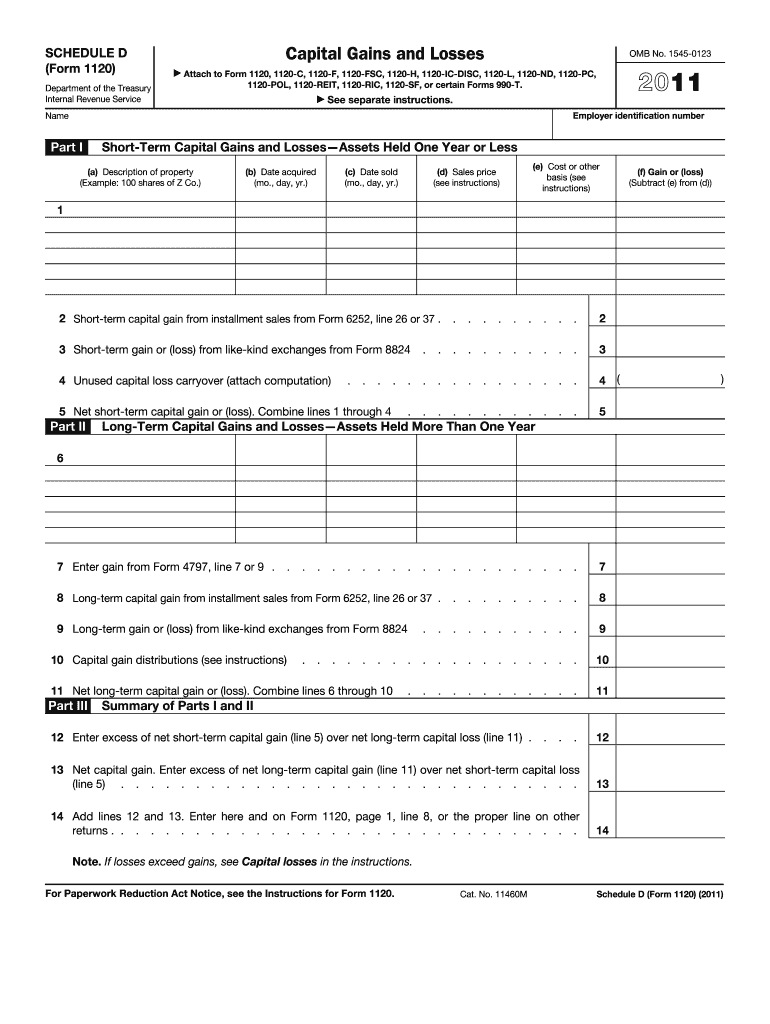

Definition and Purpose of the 2011 Schedule D Form

The 2011 Schedule D form is a tax document utilized by U.S. taxpayers to report capital gains and losses from the sale of assets. This form is essential for reflecting both short-term and long-term capital transactions on individual tax returns, specifically for taxpayers filing Form 1040. The Schedule D is used to calculate net capital gains or losses, which are then transferred to the Form 1040 to determine the overall tax implication.

Key Components of the Schedule D Form

- Short-Term Capital Gains and Losses: This section reports gains from assets that have been held for one year or less.

- Long-Term Capital Gains and Losses: This section is dedicated to assets held for more than one year, often taxed at lower capital gains tax rates.

- Summary: The bottom of the form aggregates the gains and losses, allowing for an overall calculation to determine tax liabilities.

The Schedule D form plays a significant role in ensuring accurate reporting of taxable events, which can significantly affect a taxpayer's overall financial position and tax responsibilities.

How to Use the 2011 Schedule D Form

Effectively utilizing the 2011 Schedule D form requires understanding the specific sections and data needed for accurate completion. Here is a step-by-step guide for using this form:

- Gather Necessary Information: Collect data on all asset sales, including purchase dates, sale dates, costs, and amounts received.

- Determine Holding Period: Identify whether the assets are classified as short-term or long-term, ensuring they are reported in the correct section of the form.

- Input Capital Transactions: Record each transaction correctly. For short-term gains and losses, use Part I of the form, while long-term transactions should be recorded in Part II.

- Calculate Totals: After entering all transactions, calculate the totals for both short-term and long-term capital gains and losses.

