Definition & Meaning

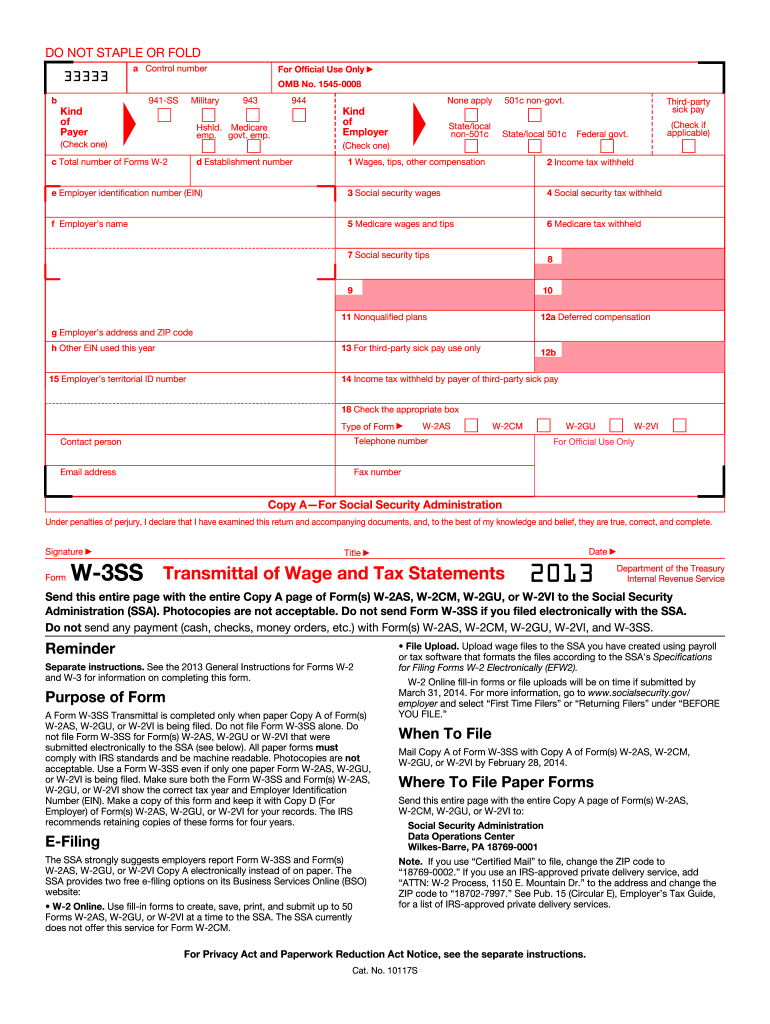

The Form W-3SS, known as the Transmittal of Wage and Tax Statements, is a critical document for employers who operate in U.S. territories. This form serves as a transmittal form for Form W-2SS, detailing the wage and tax information for each employee. It is specifically designed for employers in American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, Puerto Rico, and the U.S. Virgin Islands. The 2013 edition of this form includes comprehensive instructions and requirements pertinent to that tax year.

How to Use the 2013 Form W-3SS

Employers must use the 2013 Form W-3SS to transmit Copy A of Form W-2SS to the Social Security Administration (SSA). This transmission process involves gathering all the W-2SS forms that accompany the W-3SS form. It is essential to ensure that the Form W-3SS correctly totals the amounts reported on all accompanying Forms W-2SS. This process ensures accurate reflection of total earnings, Social Security wages, and taxes withheld for the year 2013.

Key Steps in Using Form W-3SS

- Gather Employee Forms W-2SS: Collect the completed Forms W-2SS for all employees.

- Verify Accuracy: Ensure that the W-2SS data is accurate and matches the employer's records.

- Complete Form W-3SS: Fill in the totals from all W-2SS forms in the Form W-3SS, including total wages, tax withheld, and other pertinent information.

- Transmit to SSA: Send the completed Form W-3SS, along with Copy A of all W-2SS forms, to the SSA by the deadline.

Steps to Complete the 2013 Form W-3SS

The completion of Form W-3SS involves several meticulous steps to ensure compliance and accuracy:

- Record Employer Information: Include the employer’s name, address, and Employer Identification Number (EIN).

- Report Totals: Sum all the amounts from the Form W-2SS for lines like wages, Social Security wages, and Medicare wages.

- Check Special Fields: Complete additional sections indicating any special compensatory payments or other adjustments.

Legal Use of the 2013 Form W-3SS

Form W-3SS must be used to comply with legal regulations regarding wage reporting in American territories. This ensures the accurate documentation and reporting to the SSA, fulfilling federal requirements. Employers must understand their obligations under both federal and territorial laws to correctly utilize this form.

Who Typically Uses the 2013 Form W-3SS

This form is specifically used by employers operating within certain U.S. territories. It is crucial for companies in these regions to file their employee wage and tax data accurately to federal entities. The primary users include accounting departments of businesses operating in territories like Puerto Rico and Guam.

IRS Guidelines for the 2013 Form W-3SS

The IRS provides specific guidelines on filling out and submitting Form W-3SS. These guidelines emphasize the importance of accuracy and submission by the deadline to avoid penalties. Detailed instructions classify how to report different types of wages and taxes, ensuring compliance with IRS regulations.

Penalties for Non-Compliance

Failure to correctly file Form W-3SS can result in penalties from the IRS. These can include fines for late submission or inaccuracies in the reported data. It is crucial to adhere to deadlines and guidelines to avoid such consequences. Compliance ensures the employer remains in good standing with the IRS and avoids unnecessary financial penalties.

Form Submission Methods (Online / Mail / In-Person)

Employers can submit Form W-3SS to the SSA via mailing the forms, with the preferred method outlined in IRS guidelines. Currently, this form must be sent as a paper submission, and it is not allowed to submit it online like some other forms. Each submission method comes with its own set of instructions to ensure that every form and accompanying document reach the SSA securely and promptly.