Definition & Meaning of Form W-3

Form W-3 serves as the transmittal for the Forms W-2, which employers must submit to the Social Security Administration (SSA) annually. Essentially, it summarizes the total earnings, Social Security wages, Medicare wages, and taxes withheld for all employees reported on the attached W-2 forms. It is vital for compliance with U.S. tax laws and contributes to an accurate report of wages paid and taxes withheld for individuals.

Importance of Form W-3

The W-3 form is instrumental in ensuring that all tax obligations are accurately reported and that the Information Return (Forms W-2) is submitted correctly. Employers and employees alike rely on this information for personal tax filings. A correct W-3 aids in the reconciliation of tax records with the IRS, helping to prevent penalties for incorrect filings.

How to Use Form W-3

Using Form W-3 involves collecting data from all W-2 forms issued by the employer to prepare an aggregate report for the SSA. The electronic filing option is preferred, making the process streamlined and reducing the likelihood of errors.

Filing Process

- Compile W-2 Data: Gather all W-2 forms issued to employees for the reporting year.

- Complete the Form: Using the W-2 data, fill out the W-3 form. This includes totals for Social Security wages, Medicare wages, and federal taxes withheld.

- Submit to SSA: Electronically file the completed W-3 form alongside the W-2 forms through the SSA's Business Services Online.

Filing Options

- Electronic Filing: Required if filing 250 or more W-2 forms to ensure quick processing and information accuracy.

- Paper Filing: Acceptable for smaller businesses that do not exceed the threshold.

Steps to Complete the Form W-3

Completing Form W-3 accurately is crucial for avoiding penalties. Here’s how to do it effectively:

- Gather Employee Information: Collect all W-2 forms for the tax year.

- Enter Summarized Figures: Fill out the form with the total figures from all W-2 forms, including:

- Employee's Social Security wages

- Medicare wages

- Federal income tax withheld

- Verify Accuracy: Double-check all figures to ensure accuracy. Errors can lead to discrepancies in employee records and potential penalties from the IRS.

- File the Form: Submit the W-3 form electronically or via mail, ensuring it is done by the deadline.

Deadlines

- E-filing Deadline: January 31 for Forms W-2 and W-3 submitted electronically.

- Paper Submission Deadline: January 31 for forms submitted via mail.

Who Typically Uses Form W-3

Form W-3 is primarily used by employers who have issued W-2 forms for their employees. This includes various types of businesses:

- Corporations

- Limited Liability Companies (LLCs)

- Partnerships

- Sole Proprietorships with employees

Relevance to Businesses

Employers in different sectors, including hospitality, retail, and corporate environments, utilize Form W-3 to ensure compliance with federal payroll tax requirements. Proper completion impacts how income is reported for individual employees.

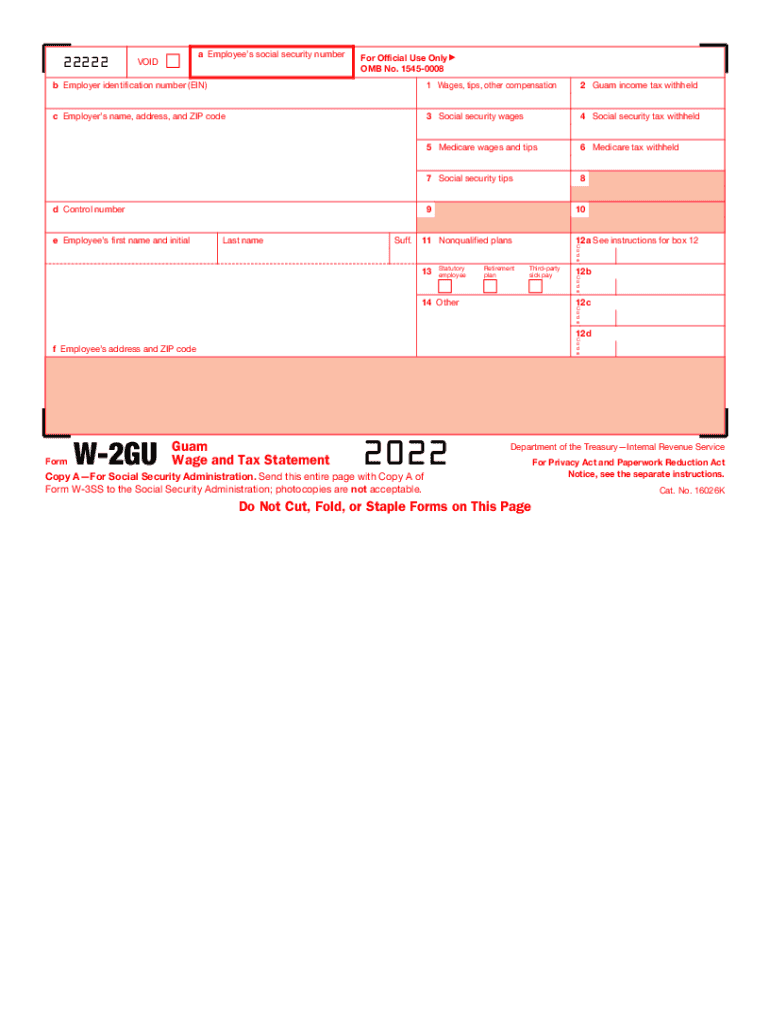

Key Elements of Form W-3

Understanding the critical components of Form W-3 is necessary for proper completion and compliance:

- Identification Information: This includes the employer's name, address, and Employer Identification Number (EIN).

- Aggregate Totals: Total figures concerning W-2 wages, Social Security wages, and Medicare wages.

- Certification Statement: A declaration ensuring that the information provided is correct under penalty of perjury.

Additional Considerations

Employers should maintain accurate records to support the figures reported. Incomplete or inaccurate forms can result in fines or corrective actions from the SSA.

IRS Guidelines for Form W-3

The IRS provides specific guidelines for filing Form W-3, which includes:

- Mandatory Filing: All businesses that issue W-2s must file an accompanying W-3 to the SSA.

- Formats: Accepts both electronic and paper submissions, but compliance standards for electronic filing are more stringent.

Compliance Importance

Failure to comply with these IRS guidelines can lead to:

- Fines and penalties

- Increased scrutiny during audits

- Delays in processing employee tax information

Legal Use of Form W-3

Form W-3 is legally required for employers filing W-2 forms, making it essential for proper tax reporting and compliance with federal laws. It also ensures that employees’ wages are correctly recorded with the SSA, impacting their future Social Security benefits.

Legal Obligations

- Accurate reporting of wage data

- Correct submission of forms by specified deadlines

- Maintaining employment records for potential audits

Employers should familiarize themselves with these legal obligations to avoid unnecessary complications.

Conclusion

By accurately completing and submitting Form W-3, employers play a crucial role in ensuring the integrity of the tax system. This process not only affects the employer’s compliance status but also ensures that their employees receive accurate Social Security credits and tax information.