- Transfer Net Gains or Losses: Finally, sum the sections and report the net gain or loss on Form 1040.

By following these steps, taxpayers can ensure that they are accurately reporting their capital transactions and complying with tax regulations.

How to Obtain a Copy of the 2011 Schedule D Form

Obtaining the 2011 Schedule D form is straightforward. Taxpayers can access the form through multiple channels:

- IRS Website: The most direct way to obtain the form is by downloading it from the Internal Revenue Service (IRS) website, where it is available in PDF format.

- Tax Preparation Software: Most tax software tools, such as TurboTax or H&R Block, automatically generate the Schedule D as part of the filing process when relevant transactions are entered.

- Tax Professionals: Individuals seeking assistance can also obtain the form from tax professionals, who have the necessary resources for compliant filing.

Having the 2011 Schedule D form readily accessible ensures that taxpayers can adequately prepare their returns.

Steps to Complete the 2011 Schedule D Form

Completing the Schedule D form involves careful attention to detail to ensure compliance with tax laws. Here’s how to methodically fill out the form:

-

Part I: Short-Term Capital Gains and Losses

- Enter the information for each transaction, including description, acquisition date, sale date, sales price, and cost basis.

- Calculate the gross gain or loss for each transaction.

-

Part II: Long-Term Capital Gains and Losses

- Similar to Part I, fill in details for long-term transactions.

- Include information on collectibles and assets eligible for different tax treatments if applicable.

-

Calculate Totals

- Use the provided sections to find total short-term gains, total long-term gains, and the overall gain or loss.

-

Transfer to Form 1040

- Summarize the results and transfer the net amount to the appropriate line on Form 1040.

-

Review and File

- Carefully review all entries for accuracy before including the completed Schedule D with your tax return.

Detail and precision during these steps can significantly affect the taxpayer’s returns and potential tax liabilities.

Important Terms Related to the 2011 Schedule D Form

Understanding key terminology is crucial when dealing with the 2011 Schedule D form. Here are several important terms related to capital gains and losses:

- Adjusted Basis: The original cost of an asset adjusted for improvements and depreciation.

- Capital Gains: Profits from the sale of assets or investments.

- Capital Losses: Losses incurred from selling an asset for less than the purchase price.

- Net Capital Gain or Loss: The overall gain or loss determined after calculating both short-term and long-term transactions.

Familiarity with these terms helps ensure compliance and clarity while completing the tax process.

IRS Guidelines for Filing the 2011 Schedule D Form

The IRS stipulates specific guidelines for accurately completing and submitting the 2011 Schedule D form to avoid penalties or issues with tax compliance:

- Filing Method: The form can be filed either electronically or submitted via mail, with certain restrictions applying based on the chosen method.

- Accuracy Requirements: Taxpayers are required to report all capital transactions accurately; failure to do so can result in audits or penalties.

- Record Keeping: It is advisable to maintain detailed records of all transaction details and supporting documentation for a minimum of three years following the tax year in which the return is filed.

Adhering to IRS guidelines ensures that taxpayers can fulfill their obligations while minimizing their risk of non-compliance.

Filing Deadlines and Important Dates for the 2011 Schedule D Form

Being aware of filing deadlines is essential for individuals reporting gains or losses using the 2011 Schedule D form. Key deadlines include:

- Tax Filing Deadline: Generally, individual tax returns are due on April 15 of the year following the tax year.

- Extensions: Taxpayers can file for an extension until October 15, but any taxes owed must still be paid by the original deadline to avoid penalties.

These timelines are crucial for ensuring timely compliance and avoiding unnecessary penalties due to late filings.

Required Documents for Filing the 2011 Schedule D Form

Before filing the Schedule D form, taxpayers should gather several key documents to ensure accurate reporting:

- Transaction Records: Documentation for all asset purchases and sales, including dates, prices, and any associated costs.

- Brokerage Statements: Statements that summarize capital transactions for the tax year can streamline the documentation process.

- Previous Tax Returns: Prior year’s returns can provide context and necessary historical data for reporting any carryover losses.

Assembling all relevant documents ahead of completing the form can minimize errors and simplify the filing process.