Definition and Purpose of the 2022 Form W-3SS

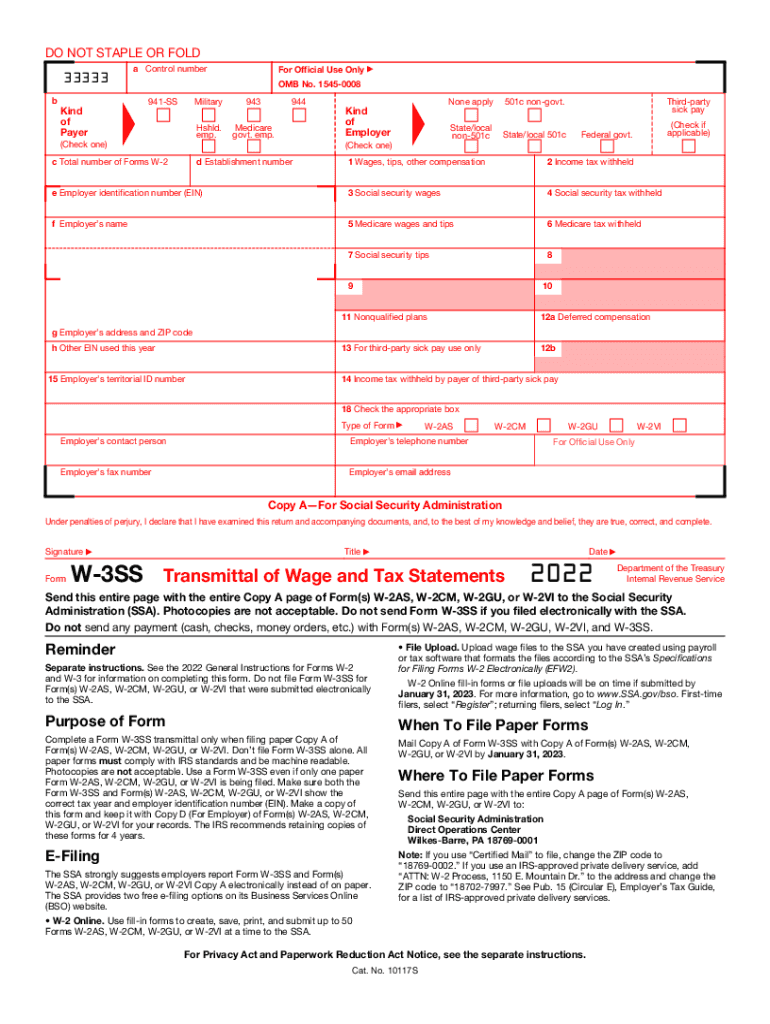

The 2022 Form W-3SS serves as a transmittal form that accompanies Forms W-2SS submitted to the Social Security Administration (SSA). It is used to summarize all wage and tax information for employees in U.S. territories, such as Puerto Rico, Guam, and the U.S. Virgin Islands. The form provides essential information like total wages paid, taxes withheld, and other relevant payroll data for these jurisdictions. The role of Form W-3SS is crucial in ensuring that the SSA receives accurate and comprehensive information to maintain employees' Social Security and Medicare records.

How to Use the 2022 Form W-3SS

To effectively use the 2022 Form W-3SS, employers must first complete individual Forms W-2SS for each employee working within U.S. territories. Once all W-2SS forms are ready, the W-3SS is used to compile the summarized wage and withholding data. This form should be filled out with attention to detail to avoid errors. Once the Form W-3SS is complete, it must be submitted to the SSA along with the corresponding Forms W-2SS.

Filing Procedures

- Ensure all Forms W-2SS are accurately completed for individual employees.

- Compile total wages and withholdings into Form W-3SS.

- Double-check for any discrepancies or errors before submission.

- Submit the Form W-3SS with all W-2SS forms to the SSA by mail or electronically if applicable.

