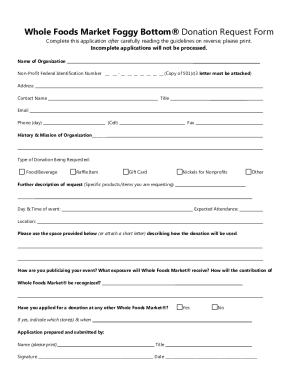

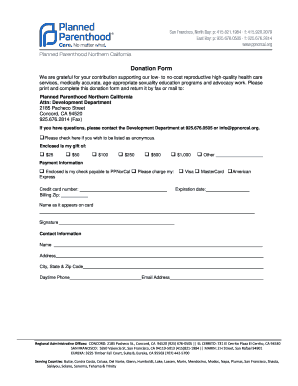

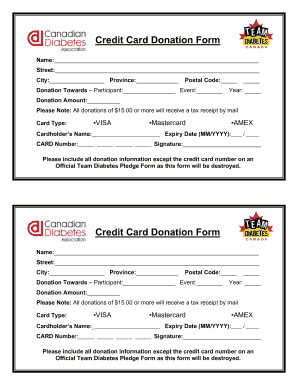

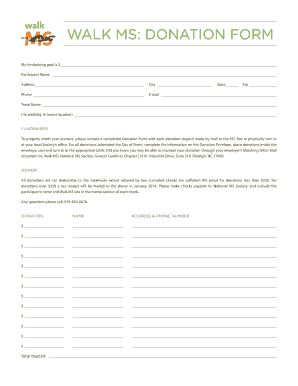

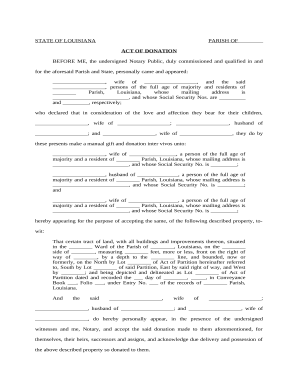

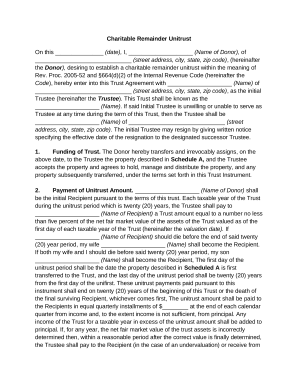

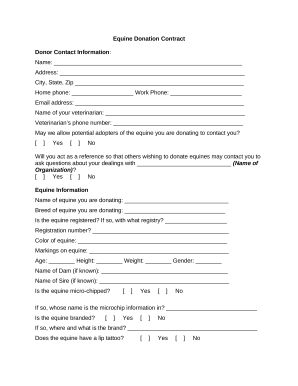

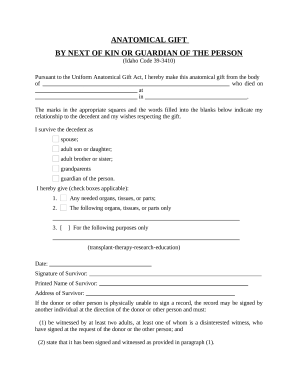

Preserve time and effort with our Planned giving Donation Forms templates on DocHub. Adjust, fill out, and send forms seamlessly for an enhanced donation process.

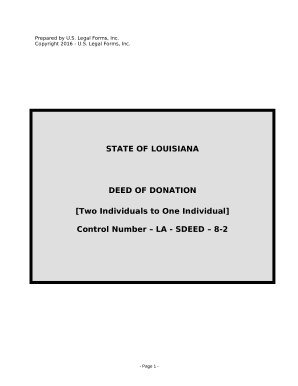

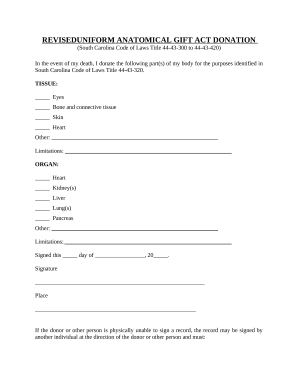

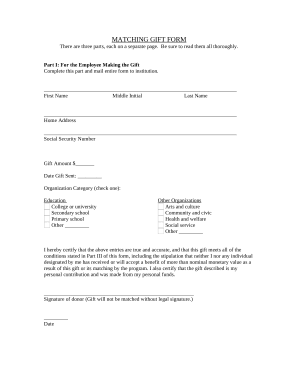

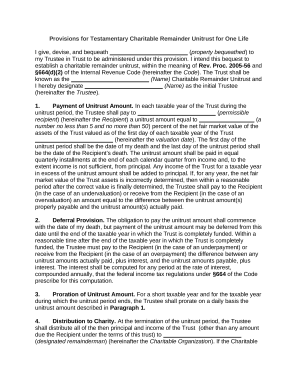

Your workflows always benefit when you can discover all the forms and documents you need on hand. DocHub delivers a huge selection of document templates to alleviate your daily pains. Get a hold of Planned giving Donation Forms category and easily discover your form.

Begin working with Planned giving Donation Forms in several clicks:

Enjoy easy file management with DocHub. Check out our Planned giving Donation Forms online library and discover your form right now!