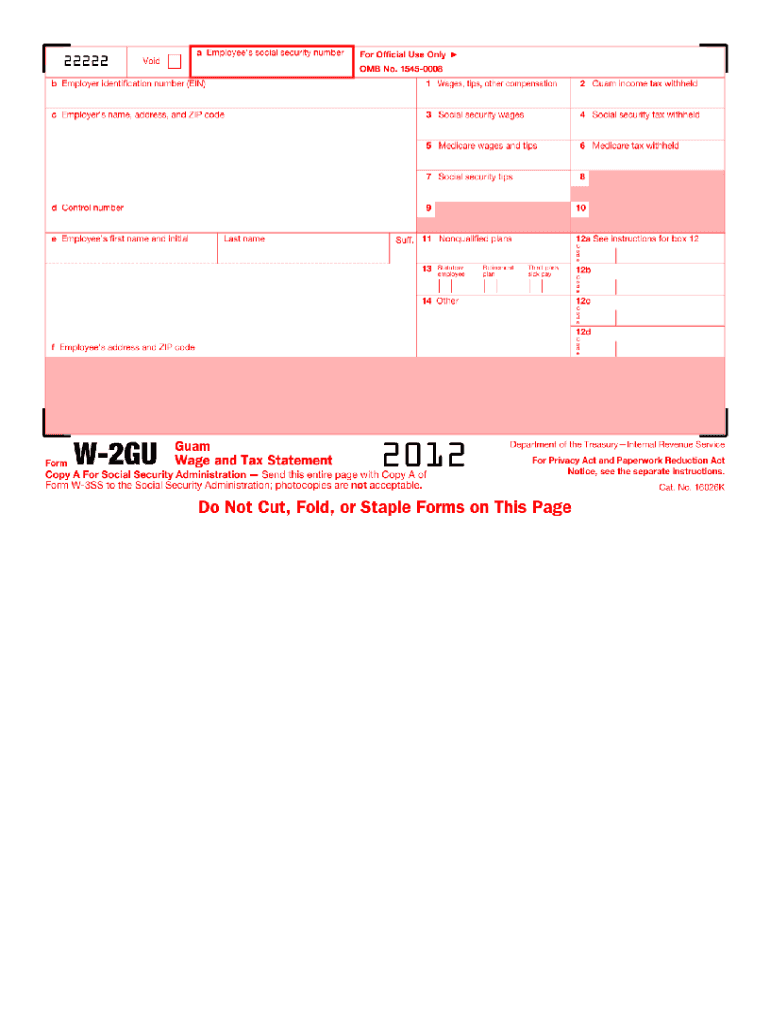

Definition and Meaning of the Printable W2 Form 2012

The W-2 form, officially known as the "Wage and Tax Statement," is an essential tax document used in the United States. Employers issue this form to report employees' annual wages and the amount of taxes withheld from their paychecks. The 2012 variant of this form follows the guidelines set forth by the Internal Revenue Service (IRS) for that tax year.

Key Components of the W2 Form

- Employer Identification: The form displays the employer's name, address, and Employer Identification Number (EIN).

- Employee Information: It includes the employee's name, address, and Social Security Number (SSN).

- Earnings and Withholdings: The form details various income figures, such as total wages, tips, and other compensation, along with federal, state, and local taxes withheld.

The W-2 form is crucial for accurately filing income tax returns, as it provides the necessary information regarding an employee's financial status for the year.

How to Use the Printable W2 Form 2012

Using the printable W-2 form 2012 involves several important steps that taxpayers need to follow to ensure accurate tax filing.

Steps for Using the W2 Form

- Obtain the Form: First, ensure you have a blank printable W-2 form for 2012.

- Fill in Employee Details: Enter the employee's name, address, and Social Security Number accurately.

- Report Income Information: Input total earnings in the appropriate boxes, including wages, tips, and other forms of compensation as per the records.

- Tax Withholding Information: Fill in the tax withheld amounts in the respective boxes for federal, state, and local taxes.

- Submit the Form: Distribute the completed form to the employee and file the necessary copies with the IRS and state agencies.

This process allows employees to utilize their W-2 form to accurately report income and tax obligations for their annual tax returns.

How to Obtain the Printable W2 Form 2012

The printable W-2 form for 2012 can be obtained through several methods, ensuring that all employers and employees have access to this vital tax document.

Sources for Obtaining the Form

- IRS Website: The IRS provides downloadable PDF versions of the W-2 form. This ensures the form complies with federal standards for the tax year 2012.

- Accounting Software: Many accounting programs and platforms offer the capability to generate W-2 forms for multiple tax years. Users should check compatibility with the 2012 version.

- Local Tax Preparation Services: Professional tax services often provide printable versions of the W-2 form for their clients.

Ensuring that the correct version of the form is used is crucial for compliance and accurate tax reporting.

Key Elements of the Printable W2 Form 2012

Understanding the key elements of the W-2 form for 2012 can help users correctly fill out and interpret the document.

Breakdown of Important Sections

- Box 1: Wages, tips, and other compensation report an employee’s total taxable income.

- Box 2: Federal income tax withheld indicates the amount deducted from an employee's paycheck for federal tax.

- Box 16: State wages, tips, etc., specify the income subject to state tax.

- Box 17: State income tax withheld shows the state tax deducted from the employee’s earnings.

- Box 12: This section includes various codes for special payments like retirement plan contributions or certain benefits offered.

Being informed about these elements allows both employees and employers to assess tax liabilities accurately while ensuring compliance with IRS regulations.

Legal Use of the Printable W2 Form 2012

The W-2 form holds significant legal importance for employees and employers in the United States.

Compliance Requirements

- Employer Obligation: Employers are legally required to provide a W-2 form to each employee by January 31 of the following tax year.

- Recordkeeping: Employers must keep copies of all W-2 forms issued for at least four years for IRS review.

- IRS Submission: Copies of the W-2 form must be sent to the Social Security Administration along with the appropriate transmittal form (W-3).

Failing to comply with these legal requirements could lead to penalties and complications for both employers and employees, emphasizing the importance of accurate and timely filing.

Important Dates and Filing Deadlines for the W2 Form 2012

Awareness of filing deadlines and important dates is essential for ensuring compliance when using the W-2 form.

Key Dates to Remember

- January 31, 2013: The deadline for employers to distribute W-2 forms to employees.

- February 28, 2013: The deadline for employers to file paper copies of W-2s with the Social Security Administration.

- April 15, 2013: The deadline for employees to file their income tax returns utilizing the information reported on their W-2 forms.

Adhering to these deadlines is critical for avoiding potential penalties and ensuring that tax returns are filed accurately and on time.

Examples of Using the Printable W2 Form 2012

Individuals and businesses utilize the W-2 form in various scenarios, demonstrating its practical applications in real life.

Practical Scenarios

- Employee Tax Filing: An employee uses the information from their W-2 to complete their federal and state tax returns, ensuring that they report income and tax withholding accurately.

- Applying for Loans: When applying for mortgages or other loans, lenders often require W-2 forms to verify income stability and financial reliability.

- Reviewing Earnings: Employees can review their W-2 forms to track their income history over the years, helping them assess their overall financial health.

These examples illustrate the broad utility of the printable W-2 form in personal finance and tax-related contexts.