Definition and Meaning of 2012 Form 720

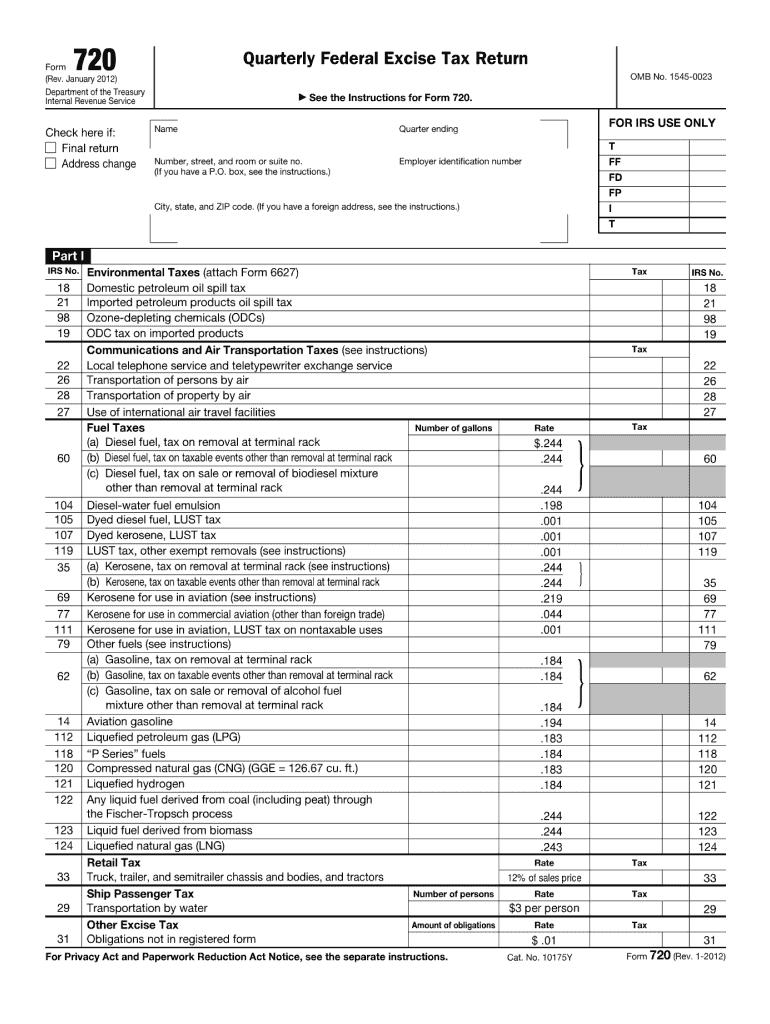

The 2012 Form 720 is a tax form used by businesses to report and pay certain types of federal excise taxes. Excise taxes may apply to specific products and activities, including fuel, environmental taxes, and communications services. The Internal Revenue Service (IRS) requires this form as part of compliance for businesses engaged in subject activities, ensuring they adequately report and pay any applicable excise taxes.

Making use of the 2012 Form 720 involves detailing taxable activities and calculating the appropriate taxes owed. Entities such as corporations, partnerships, and LLCs may find this form relevant, depending on their business operations.

How to Obtain the 2012 Form 720

Acquiring the 2012 Form 720 is straightforward. You can obtain it through several methods:

- IRS Website: The IRS maintains a repository of tax forms, including the 2012 Form 720, available for download in PDF format.

- Tax Preparation Software: Programs like TurboTax and H&R Block may provide access to this form during the preparation process, allowing users to fill out and submit it electronically.

- Tax Professionals: Many tax advisors and preparers have access to the form and can assist in filling it out correctly.

When obtaining the form, ensure you're using the correct version for the relevant tax year to avoid complications associated with filing outdated or incorrect forms.

Steps to Complete the 2012 Form 720

Completing the 2012 Form 720 involves several key steps to ensure accuracy in reporting and payments:

-

Identify Applicable Excise Taxes:

- Determine which types of excise tax apply to your business operations. This can include fuel taxes, environmental taxes, or occupational taxes.

