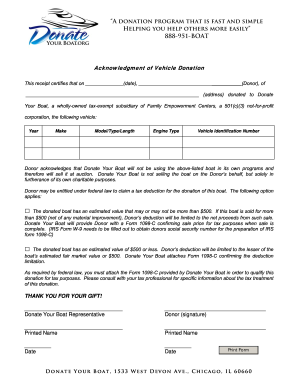

Pick Charitable receipt canada Donation Forms and effortlessly edit them online. Improve your document management processes with DocHub.

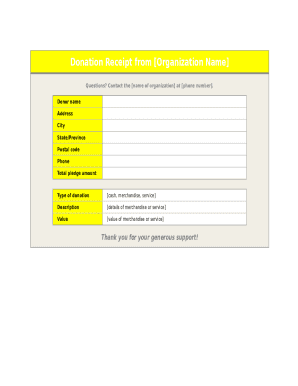

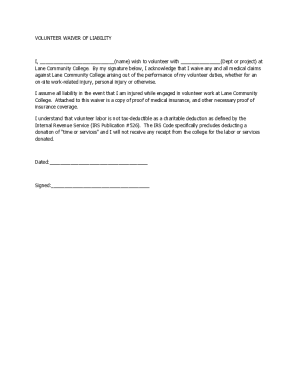

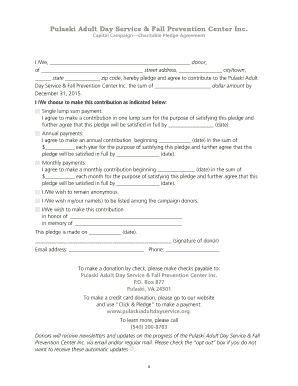

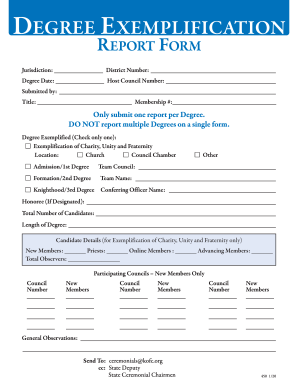

Your workflows always benefit when you are able to locate all the forms and documents you need at your fingertips. DocHub offers a a huge library of forms to alleviate your everyday pains. Get hold of Charitable receipt canada Donation Forms category and easily discover your form.

Start working with Charitable receipt canada Donation Forms in a few clicks:

Enjoy smooth form managing with DocHub. Explore our Charitable receipt canada Donation Forms online library and discover your form right now!