Definition & Meaning

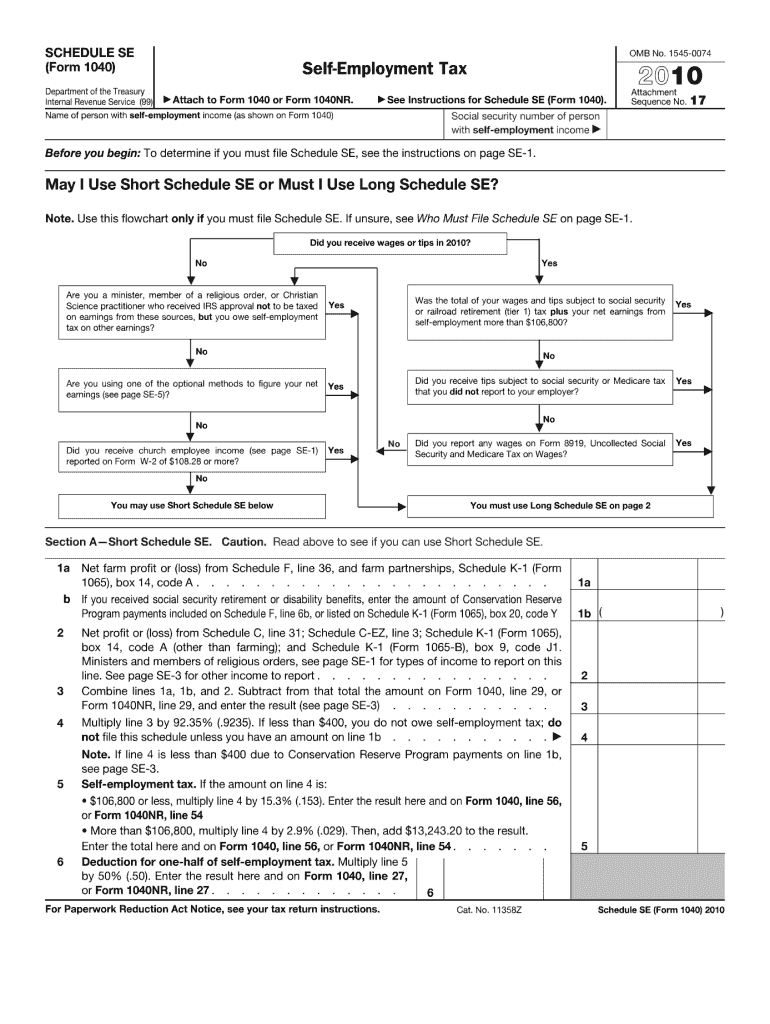

The 2010 form schedule, specifically Schedule SE (Form 1040), is a tax document used to calculate self-employment tax for individuals with self-employment income. This form is crucial for ensuring the proper reporting and contribution of Social Security and Medicare taxes. By accurately filling out Schedule SE, taxpayers can determine the amount of tax that needs to be paid based on their self-employment earnings.

Steps to Complete the 2010 Form Schedule

- Determine Eligibility: Identify whether you need to use the Short or Long Schedule SE based on your self-employment situation.

- Calculate Net Earnings: Use your business profit or loss to compute net earnings.

- Use Optional Methods: If applicable, consider optional methods for farming or non-farming income to potentially lower your tax.

- Apply the Tax Rate: Utilize the tax rate to calculate the total self-employment tax due.

- Transfer the Amount: Report this amount on your Form 1040, ensuring alignment with other financial documentation.

Key Elements of the 2010 Form Schedule

- Short Schedule SE: Suitable for individuals with less complex tax situations or those with lower net earnings.

- Long Schedule SE: Necessary for those with more intricate financial circumstances, including higher income levels.

- Net Earnings Calculations: This involves deductions and adjustments for business-related expenses.

- Tax Rate Application: Specific rates apply, reflecting a combination of Social Security and Medicare contributions.

IRS Guidelines

The IRS provides clear guidelines to ensure accurate completion and submission of Schedule SE. These instructions help taxpayers understand eligibility criteria, define net earnings, and specify the conditions under which the Short or Long form should be used. Following these guidelines closely is essential for compliance and accurate tax calculation.

Filing Deadlines / Important Dates

For the 2010 tax year, Schedule SE must be filed alongside your Form 1040 by the standard tax filing deadline, which typically falls on April 15. It is important to be aware of any extensions or changes to this date due to holidays or other circumstances.

Required Documents

To accurately complete the Schedule SE, you will need:

- Profit and loss statements or other business income records

- Documentation of business expenses

- Previous year's tax returns (if applicable for reference)

- Any IRS notices related to self-employment

Form Submission Methods

- Online: Many taxpayers prefer electronic submission through IRS e-file, which ensures quicker processing and immediate confirmation of receipt.

- Mail: Schedule SE can also be mailed directly to the IRS. Be sure to use certified mail for tracking.

- In-Person: Visiting a local IRS office is another option, though this might not be convenient for all.

Penalties for Non-Compliance

Failure to accurately report self-employment income on Schedule SE can result in penalties, including interest on unpaid taxes and possible fines. Ignoring tax obligations could also trigger audits and further legal consequences from the IRS.