Definition and Overview of the W-2GU 2016 Form

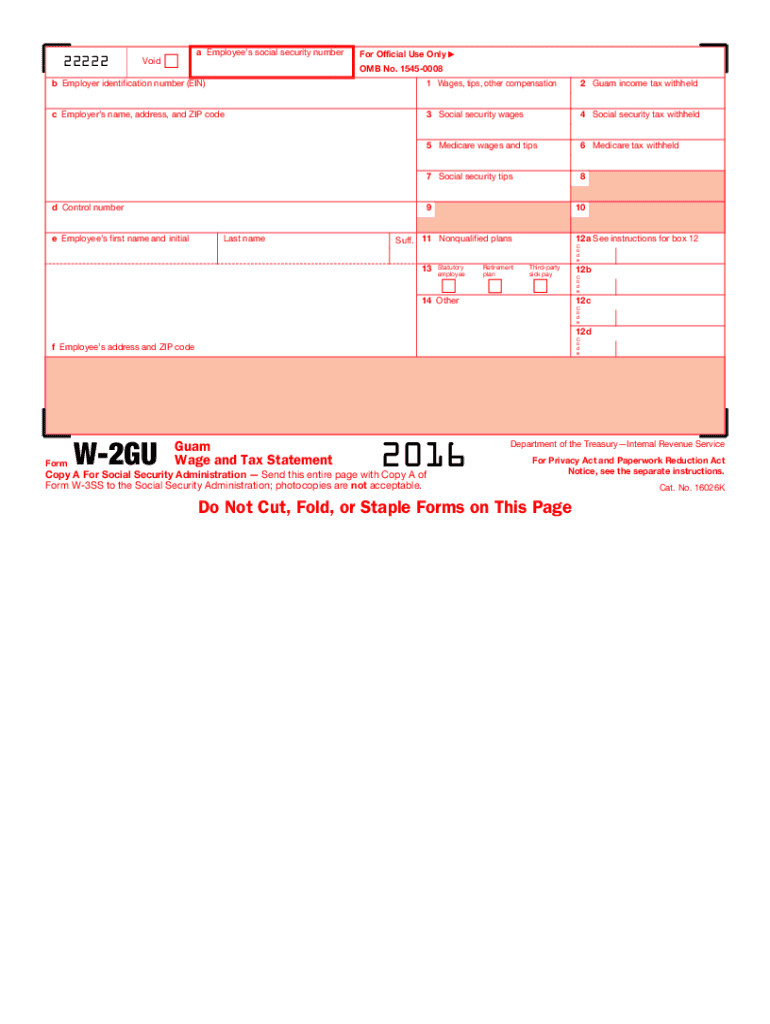

The W-2GU 2016 form serves as the Guam Wage and Tax Statement for the tax year 2016. This specific form is pivotal for individuals who are employed in Guam, as it reports wages paid to employees and the taxes withheld over the year. The W-2GU form is similar to the W-2 form used in the mainland United States but tailored to meet the local tax regulations in Guam. Understanding the definition and purpose of the W-2GU 2016 form is crucial for both employers and employees to ensure compliance with local tax laws and accurate reporting of income.

This form includes essential details such as the total wages earned by an employee and the various deductions taken for federal, territorial, and local taxes. Additionally, the format must adhere to regulations set forth by the Guam Department of Revenue and Taxation, ensuring that the information reported is accurate and verifiable. For many employees in Guam, the W-2GU serves as an important document for completing personal tax returns, making it essential for proper tax compliance.

How to Properly Use the W-2GU 2016 Form

To make effective use of the W-2GU 2016 form, both employers and employees must understand its components and significance in the tax reporting process. Here are some important points regarding its usage:

-

For Employers: Employers in Guam are mandated to provide the W-2GU form to their employees by the specified deadline. They utilize this form to report wages and withholding amounts accurately to local tax authorities. Each employee must receive a copy of their W-2GU form for their personal records, as it is necessary for preparing individual tax returns.

-

For Employees: Employees should use the information provided on their W-2GU form to complete their annual tax filings. It is crucial to check the entries on the form against personal records of income and withholding to ensure accuracy. Misreporting can lead to issues with tax compliance, including penalties or audits by tax authorities.

