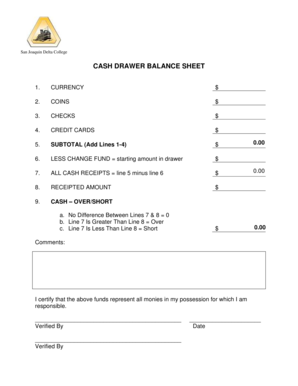

Obtain all the appropriate tools when organizing Checking account statement Balance Sheet Templates and boost your productivity. Modify and manage your financial documents online with a free DocHub account.

Boost your document managing with our Checking account statement Balance Sheet Templates collection with ready-made document templates that suit your requirements. Get the form, change it, fill it, and share it with your contributors without breaking a sweat. Start working more effectively together with your forms.

How to use our Checking account statement Balance Sheet Templates:

Discover all the opportunities for your online file management using our Checking account statement Balance Sheet Templates. Get a totally free DocHub account right now!