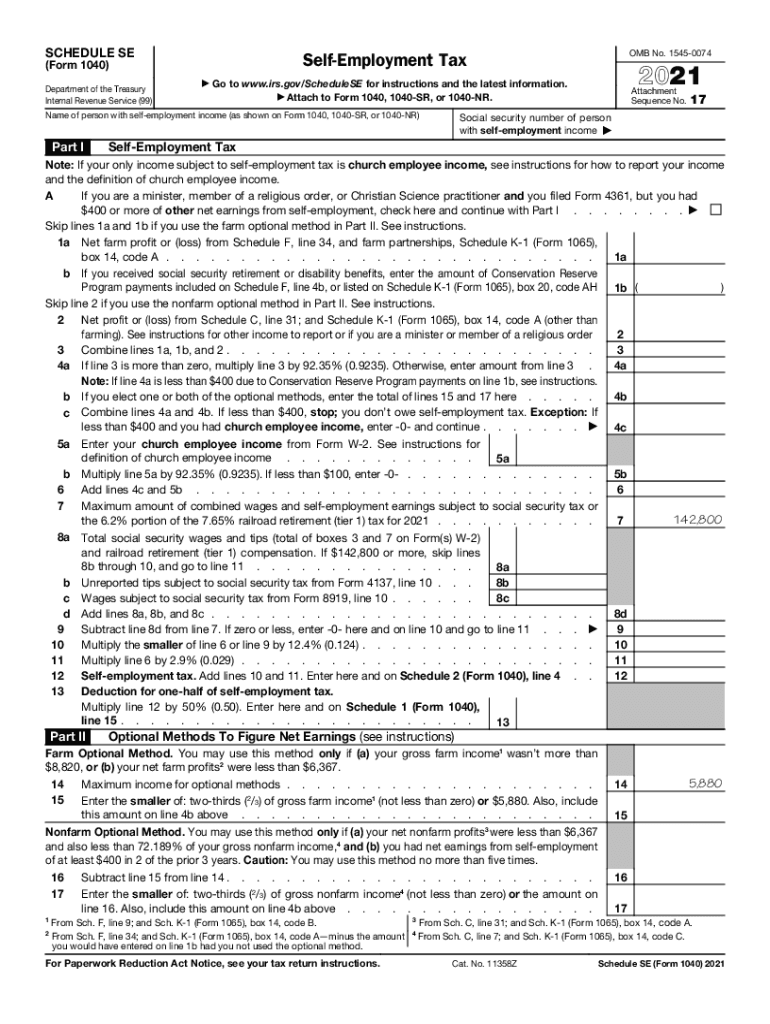

Definition and Purpose of Schedule SE

Schedule SE, also known as "Self-Employment Tax," is a form utilized by self-employed individuals in the United States to calculate their self-employment tax for the year. The form serves as an attachment to Form 1040, 1040-SR, or 1040-NR, ensuring that the IRS receives accurate information on income from self-employment. This form is essential because it allows individuals who work for themselves, such as freelancers, independent contractors, and small business owners, to compute the Social Security and Medicare taxes owed on their net earnings.

Key Components of Schedule SE

- Net Earnings Calculation: Schedule SE helps calculate net earnings from self-employment, which is the basis for the self-employment tax. It requires reporting of income from various self-employed activities, including both farming and non-farming sources.

- Tax Rates: The form stipulates different tax rates for Social Security and Medicare, which combined make up the self-employment tax, usually amounting to 15.3%.

Steps to Complete Schedule SE

Filing Schedule SE involves several steps, requiring careful attention to detail to ensure accuracy. Understanding each step can simplify the process.

- Gather Required Information: Before completing Schedule SE, individuals need to assemble all relevant financial information from their self-employment activities throughout the year. This includes income statements, expense records, and any other pertinent documents.

- Fill Out Part I: This section involves calculating net earnings from self-employment, which considers income and deductions. It's crucial to follow the instructions carefully, as errors in this part can lead to incorrect tax liability calculations.

