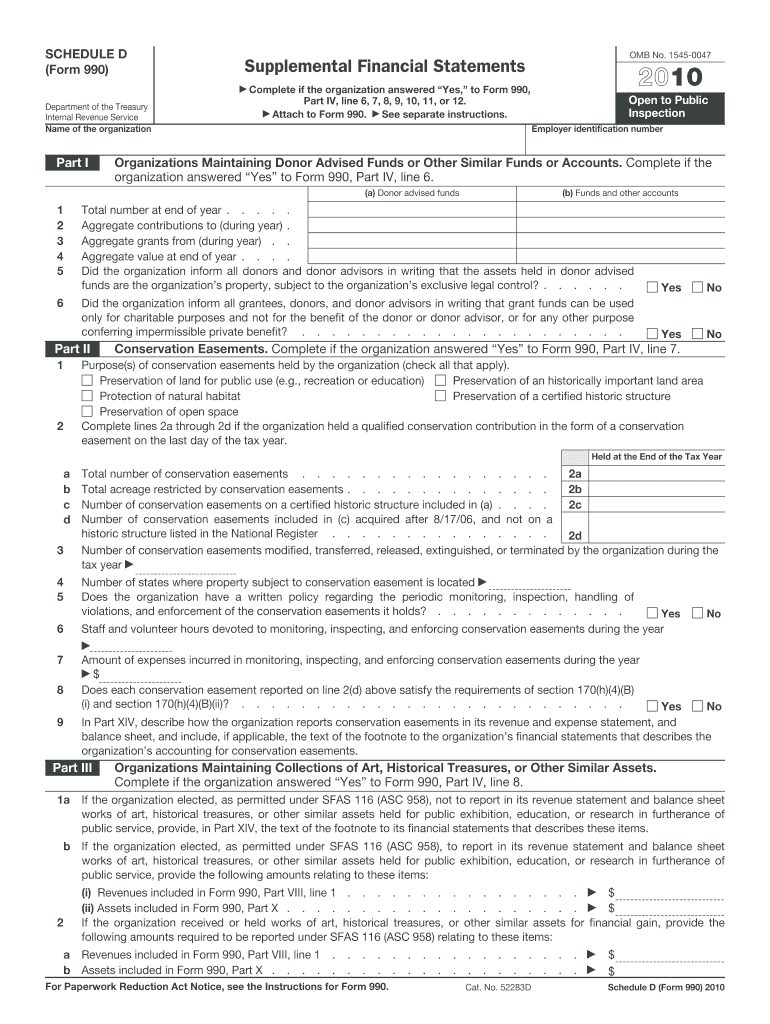

Definition and Purpose of the 2010 Form 990 Schedule D

The 2010 Form 990 Schedule D, a supplement to the main Form 990, is essential for non-profit organizations that need to provide additional financial statement details. It helps disclose information about specific types of funds and organizational assets such as donor-advised funds, endowment funds, and artworks. By detailing collections and ensuring accurate financial monitoring, this form enhances transparency and accountability. Organizations with diverse portfolios or complex financial activities must complete Schedule D to provide a comprehensive financial picture to the IRS and stakeholders.

Key Elements of Schedule D

Several key elements are fundamental to understanding the 2010 Form 990 Schedule D:

- Donor-Advised Funds: These sections capture details about funds held where donors retain advisory privileges.

- Conservation Easements: Information on land use restrictions meant to conserve property for public benefit.

- Collections of Art and Treasures: Details about significant artwork or historical collections held by the organization.

- Escrow and Credit Arrangements: Financial obligations related to conditional funds or secured credits.

- Endowment Funds: Information concerning funds meant to be invested in perpetuity to generate income for the organization.

- Reconciliation of Net Assets: Sections ensuring that reported net assets align with audited statements, promoting accuracy.

Each component requires in-depth reporting to facilitate IRS assessments and public scrutiny, ensuring all financial activities align with tax-exempt purposes.

Who Typically Uses the 2010 Form 990 Schedule D

Organizations that frequently utilize Schedule D often include:

- Non-Profits with Large Assets: Institutions with significant donor funding or physical assets like universities or museums.

- Charitable Organizations with Endowments: Those maintaining large endowments, requiring detailed reporting on fund management.

- Environmental Groups: Organizations holding conservation easements to preserve land.

- Art and Cultural Institutions: Entities in possession of valuable art or historical treasures, providing insights into their cultural stewardship.

Each of these organizations relies on the form to substantiate their financial practices and compliance with regulatory standards.

Steps to Complete the 2010 Form 990 Schedule D

Completing 2010 Form 990 Schedule D involves several meticulous steps:

- Gather Necessary Financial Documents: Collect all pertinent financial records such as statements of assets, escrow documentation, and endowment fund details.

- Fill Out Applicable Parts: Enter the gathered data into the respective sections, ensuring clarity and accuracy.

- Verify Reconciliation Sections: Confirm the reconciliation sections align with audited figures to prevent discrepancies.

- Review for Completeness: Ensure all relevant sections are completed before submission.

- Submit Alongside Form 990: File Schedule D as an attachment to the main Form 990, ensuring timely and accurate submission.

Adhering to these steps ensures compliance and avoids potential errors in reporting.

Important Terms Related to the 2010 Form 990 Schedule D

Understanding important terms is crucial for accurately filling out the form:

- Donor-Advised Fund: A fund constituted at a public charity and advised by donors regarding distributions.

- Conservation Easement: A legal agreement preserving property for conservation purposes.

- Endowment Fund: Funds set aside for investment, generally meant to exist in perpetuity.

- Net Assets Reconciliation: The process of ensuring reported net assets match audited financial statements.

Clarity of these terms ensures accurate representation and compliance with IRS requirements.

IRS Guidelines for Schedule D

The IRS provides specific guidelines for completing Schedule D:

- Accurate Asset Reporting: Detail all assets, particularly those of significant value or public interest.

- Strict Compliance Requirements: Ensure that all reconciliations and fund details meet IRS standards.

- Record Retention: Maintain records supporting data entries for at least six years.

Adhering to these guidelines is essential to prevent compliance issues and maintain the organization’s tax-exempt status.

Penalties for Non-Compliance

Failure to accurately complete and submit the 2010 Form 990 Schedule D may lead to severe penalties:

- Fines for Inaccuracies: Misreporting funds or assets can result in financial penalties.

- Loss of Tax-Exempt Status: Continued non-compliance can jeopardize an organization’s tax-exempt classification.

- Public Scrutiny: Incomplete or inaccurate disclosures can lead to public mistrust and reputational harm.

Understanding these implications emphasizes the importance of diligence in completing the form.

Form Submission Methods

Non-profits have several methods to submit their completed Form 990 and Schedule D:

- Online Filing: Most organizations are now required to electronically file these forms using approved IRS systems.

- Mail Submissions (exception): Small entities with specific exemptions might qualify to submit paper forms, although electronic filing is preferred.

- Professional Assistance: Utilize software like QuickBooks or engage tax professionals to ensure correct submission.

Efficient submission methods ensure compliance with IRS requirements and streamline organizational workflow.