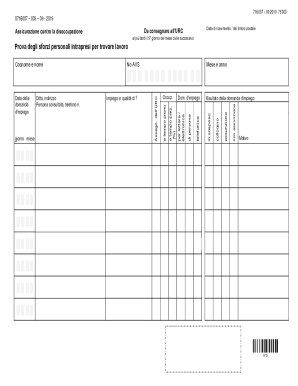

Definition and Purpose of Form 990 Schedule D 2011

Form 990 Schedule D 2011 is a supplement to Form 990, which is used by tax-exempt organizations to provide specific details about certain financial activities and balances. This schedule is essential for organizations that hold assets such as donor-advised funds, conservation easements, and collections of art. It includes several parts that focus on the reporting of financial statement footnotes, reconciliation of financial statements, and details on endowments and other forms of savings or investments.

Organizations use this form to ensure compliance with the Internal Revenue Service (IRS) regulations and to provide transparency regarding their financial activities. Specifically, Schedule D is used to elaborate on the organization’s assets, liabilities, as well as to detail the methods used for calculating the value of such assets.

How to Use Form 990 Schedule D 2011

To use Form 990 Schedule D 2011, organizations need to first determine whether they are required to complete this schedule by reviewing their financial activity and asset holdings. This includes evaluating whether they have activities or balances that fall under donor-advised funds, conservation easements, or endowment funds.

-

Identify Reporting Requirements: Confirm which parts of Schedule D apply to your organization based on its financial transactions and holdings.

-

Gather Necessary Financial Data: Collect detailed financial records required for each applicable part of the schedule, such as valuations of real estate holdings or contributions to donor-advised funds.

-

Complete Each Relevant Section: Carefully fill out each applicable part of the schedule, ensuring all entries are accurate and in line with IRS guidelines.

-

Review Financial Footnotes: Ensure that any financial footnotes from the main financial statements that affect the information in Schedule D are appropriately referenced.

-

Align with IRS Standards: Maintain compliance by cross-referencing with current IRS instructions to make sure all reporting is up-to-date and complete.

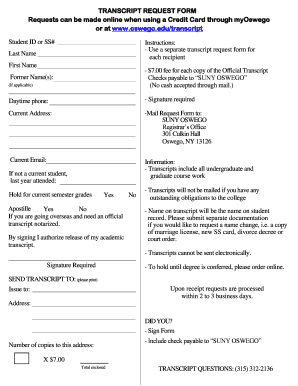

How to Obtain Form 990 Schedule D 2011

Obtaining Form 990 Schedule D 2011 is a straightforward process. It can be accessed online through the IRS website where it is available for download in PDF format.

- Online Access: Visit the IRS official website and search for "Form 990 Schedule D 2011" to find and download the file.

- Tax Software: If using tax preparation software, such as TurboTax or QuickBooks, the form can typically be accessed directly within the software, providing a guided experience for filling it out.

- Contacting the IRS: For those who prefer physical copies or need additional assistance, contacting the IRS directly to request a paper version of the form is also an option.

Steps to Complete Form 990 Schedule D 2011

Completing Form 990 Schedule D involves several specific steps, depending on the sections that apply to an organization:

- Review General Instructions: Carefully read the instructions to understand filing requirements and sections applicable to your financial context.

- Start with the Reconciliation of Financials: Compare financial statement footnotes with accounting records to ensure consistency.

- Proceed to Each Section:

- Part I: Provide details on donor-advised funds.

- Part II: Describe any conservation easements.

- Part III: Document collections of art, treasures, or other historical artifacts.

- Validate Information: Double-check all reported data for accuracy.

- Attach to Form 990: Make sure Schedule D is securely attached to the main Form 990 submission.

Key Elements of Form 990 Schedule D 2011

Each part of Schedule D serves a distinct purpose related to the assets and financial activities of an organization:

- Part I focuses on donor-advised funds, requiring detailed disclosures about contributions, grants, or distributions.

- Part II involves conservation easements and necessitates providing descriptions, locations, and use restrictions.

- Part III demands a valuation and brief on art collections, emphasizing public trust and stewardship.

- Part IV and V are reserved for reporting initially about endowment funds and then financial statement footnotes, ensuring high accuracy and transparency.

State-Specific Rules for Using Form 990 Schedule D 2011

While IRS regulations set the federal requirements for Form 990 Schedule D, individual states may impose additional rules or variations in filing obligations, especially for organizations registered or operating in multiple states.

- State Filings: Check with the relevant state tax agency for additional reporting requirements that might affect items disclosed on Schedule D.

- Conservation Rules: States with specific conservation laws might have additional disclosures required for easements.

IRS Guidelines and Filing Deadlines

Organizations must adhere to the IRS guidelines for filing deadlines which typically align with the annual tax filing deadline:

- Regular Deadline: Generally due the 15th day of the 5th month after the end of an organization’s fiscal year.

- Extensions: An automatic three-month extension is often available upon request.

Noncompliance with the guidelines or deadlines can result in penalties, emphasizing the importance of maintaining timely and accurate submissions.

Penalties for Non-Compliance

Failing to file Form 990 Schedule D accurately and on time can lead to significant fines and penalties imposed by the IRS:

- Monetary Penalties: Monetary fines can vary depending on the size of the organization and the duration of non-compliance.

- Public Disclosure: Persistent non-compliance may lead to public disclosure, which can affect the organization's reputation.

This broad overview outlines essential aspects of Form 990 Schedule D for 2011, providing a comprehensive guide to navigation and compliance.