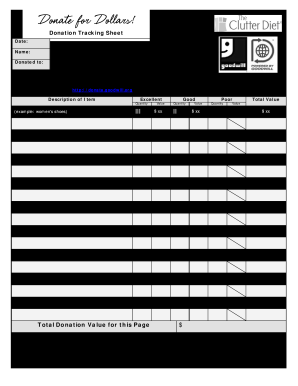

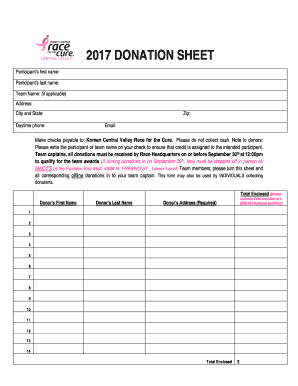

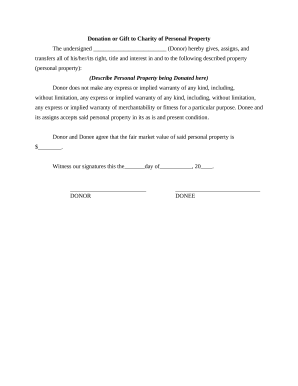

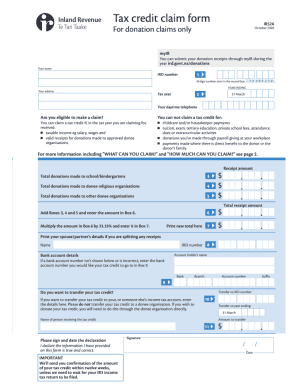

Obtain customizable Monetary receipt Donation Forms catalog and find the document you require. Complete, sign, and send templates with effortlessness using DocHub.

Your workflows always benefit when you are able to find all the forms and documents you need on hand. DocHub delivers a wide array of templates to ease your daily pains. Get a hold of Monetary receipt Donation Forms category and quickly find your form.

Start working with Monetary receipt Donation Forms in several clicks:

Enjoy smooth record administration with DocHub. Discover our Monetary receipt Donation Forms collection and discover your form right now!