Definition and Meaning of Form Tax

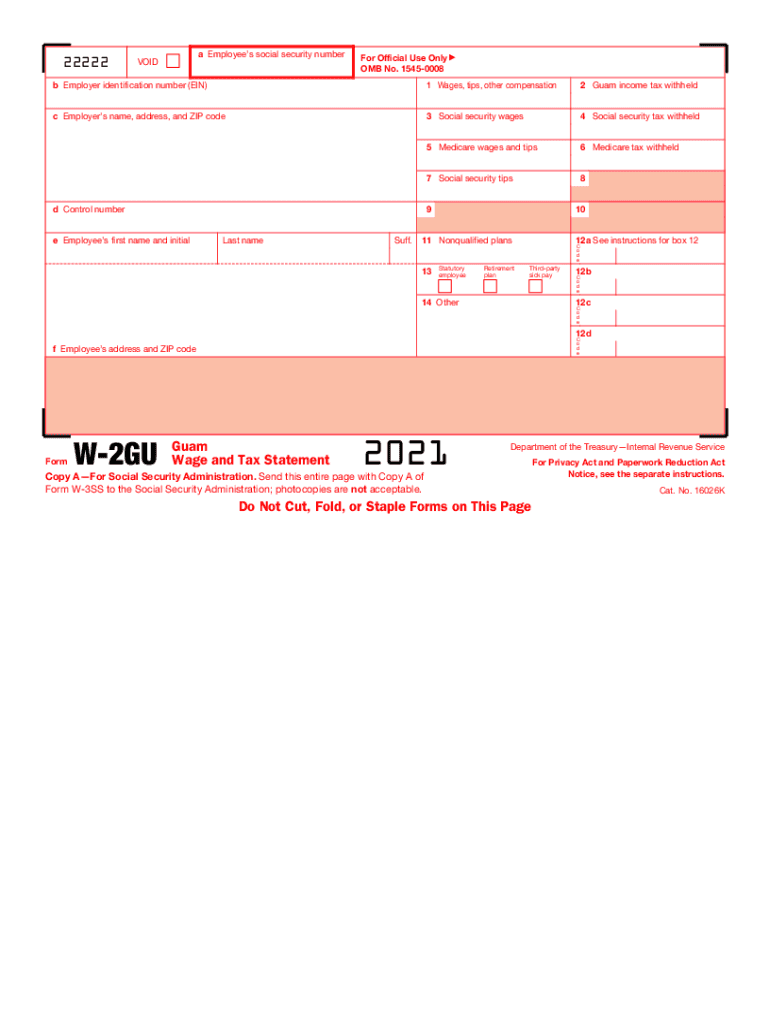

The term "form tax" generally refers to the specific documentation required by federal or state authorities to report income, deductions, or other important financial details relevant for tax purposes. Each form serves a distinct function and is vital for compliance with tax laws. Understanding the meaning of the form is crucial for both individual taxpayers and businesses, as it directly influences how they report earnings and expenses. Various forms, such as Form W-2 for wage reporting and Form 1099 for freelance income, fall under the umbrella of form tax, each fulfilling a unique role in the overall tax process.

Importance of Understanding Form Tax

- Compliance: Using the right form ensures adherence to tax regulations, minimizing the risk of penalties.

- Accuracy: Correctly completed forms lead to precise tax calculations, avoiding discrepancies that may trigger audits.

- Claiming Deductions: Understanding specific form requirements may help taxpayers identify eligible deductions they can claim.

Steps to Obtain Form Tax

Obtaining the correct form tax can be a straightforward process, provided you know where to look. Most common forms are available online on the official IRS website or other state tax department resources. Here are the steps to secure the required form:

- Identify the Form Needed: Determine which form you need based on your financial situation (e.g., income type, business structure).

- Visit Official Websites: Access the IRS or relevant state tax department's website to download the necessary form.

- For federal forms, go to .

- Each state has its own tax website for state-specific forms.

- Use Tax Software: Programs like TurboTax or H&R Block often include the necessary forms and can automate the filing process.

- Request by Mail: You may also request forms by calling or writing to the IRS or your state tax authority for a mailed copy.

