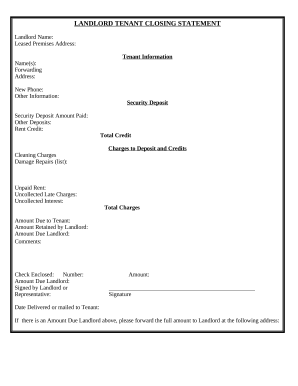

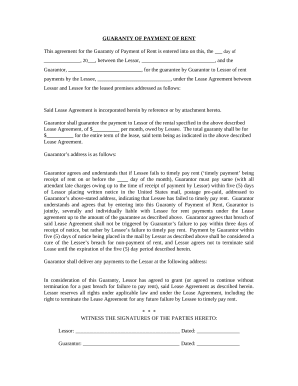

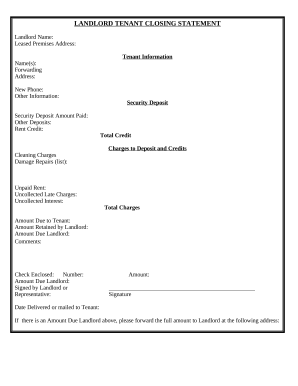

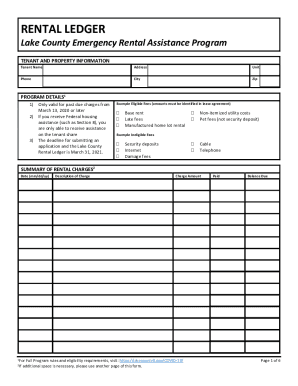

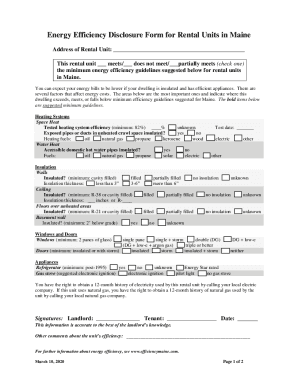

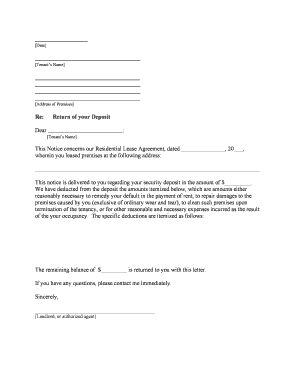

Preview and obtain Simple rental income 1 unit Balance Sheet Templates to ensure the precision and transparency of your financial statements. The DocHub web library offers numerous ready-made customizable templates.

Your workflows always benefit when you can get all of the forms and documents you need at your fingertips. DocHub offers a wide array of document templates to alleviate your daily pains. Get hold of Simple rental income 1 unit Balance Sheet Templates category and easily discover your document.

Start working with Simple rental income 1 unit Balance Sheet Templates in several clicks:

Enjoy smooth document administration with DocHub. Explore our Simple rental income 1 unit Balance Sheet Templates online library and look for your form right now!