which may be deducted from capital gains.

-

Carryover: The ability to transfer unused capital losses to offset gains in future tax years.

-

Adjusted Gross Income (AGI): The taxpayer’s total gross income minus specific deductions. Capital losses may impact the AGI calculation.

-

Schedule D (Form 1040): The IRS form that provides details on capital gains and losses for individual taxpayers.

Understanding these terms supports efficient usage of the worksheet and enhances the ability to strategize effectively around tax payments.

IRS Guidelines for Capital Loss Carryover

The IRS has specific guidelines surrounding capital loss carryovers that taxpayers must adhere to in order to utilize this benefit properly. Key points include:

-

Limit on Ordinary Income Offset: Taxpayers can deduct up to three thousand dollars of capital losses from ordinary income in a single tax year (or one thousand five hundred dollars if married filing separately).

-

Period of Carryover: Any unused capital losses may be carried over indefinitely until the losses are fully utilized against future capital gains.

-

Recordkeeping Requirements: Taxpayers are required to keep meticulous records of transactions leading to capital losses, including purchase and sale documentation, to validate claims made on tax returns.

-

Filing: Capital losses must be reported on the federal tax filing, specifically on Schedule D. Failure to report can lead to penalties or missed opportunities for tax relief.

Adhering to these guidelines ensures compliance and maximizes the tax advantages of carrying over capital losses.