- Local Tax Offices: For physical copies, visit local IRS offices or public libraries that may have forms available.

Additional Tips

- Review deadlines to ensure you obtain your form in time for tax season.

- Keep copies of all forms for your records after acquiring and completing them.

How to Complete the Form Tax

Completing a form tax involves providing accurate information and adhering to specific guidelines set by the IRS or state tax authorities. Follow these steps to effectively fill out your tax form:

- Gather Necessary Documents: Collect all relevant financial documents, such as income statements, deductions, and previous tax returns.

- Read Instructions Carefully: Each form comes with its own set of instructions. Familiarize yourself with these before proceeding.

- Fill in Personal Information: Provide your name, address, and Social Security Number or Employer Identification Number as required.

- Report Income and Deductions: Enter accurate figures for your income sources and eligible deductions. Refer to documents like W-2s or 1099s to verify amounts.

- Review and Sign: Double-check all entries for accuracy. Once satisfied, sign and date the form.

- Keep Copies: Make copies for personal records before submitting your form.

Example Scenarios

- For an individual taxpayer filing Form 1040, key steps include reporting wages from a W-2 and detailing any interest income from a bank statement.

- Businesses utilizing Form 1065 must collect partnership income details and list all partners involved.

Legal Use of Form Tax

The legal implications of using form tax are significant, as the information provided is often used to calculate tax liabilities and determine eligibility for certain programs. Ensuring that forms are completed correctly is essential for regulatory compliance. Legal use encompasses several facets:

- Accurate Reporting: All income must be reported honestly to avoid legal consequences such as fines or audits.

- Timely Submission: Adhering to filing deadlines is critical for maintaining good standing with tax authorities.

- Record Keeping: Tax laws require that proper records are maintained for corroborating the information included in filed forms.

Key Regulations

- IRS Guidelines: The IRS provides specific guidelines on how each form should be completed to avoid discrepancies.

- Potential Legal Actions: Failure to comply with regulations can lead to legal actions, penalties, or even criminal charges in severe cases.

Examples of Using Form Tax

Form tax application varies widely based on individual circumstances, professions, and business structures. Here are some examples of how different entities utilize various forms:

- Employees: Individuals receive a Form W-2 at the end of the year from their employers, reflecting wages earned and taxes withheld.

- Freelancers: Self-employed individuals must file Form 1099 if they earned $600 or more from any single client over the year, detailing their income from such services.

- Businesses: Partnerships use Form 1065 to report income, deductions, and credits, ensuring all partners receive a Schedule K-1 for their share of income.

Real-World Scenarios

- A self-employed graphic designer earns income from multiple clients and receives various 1099 forms; understanding how to compile this income on their tax return is crucial.

- An employee tolerates a payroll error with the W-2 that incorrectly reports income, making timely resolution necessary before filing taxes.

Required Documents for Filing Form Tax

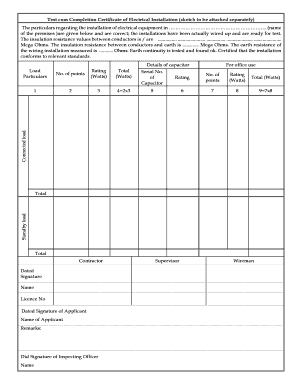

Filing any form tax necessitates the collection of a variety of documents that provide the necessary information to complete the form accurately. Depending on the type of form being filed, required documents may include:

- Wage and Income Statements: Documents such as Form W-2 or various forms of 1099.

- Tax Returns from Previous Years: Reference previous filings for accuracy in reporting.

- Receipts for Deductions: Maintain records of all deductible expenses throughout the year, such as those categorized under business expenses or medical costs.

- Investment Statements: Include documents that detail stock sales or interest earned.

Document Preparation Checklist

- Gather all income statements for the reporting year.

- Compile all receipts and records associated with deductible expenses.

- Ensure you have ID numbers, such as Social Security Numbers or Employer Identification Numbers.

By meticulously organizing these documents, you can streamline the process of completing your form tax and guarantee the accuracy of your filing.