Definition and Meaning

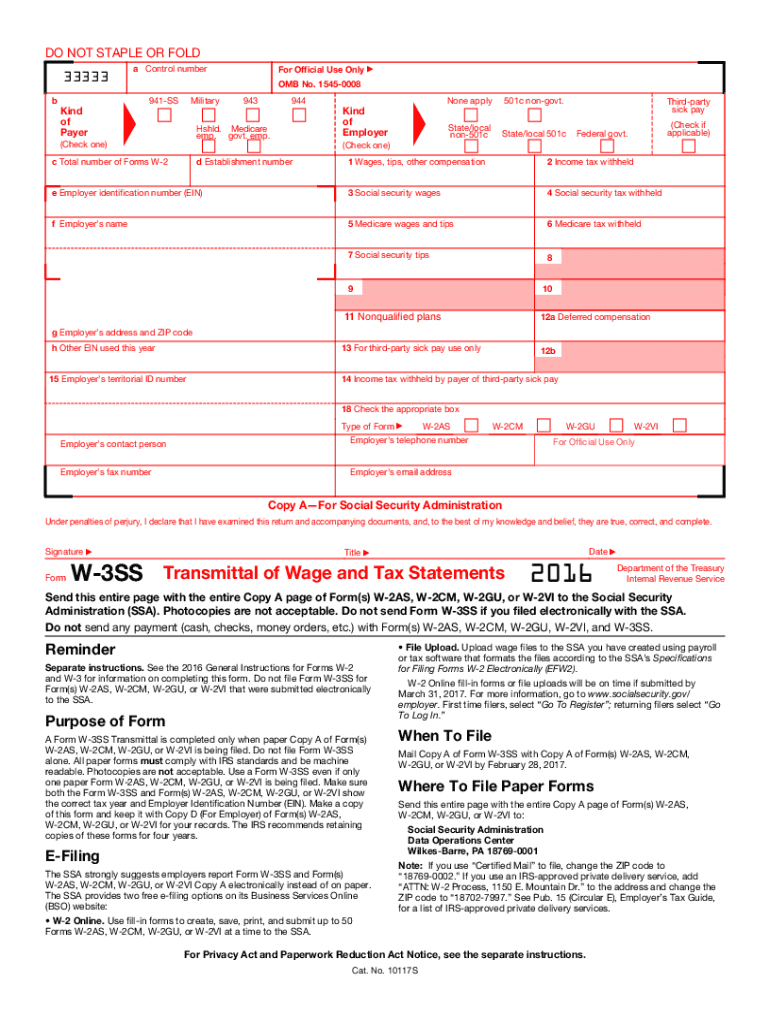

The W-3 SS 2016 Form, known as the Transmittal of Wage and Tax Statements, is a form used in conjunction with W-2 forms. It is primarily utilized for reporting employee wages and accompanying tax withholdings to the Social Security Administration (SSA). Used by employers in U.S. territories, this form consolidates multiple W-2 submissions, providing a summary for accurate payroll tax reporting.

Practical Functionality

- Serves as a cover sheet for W-2 forms submitted to the SSA.

- Applies to wages paid to employees working in the U.S. territories.

- Essential in ensuring all wage and tax information is accurately reported to avoid fines.

Specific Use Cases

- Employers operating in Puerto Rico, American Samoa, Guam, or the U.S. Virgin Islands.

- Businesses with payroll obligations in these territories.

How to Use the W-3 SS 2016 Form

Using the W-3 SS 2016 form involves several structured steps to ensure compliance with regulatory requirements. Understanding these procedures helps avoid errors that could lead to penalties.

Step-by-Step Instructions

- Gather W-2 Forms: Collect all employee W-2 forms for the tax year.

- Complete W-3 SS Form: Enter the total number of W-2 forms and aggregate wages, social security wages, and tax withheld.

- Verify Information Accuracy: Cross-check the information for accuracy, ensuring alignment with payroll records.

- Submit to SSA: File the completed W-3 SS form, accompanying the batch of W-2s, to the SSA by the due date.

Filing Details

- Utilize the official SSA website for electronic submissions.

- Physical forms must be sent to the appropriate SSA address.

Steps to Complete the W-3 SS 2016 Form

Filling out the W-3 SS 2016 form correctly is essential for seamless processing and compliance adherence.

Detailed Completion Guide

- Employer Identification: Fill in the employer’s name, address, and Employer Identification Number (EIN) at the top of the form.

- Wage and Tax Totals: Aggregate totals from all employee W-2 forms, including wages, tips, and other compensations.

- Specific Boxes: Carefully enter total amounts in designated boxes, such as:

- Box 1: Total wages, tips, and other compensation.

- Box 2: Total federal income tax withheld.

- Box 5: Medicare wages and tips.

- Box 7: Social security tips.

- Sign and Date: Ensure the form is signed by an authorized person, including the date to confirm authenticity.

Common Mistakes

- Misreporting employee totals.

- Incorrectly aggregating tax amounts.

- Forgetting to sign the form.

Important Terms Related to W-3 SS 2016 Form

Understanding common terminology related to the W-3 SS 2016 form aids in accurate completion and compliance.

Key Terms

- EIN (Employer Identification Number): A unique nine-digit number assigned to businesses by the IRS for identification purposes.

- FICA (Federal Insurance Contributions Act): Covers social security and Medicare taxes.

- SSA (Social Security Administration): The U.S. government agency managing social security and processing W-3 and W-2 forms.

Related Concepts

- W-2 Form: Provides detailed employee wages and tax summaries for the year.

- Tax Withholding: Amount withheld from employee wages for tax purposes.

Legal Use of the W-3 SS 2016 Form

Employers use the W-3 SS 2016 form within specific legal frameworks to ensure accurate tax reporting and compliance.

Legal Obligations

- Employers are legally required to file W-3 forms alongside W-2s to the SSA.

- Accurate reporting prevents penalties for non-compliance with federal regulations.

Compliance Standards

- Ensuring all employee wages and taxes are correctly reported.

- Filing deadlines are adhered to, typically by January 31st for the prior tax year.

Filing Deadlines and Important Dates

Timeliness in filing the W-3 SS 2016 form is critical for compliance and avoiding penalties.

Key Filing Dates

- Deadline: Typically January 31st for forms covering the previous calendar year.

- Extensions: May be available, but require formal requests.

Penalty Considerations

- Late filing can result in financial penalties.

- Delays can disrupt employee tax reporting and refunds.

Penalties for Non-Compliance

Failure to properly file the W-3 SS 2016 form can lead to penalties, underlining the importance of accurate and timely submissions.

Types of Penalties

- Late Filing Penalties: Fines imposed for missing the January 31st deadline.

- Inaccurate Filing: Additional penalties for incorrect information that hinders SSA processing.

Avoidance Strategies

- Regular audits of payroll systems to ensure accuracy.

- Early preparation and filing to accommodate potential errors.

Form Submission Methods

The W-3 SS 2016 form can be submitted using various methods, each with specific requirements.

Submission Options

- Electronic Submission: Via the SSA’s Business Services Online platform, preferred for expediency and security.

- Paper Submission: Must be mailed to the SSA’s designated address for forms from U.S. territories.

Security Considerations

- Ensure all data transmissions are secure.

- Use SSA’s recommended submission interfaces to protect sensitive information.