Filing the W-2GU form typically involves both electronic and paper submissions, depending on the employer's preference and capabilities. Adhering to local deadlines for filing this form is vital to avoid potential fines or complications.

Steps to Complete the W-2GU 2016 Form

Completing the W-2GU 2016 form accurately involves several key steps:

-

Gather Necessary Information: Collect all employment records, including total wages, tips, bonuses, and any withheld amounts from paychecks. This includes any adjustments or corrections that might need to be made.

-

Fill Out Employee Details: Begin by entering the employee's name, address, and Social Security number. Ensure accuracy since errors can lead to tax complications.

-

Report Wages and Deductions: Enter the total amount of wages earned (Box 1) and the appropriate tax deductions in the relevant boxes. Include federal income tax withheld, Guam territorial tax withheld, and any other applicable deductions.

-

Provide Employer Information: Include the employer's name, address, and Employer Identification Number (EIN). This information links the form back to the employer in tax records.

-

Review for Accuracy: Double-check all entered information for correct amounts and spellings, ensuring all figures match employment records. Any discrepancy may raise flags during tax audits.

-

Distribute Copies: Once completed, distribute copies of the W-2GU 2016 form to the employee and retain copies for your records. Ensure compliance with the deadline to avoid penalties.

Following these steps helps ensure correct reporting and compliance with Guam tax regulations.

Important Filing Deadlines for the W-2GU 2016 Form

Filing deadlines for the W-2GU 2016 form are critical to maintaining compliance with tax regulations in Guam. Employers must adhere to the following deadlines:

-

Employee Distribution Deadline: Employers are required to provide the W-2GU form to their employees by January 31, 2017. This includes both electronic and paper forms to ensure timely tax preparation by employees.

-

Filing with Authorities: Employers must file the W-2GU forms with the Guam Department of Revenue and Taxation by February 28, 2017, if submitting paper forms. For electronic submissions, the deadline is extended to March 31, 2017.

Missing these deadlines can result in penalties, making it imperative for employers to track timelines effectively and ensure that all forms are distributed and filed appropriately.

Key Elements Included in the W-2GU 2016 Form

The W-2GU 2016 form consists of several critical elements that serve both the employer and employee in the tax reporting process. Key components include:

-

Employee Information: This section captures the employee's full name, address, and Social Security number, which are essential for accurate tax filings.

-

Wages and Tips: The form outlines the total wages, tips, and other compensation received by the employee. This figure is critical for determining the overall income for tax purposes.

-

Tax Withholding Information: Several sections of the form detail amounts withheld for federal and territorial taxes, Medicare, Social Security, and any additional state-specific withholdings. Each amount must align with pay records to avoid discrepancies.

-

Employer Information: This segment lists the employer's details, including the business name, address, and Employer Identification Number (EIN). This ensures the respective tax authority can link the W-2GU back to the employer for verification.

-

Summary of Taxes: The summary section details total tax amounts withheld for the year, which assists employees in understanding their contributions towards social security and tax obligations.

These elements collectively provide a comprehensive overview of an employee's earnings and tax responsibilities, facilitating both personal and employer tax filings.

Common Scenarios Involving the W-2GU 2016 Form

Various scenarios necessitate the use of the W-2GU 2016 form, impacting both employees and employers. Some common situations include:

-

Full-Time Employment: Employees who work full-time in Guam typically receive a W-2GU form for income reporting during tax season, detailing their annual earnings and tax withholdings.

-

Part-Time or Seasonal Workers: Part-time or temporary employees in Guam also receive a W-2GU for any periods of employment, ensuring that all earnings, regardless of duration, are reported.

-

Multiple Employers: Employees with more than one job in Guam must collect a W-2GU from each employer to accurately report total earnings and withheld taxes when filing their annual tax return. Each W-2GU contributes to a complete financial picture for the employee.

-

Employee Transfers: If an employee transfers to a new job within Guam or changes employers during the tax year, they will receive a W-2GU from their previous employer for any income generated there. Proper handling of these forms is essential to avoid confusion during tax filings.

Understanding these scenarios helps both employees and employers appreciate the importance of the W-2GU 2016 form in the broader context of wage and tax reporting.