Steps to Complete the 2022 Form W-3SS

Completing the 2022 Form W-3SS involves several systematic steps:

- Gather Information: Collect all finalized Forms W-2SS for your employees.

- Fill in Employer Information: Enter employer identification details, such as the employer identification number (EIN), address, and contact details.

- Provide Total Wages and Taxes: Record total wages and withheld taxes from compiled Forms W-2SS into the corresponding sections of Form W-3SS.

- Reconciliation: Ensure the totals match the information entered on individual Forms W-2SS.

- Sign and Date: The form must be signed and dated by the employer or authorized representative.

- Submit to the SSA: Choose the submission method (mail or e-file) and deliver the completed form along with all W-2SS forms to the SSA.

Who Typically Uses the 2022 Form W-3SS

The primary users of the 2022 Form W-3SS are employers conducting business within U.S. territories. This includes a variety of businesses, both small and large, that have employees residing in these areas. Typically, the form is used by:

- Employers in Puerto Rico, Guam, American Samoa, the U.S. Virgin Islands, and the Northern Mariana Islands.

- Businesses of all sizes responsible for withholding and reporting Social Security and Medicare taxes.

- Payroll departments within these businesses that manage wage reporting.

Key Elements of the 2022 Form W-3SS

The key elements of the 2022 Form W-3SS consist of several important sections that must be accurately filled out to ensure correct processing:

- Employer Information: Fields for the employer’s EIN, name, and address.

- Total Employee Count: Number of employees for whom Forms W-2SS are being filed.

- Wage Totals: Aggregated total of taxable wages, tips, and other compensation paid during the tax year.

- Tax Withheld Totals: The overall amount of Social Security and Medicare taxes withheld.

- Special Allocations: Space to clarify details like third-party sick pay and group-term life insurance in cases where applicable.

IRS Guidelines and Compliance for 2022 Form W-3SS

Form W-3SS must adhere to specific IRS and SSA guidelines to ensure compliance:

- Accurate Reporting: Employers are required to ensure all figural entries are exact replicas of employee contributions and wages.

- Timely Filing: It is crucial to submit forms by the prescribed deadlines. For the year 2022, the deadline generally is January 31, 2023.

- E-filing Encouragement: Employers who file 250 or more W-2SS forms are encouraged to file these electronically per IRS instructions.

- Verification Process: Utilize the SSA Business Services Online (BSO) to confirm proper filing and address errors promptly.

Penalties for Non-Compliance with Form W-3SS

Non-compliance or incorrect filing of Form W-3SS can lead to substantial penalties. These penalties emphasize the need for diligence:

- Incorrect Information Penalties: Errors on the form can result in penalties, with fines varying based on the degree and timing of detected errors.

- Late Filing Penalties: Delayed filing, particularly past the stipulated deadline, incurs financial penalties. Timeliness in submission is crucial.

- Intentional Disregard: If an employer is found to have intentionally disregarded their filing obligations, the associated fines are significantly higher, underlining the importance of genuine compliance efforts.

Differences Between Digital and Paper Form W-3SS

Choosing between digital and paper filing of Form W-3SS has significant implications:

- Digital Filing Advantages: Offers faster processing times, immediate confirmation of receipt, and reduces the likelihood of physical document loss.

- Paper Filing Considerations: While still valid, paper filing can lead to slower processing times and increased potential for errors due to manual data entry.

- Technological Accessibility: The SSA's electronic systems such as BSO offer advanced security measures, making digital filing the preferred method for many businesses.

Business Entity Types That Benefit Most from Form W-3SS

Different business structures in U.S. territories may have unique interactions with the 2022 Form W-3SS:

- Corporations and Large Enterprises: Often have numerous employees and benefit significantly from organized payroll reporting systems.

- Small Businesses: These entities need streamlined processes to comply with territorial tax and payroll obligations efficiently.

- Non-Profit Organizations: Often operate within U.S. territories and require robust documentation like the W-3SS to maintain financial integrity and IRS compliance.