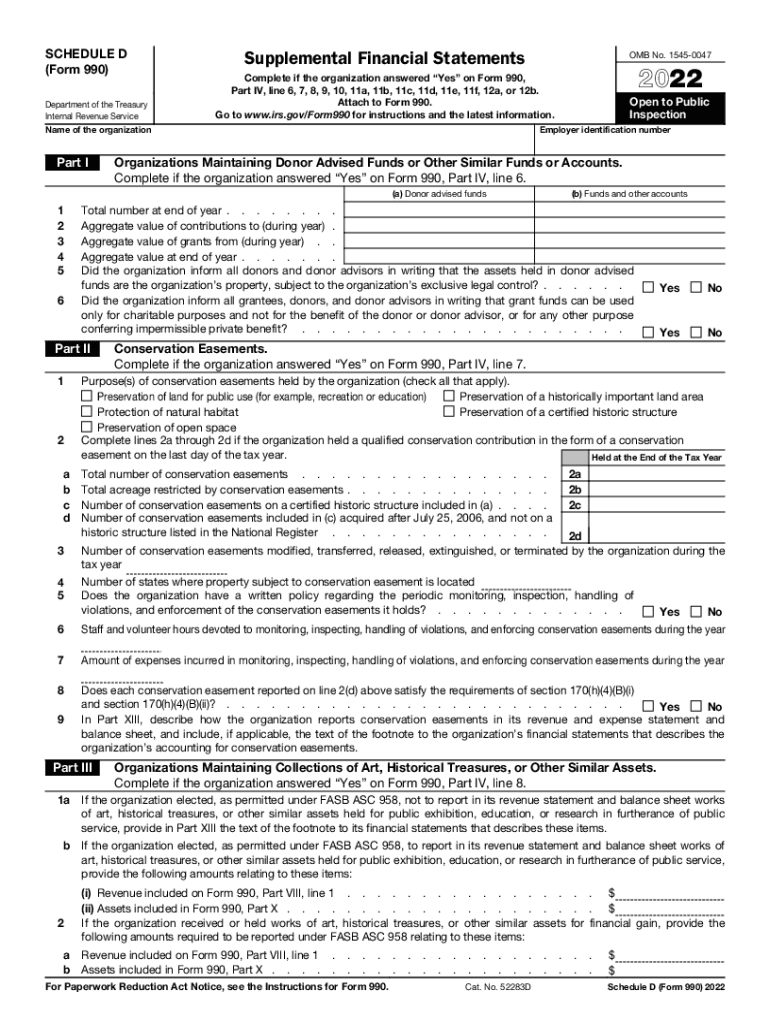

Definition & Purpose of Schedule D (Form 990)

Schedule D (Form 990) is a critical supplemental financial statement required by the IRS for specific organizations. It serves to ensure transparency and compliance, particularly for non-profit entities. This form provides detailed reporting on various financial aspects such as donor-advised funds, conservation easements, collections of art, and historical treasures. The primary objective is to maintain accountability in financial reporting and ensure that organizations adhere to tax regulations. Organizations required to fill out Schedule D usually manage assets that demand a robust disclosure process to ensure public trust and regulatory compliance.

How to Use the 2022 Schedule D (Form 990)

Successfully navigating the 2022 Schedule D involves understanding its structure and purpose. Organizations use this form to report on specific assets and financial transactions that require additional documentation beyond what is typically included in Form 990.

- Donor-Advised Funds: Carefully document the contributions and related activities involving these funds.

- Conservation Easements: Include information on the number and nature of easements held, along with their purposes and geographic locations.

- Collections of Art: Details regarding the size, nature, and use of the organization’s art collections must be provided.

Clear and accurate records ensure compliance and assist the IRS in evaluating fund management practices within these organizations.

Steps to Complete the 2022 Schedule D (Form 990)

Filling out Schedule D requires careful attention to detail.

- Collect Necessary Information: Gather all pertinent financial data, including records of contributions, easements, and any related transactions.

- Complete Each Section: Start with Part I, detailing donor-advised funds, and proceed through subsequent sections, meticulously entering data.

- Review for Accuracy: Once filled, thoroughly review the form to ensure all entries are complete and accurate, reflecting the organization’s financial activities.

- Submit: Schedule D must accompany the organization’s Form 990 upon submission to the IRS.

Key Elements of the 2022 Schedule D (Form 990)

Several critical components make up the form:

- Part I: Donor-Advised Funds: Requires detailed tracking of contributions and distributions.

- Part II: Conservation Easements: Involves disclosure of each easement, its purpose, and location.

- Part III: Collections of Art and Similar Items: Reporting on the valuation and use of the organization’s art collections.

These elements allow the IRS to obtain a thorough understanding of the financial dealings and asset management of the filing organization.

Legal Use of the 2022 Schedule D (Form 990)

Schedule D must be filled out accurately to comply with federal regulations. Misreporting or omissions can lead to penalties, legal challenges, and potential audits. It is essential to understand that providing complete and honest financial disclosures on this form is not just about regulatory adherence but also about sustaining public confidence and organizational integrity.

Who Typically Uses the 2022 Schedule D (Form 990)

This form is predominantly used by non-profit organizations recognized under section 501(c) of the IRS tax code. These organizations typically manage donor-advised funds, conservation easements, or possess significant collections of art. Its use helps in maintaining transparency about their financial management to donors, regulatory bodies, and other stakeholders.

IRS Guidelines for Schedule D (Form 990)

The IRS provides comprehensive instructions outlining how organizations should approach their financial reporting obligations with Schedule D. The guidelines emphasize the necessity for transparency, complete data disclosure, and adherence to specific instructions included with each section of the form. Organizations should regularly consult these IRS instructions to remain compliant.

Filing Deadlines / Important Dates

Organizations filing Schedule D must observe strict deadlines to avoid penalties:

- Annual Submission: It accompanies Form 990, due annually by the 15th day of the 5th month after the close of the organization’s fiscal year.

- Extensions: If more time is needed, organizations may file for an extension. However, deadlines must be closely monitored to ensure compliance.

Failing to submit the form in a timely manner can result in financial penalties and increased scrutiny from the IRS.