Definition and Meaning of Form Gains

Form gains refer to a specific tax form utilized to report capital gains and losses on investment transactions. This form is crucial for individuals and entities, such as corporations, who need to disclose their financial performance related to buying and selling capital assets. Capital gains arise from the sale of assets such as stocks, real estate, and other investments, and understanding this form is essential for accurate tax reporting in the United States.

Key Components of Form Gains

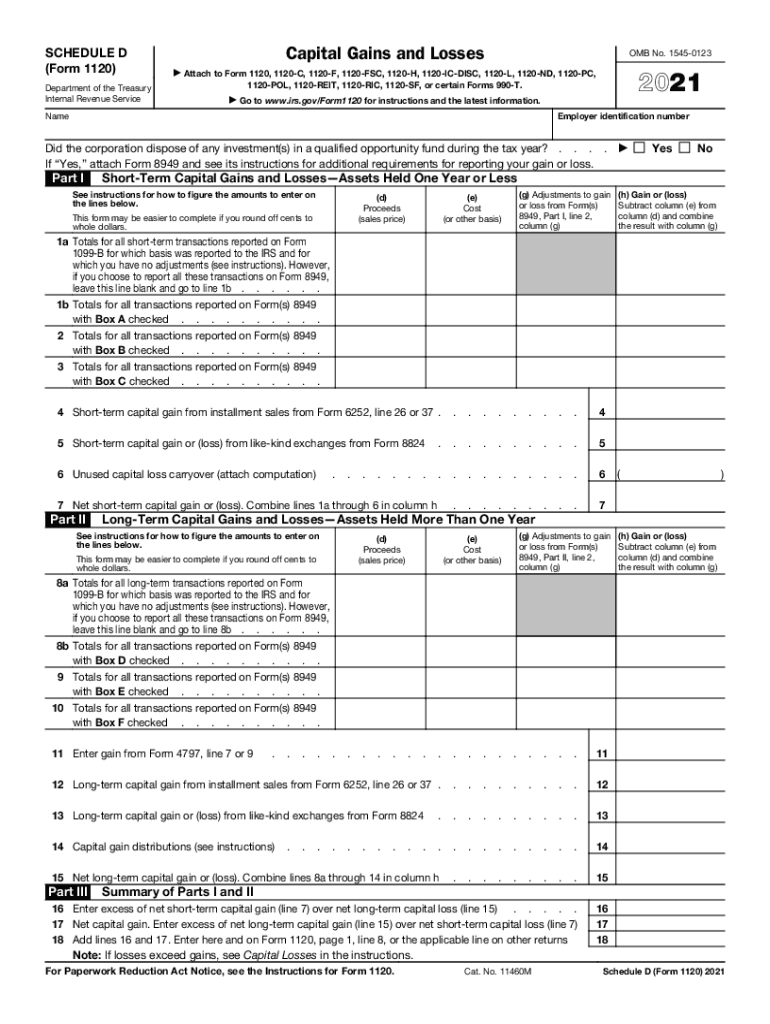

- Short-term vs. Long-term Gains: The form differentiates between short-term and long-term capital gains. Short-term gains apply to assets held for one year or less, whereas long-term gains apply to assets held for more than one year. This classification affects the applicable tax rates, with long-term gains generally taxed at lower rates.

- Proceeds and Costs: Reported on the form are the proceeds from the sale and the associated costs. This helps in determining the net capital gain or loss, which is crucial for tax calculations.

- Adjustments: There may also be adjustments for specific factors, such as depreciation recapture or the taxation of collectibles, leading to different financial outcomes once reported correctly.

Understanding these elements provides clarity on how form gains impacts an individual or entity’s tax obligations.

How to Use Form Gains

Utilizing form gains effectively begins with understanding when and how it should be approached to ensure compliance with IRS regulations. This process involves several steps that can help streamline efficient reporting.

Steps to Utilize Form Gains

- Gather Documentation: Collect all necessary paperwork related to your transactions, including purchase and sale records, brokerage statements, and any other applicable documents.

- Categorize Gains and Losses: Identify each transaction as short-term or long-term and classify the gains accordingly. This classification is essential to determine tax implications.

- Calculate Net Gain or Loss: Use the collected data to calculate your total capital gains and losses. Ensure that you account for any previous losses that can offset current gains for tax purposes.

- Complete the Form: Accurately fill out all sections of the form, adhering to IRS guidelines. Each section typically includes spaces for detailing gains, losses, and adjustments.

- File the Form: Submit the completed form to the IRS by the designated deadline, ensuring that you retain copies for your records.

Correctly using form gains helps taxpayers maintain accurate financial records while complying with tax laws.

Steps to Complete Form Gains

Completing form gains involves multiple steps that require attention to detail and accurate reporting. Below are the essential steps to ensure the form is filled out correctly.

Step-by-Step Guide

- Identify All Transactions: List all transactions capable of generating capital gains, ensuring you account for both sales and exchanges.

- Determine Holding Period: For each transaction, identify whether it is short-term or long-term based on the holding period.

- Document Costs: Record the initial purchase price, any expenses related to the acquisition, and the final sale price for each transaction to accurately calculate gains or losses.

- Calculate Adjustments: Consider any adjustments necessary, such as depreciation or capital improvements, which may influence capital gains calculations.

- Use Supporting Forms: You may need to reference and complete additional forms such as Schedule D, especially if there are numerous transactions or if you're carrying over losses from previous years.

- Review for Accuracy: Once completed, thoroughly review the form for any errors or omissions before filing.

Following these detailed steps facilitates a clear understanding of the form and assures accurate reporting compliant with IRS expectations.

Important Terms Related to Form Gains

Understanding specific terminology related to form gains is pivotal for accurate tax reporting. Below are critical terms that every taxpayer should recognize.

Common Terms Explained

- Capital Asset: Any property held by a taxpayer, including investments, personal items, and real estate, which can result in capital gains or losses when sold.

- Net Capital Gain: The amount by which total capital gains exceed total capital losses during a tax year, ultimately influencing the taxpayer's liability.

- Established Basis: The cost of an asset, factoring in adjustments and improvements made, which will determine capital gains when sold.

- Holding Period: The duration an asset is owned before it is sold, dictating whether gains are considered short-term or long-term.

Familiarity with these terms aids in navigating the complexities of the form and ensures compliance with tax regulations.

Filing Deadlines and Important Dates

It is crucial to adhere to filing deadlines associated with form gains to avoid penalties.

Key Dates to Remember

- Tax Year Deadline: Generally, the deadline for filing form gains is the 15th day of the fourth month following the end of the tax year. For individual taxpayers, this typically falls on April 15.

- Extensions: Taxpayers may file for an extension, which typically grants an additional six months for filing, but any outstanding taxes owed are still due by the original deadline.

- Noteworthy Exceptions: Be aware that specific extensions apply to certain taxpayers, such as those affected by natural disasters or military personnel, potentially altering due dates.

Staying informed about these timelines helps ensure a smooth filing process and compliance with taxation requirements.

Who Typically Uses Form Gains

Various individuals and entities utilize form gains, each with distinct needs regarding capital reporting.

Typical Users

- Individual Investors: Everyday investors selling stocks or real estate will report their trades and any applicable capital gains or losses.

- Businesses: Corporations and partnerships involved in capital asset transactions need to report these gains to accurately reflect their financial health.

- Real Estate Developers: Individuals or businesses selling properties are often required to report gains using this form, given the complex nature of real estate transactions.

Recognizing the users of form gains highlights the importance of understanding the form across diverse financial scenarios.