- Complete Part II: If applicable, individuals will use optional methods outlined in Part II to calculate net earnings. This section might apply to those with low income from self-employment or net losses but who need to increase net earnings for Social Security credit purposes.

- Transfer Information: After completing Schedule SE, the calculated tax should be transferred to the main tax forms (Form 1040, 1040-SR, or 1040-NR) where it becomes part of the total tax liability for the year.

Required Documents for Schedule SE

To accurately complete Schedule SE, taxpayers need to provide various documents that verify their self-employment income and expenses.

- Income Statements: These should include all forms of received revenue from self-employment.

- Expense Records: Detailed accounts of business purchases, utility bills, travel expenses, and any other deductible costs.

- Previous Year’s Tax Returns: For comparison and verification purposes.

- Social Security Number: Required to ensure accurate reporting and taxation.

IRS Guidelines and Compliance

Complying with IRS guidelines is imperative to avoid penalties and ensure correct tax reporting. The IRS provides detailed instructions for Schedule SE, specifying the documentation required, lines that need completing based on income and deductions, and how to transfer calculated taxes to Form 1040 or its variants. Following these guidelines is vital to maintain compliance and avoid issues such as underpayment of taxes or misreporting income.

Penalties for Non-Compliance

Failure to accurately complete and file Schedule SE with the appropriate accompanying forms may result in several penalties imposed by the IRS.

- Late Filing Penalties: If the form is not submitted by the deadline, the filer might incur additional charges calculated as a percentage of the unpaid tax.

- Accuracy Penalties: Mistakes due to negligence or inaccurate information can lead to penalties. Substantial omissions of income, for instance, can result in fines.

- Interest on Unpaid Taxes: Any tax not paid by the filing deadline will accrue interest, augmenting the overall tax burden.

Filing Deadlines and Important Dates

Understanding and adhering to the filing deadlines for Schedule SE is crucial in avoiding late fees and penalties.

- Annual Deadline: The form is generally due on the federal tax filing deadline, which is April 15 unless it falls on a weekend or holiday, in which case it is pushed to the next business day.

- Estimated Tax Payments: Self-employed individuals typically need to make estimated tax payments throughout the year. These are due quarterly, with deadlines in April, June, September, and January of the following year.

Digital vs. Paper Version of Schedule SE

Schedule SE can be submitted either digitally or via paper, depending on the filer’s preference and comfort with electronic filing systems.

- Digital Filing: Provides a faster processing time and immediate acknowledgment of receipt. Software compatibility such as with TurboTax and QuickBooks enhances the convenience of digital filing.

- Paper Filing: While still an option, it requires mailing the completed forms to the IRS, which can be slower and doesn't offer immediate confirmation of receipt.

Eligibility Criteria for Filing Schedule SE

Schedule SE is not applicable to every taxpayer; understanding eligibility criteria is essential.

- Self-Employed Status: Individuals must be self-employed to file this form, encompassing roles like freelancers, consultants, or business owners.

- Income Thresholds: If net earnings are $400 or more from self-employment, the individual must file Schedule SE.

- Special Circumstances: Certain individuals, such as those under the clergy with specific income rules, may also need to use Schedule SE according to specific IRS instructions.

Examples and Real-World Scenarios

The use of Schedule SE can be illustrated through numerous real-world scenarios, offering practical insight.

- Freelancer: John, a freelance graphic designer, reports his income and expenses annually to calculate his self-employment tax. His meticulous expense tracking throughout the year enables him to deduct business-related costs, reducing his taxable income.

- Small Business Owner: Sarah operates a small bakery as a sole proprietorship. She uses Schedule SE to report both her revenue streams and her business expenses, ensuring accurate tax computation and compliance.

- Farmers: For Mary, an independent farmer, Schedule SE is crucial for determining tax liabilities concerning income from her agricultural produce. She employs the optional method to maximize Social Security credits due to variable annual income.

Each of these individuals relies on Schedule SE to ensure they meet federal tax obligations while maintaining adherence to legal requirements.