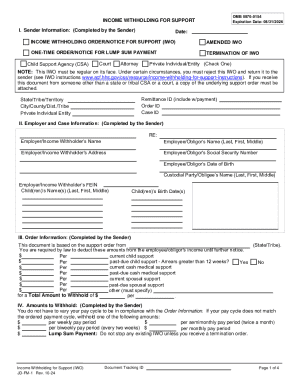

Definition & Function of W-3SS

The "W-3SS" form, titled "Transmittal of Wage and Tax Statements," is an essential document utilized by employers to transmit Copy A of Forms W-2 to the Social Security Administration (SSA) for employees covered by the Social Security Act. This specific form is applicable for those reporting W-2 data for American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands. The W-3SS consolidates W-2 forms for these regions, ensuring that employee wage and tax information is accurately reported.

How to Use the W-3SS Form

-

Filing Purpose:

- Employers must accompany each batch of W-2 forms with a W-3SS form. It acts as a summary report for all W-2 entries submitted.

-

Completion Guidelines:

- While completing the form, employers must fill out details such as the total amount of wages, tips, and other compensation.

- Ensure accuracy for total social security wages, Medicare wages, and tax data.

-

Key Fields:

- Employer Information: Include name, address, and Employer Identification Number (EIN).

- Employment Statistics: Enter total number of W-2s attached and aggregate amounts.

Steps to Complete the W-3SS

-

Gather Necessary Information:

- Collect all completed W-2 forms and confirm that all details are accurate for each employee.

-

Fill in Employer Details:

- Provide employer name, EIN, and address as they appear on your other tax documentation.

-

Accumulate Wage and Tax Information:

- Sum up wages, tips, and other forms of compensation for all employees in the covered territories.

- Include total social security wages and Medicare wages subject to payroll withholding.

-

Verify Entries:

- Double-check all calculated totals and identify discrepancies in the data provided on the W-2 forms.

-

Submit Form:

- Send the W-3SS alongside the W-2 forms to the SSA using the specified submission method.

Who Typically Uses the W-3SS

The W-3SS form is typically utilized by:

- Employers operating within U.S. territories: This includes businesses in American Samoa, Guam, Northern Mariana Islands, and U.S. Virgin Islands that process payroll and tax reports.

- Payroll Departments: Those handling comprehensive wage and tax filings for multiple employees.

- Tax Professionals: Individuals tasked with managing international or U.S. territorial payroll can assist businesses with filing procedures using the W-3SS form.

Legal Guidelines for W-3SS Usage

-

Mandatory Reporting: Employers must fulfill the obligation to report employee wages and taxes accurately within applicable deadlines to the SSA.

-

Data Integrity: Use the W-3SS to submit correct and complete wage data. Any inaccuracies can lead to penalties for incorrect submissions.

-

Recordkeeping: Employers are required to maintain accurate records of all wage and tax filings for a specified period as mandated by the IRS and SSA guidelines.

Key Elements of the W-3SS

- Summary Totals: The form aggregates total wages, tax withheld, and other vital payroll data.

- Employer Identifier: EIN acts as the primary tracking number ensuring proper association with the business entity.

- Territory-Specific Reporting: The form applies specifically to taxation in U.S. territories, not the continental U.S.

Software Compatibility for Filing W-3SS

-

E-File Services: Various tax software, such as TurboTax and QuickBooks, offer compatibility, enabling the electronic preparation and filing of the W-3SS form directly with the SSA.

-

Payroll Software Integration: Systems like ADP and Paychex facilitate streamlined data collection and seamless form generation for accurate reporting.

Important Deadlines & Submission Methods

-

Filing Deadlines: Ensure submission of W-3SS forms by the February deadline when accompanying paper filings. For electronic filings, confirm SSA guidelines for specific e-filing dates.

-

Submission Options:

- Mail: Employers may choose to send physical copies via certified mail to ensure delivery and receipt acknowledgment.

- Online Filing: SSA’s Business Services Online offers an e-filing method for streamlined processing.

By adhering to these guidelines, employers can efficiently manage their payroll and tax reporting obligations, minimizing the risk of penalties and avoiding unnecessary discrepancies in wage reporting for employees within U.S. territories.