-

Gather Necessary Information:

- Collect financial records, receipts, and previous tax returns related to taxable activities and products.

-

Fill Out the Form:

- Begin with the basic information, including the taxpayer’s name and address.

- Report taxable activities and compute the excise taxes owed in the designated sections of the form.

-

Double-Check Calculations:

- Review all entries for accuracy. Mistakes in calculation can lead to penalties or the need to amend your submission.

-

Submit the Form:

- File your completed form by the due date, utilizing the methods accepted by the IRS, whether online, by mail, or in-person.

By following these steps, businesses can accurately report their excise taxes and avoid common pitfalls associated with tax filing.

Important Terms Related to 2012 Form 720

Understanding specific terminology associated with the 2012 Form 720 is crucial for accurate completion and compliance:

- Excise Tax: A tax imposed on the sale or production of specific goods, activities, or services, separate from regular income tax.

- Taxable Activity: Any action or transaction that falls under the purview of excise tax regulations, such as the sale of fuel or certain services.

- Filing Deadline: The due date for submitting the form, which is determined by the IRS and can vary depending on the type of excise tax.

- Taxpayer Identification Number (TIN): A unique identifier assigned to taxpayers for tax filing and reporting purposes.

Familiarity with these terms ensures clarity when completing the form and communicates effectively with tax professionals and the IRS.

Filing Deadlines and Important Dates for the 2012 Form 720

Filing deadlines for the 2012 Form 720 must be adhered to strictly, as late submissions can incur penalties. Key dates include:

-

Quarterly Prepayments: Form 720 is generally filed quarterly, with specific due dates for prepayments:

- For the first quarter, the deadline is typically April 30.

- For the second quarter, it is generally July 31.

- For the third quarter, the filing date is usually October 31.

- For the fourth quarter, the final filing is due January 31 of the following year.

-

Annual Reconciliation: If applicable, it may be necessary to reconcile excise taxes for the year with any discrepancies noted during quarterly filings.

Staying informed about these deadlines can help alleviate stress and ensure timely compliance with IRS regulations.

Legal Use of the 2012 Form 720

The 2012 Form 720 serves a vital legal function in regard to compliance with federal tax obligations. Businesses are obligated to file this form to report any federal excise taxes applicable to them based on their operations and activities. Failure to file correctly can lead to:

- Penalties: Late or inaccurate submissions can result in fines imposed by the IRS.

- Legal Consequences: Prolonged non-compliance can lead to audits or further legal action by government entities.

Moreover, proper use of Form 720 demonstrates due diligence in adhering to tax laws, which can protect businesses from potential scrutiny or liabilities associated with non-compliance.

Examples of Using the 2012 Form 720

Utilizing the 2012 Form 720 can vary based on the nature of the business and its tax obligations. Here are a few practical examples:

-

Fuel Tax Reporting: A trucking company must report the fuel excise taxes they collected from clients. They would list their taxable sales, calculate the owed fuel tax based on gallons sold, and remit payment through Form 720.

-

Air Transportation Services: An airline may need to report taxes associated with ticket sales under certain conditions. They would fill out the form detailing their gross ticket sales and compute the excise tax accordingly.

-

Manufacturing Business: A manufacturer of specific goods subject to excise tax must track sales accurately and file the form to avoid discrepancies between reported and actual sales.

These examples illustrate the diverse applications of Form 720, highlighting its relevance across various industries.

IRS Guidelines for the 2012 Form 720

The IRS provides explicit guidelines and instructions for completing and submitting the 2012 Form 720. Key points include:

- Accurate Reporting: Businesses must report all taxable activities relevant to excise taxes appropriately.

- Calculation Methods: The IRS stipulates how to calculate taxes owed based on the type of excise tax and relevant rates.

- Record-Keeping: Maintaining accurate and comprehensive records of all transactions is essential for supporting claims made on the form.

Following these guidelines is critical for ensuring compliance and Avoiding issues during reviews or audits by the IRS.