Definition and Purpose of the 2023 Form W-2GU Guam Wage and Tax Statement

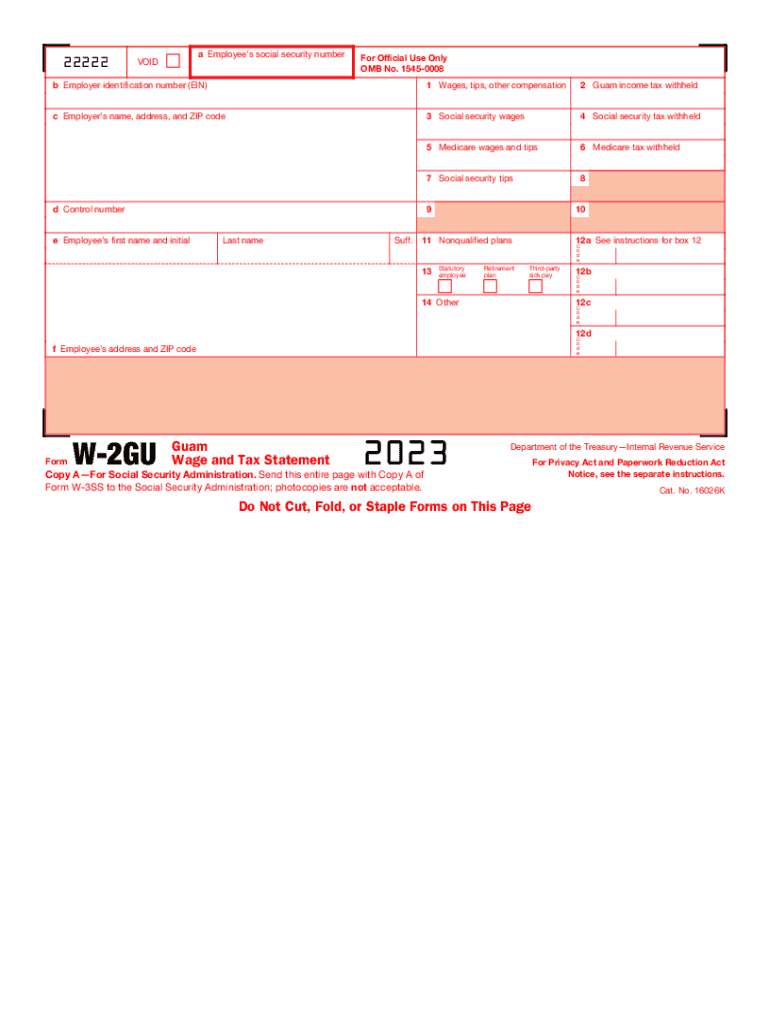

The 2023 Form W-2GU Guam Wage and Tax Statement is a critical document used to report wages paid to employees in Guam and the corresponding taxes withheld. It serves as a tax record for both employers and employees, ensuring accurate reporting to the Internal Revenue Service (IRS) and the Guam Department of Revenue and Taxation. Understanding the specifics of this form is essential for compliance with tax regulations and for employees to correctly report their income and taxes on their annual tax returns.

Generally, the form covers the following key aspects:

- Wages Earned: Displays the total amount earned by an employee during the tax year.

- Tax Withheld: Indicates the amount of federal and local taxes withheld from an employee’s paycheck.

- Social Security and Medicare Contributions: Reports contributions to Social Security and Medicare programs, where applicable.

Employers are responsible for filling out and distributing this form to their employees by the IRS deadline. Employees use the information presented on the W-2GU when preparing their tax returns, making it crucial for accurate tax filings.

How to Obtain the 2023 Form W-2GU Guam Wage and Tax Statement

To obtain the 2023 Form W-2GU, employers can access it through the official IRS website or the Guam Department of Revenue and Taxation. Here are specific steps for obtaining the form:

- Visit the IRS Website: Go to the IRS forms and publications section to find the W-2GU.

- Download the Form: Download the form in PDF format or print a copy directly from the site.

- Access Local Resources: Employers in Guam can also contact the Guam Department of Revenue and Taxation for guidance.

- Use Tax Preparation Software: Many tax software programs include the W-2GU, making it easy for employers to generate the form digitally.

It's essential to ensure that you are using the correct version for 2023, as previous versions may not comply with current reporting standards.

Steps to Complete the 2023 Form W-2GU Guam Wage and Tax Statement

Completing the 2023 Form W-2GU involves several specific steps to ensure accurate reporting. Here is a detailed breakdown:

- Gather Required Information: Collect necessary details such as the employee's name, address, Social Security number, and total wages earned.

- Fill in Employer Information: Input details including the business name, address, Employer Identification Number (EIN), and state code for Guam.

- Report Wages and Taxes:

- In Box 1, enter total wages earned.

- In Box 2, report federal income tax withheld.

- Include amounts for applicable state taxes in the relevant boxes.

- Specify Other Deductions: Report any other relevant deductions or contributions, such as retirement or medical contributions.

- Review for Accuracy: Check all entries for errors or omissions before finalizing the form.

Companies should familiarize themselves with the detailed definitions provided by the IRS for each box to ensure complete and accurate reporting.

Key Elements of the 2023 Form W-2GU Guam Wage and Tax Statement

Several key elements are crucial when dealing with the 2023 Form W-2GU. These elements ensure that both employers and employees have the necessary information for tax purposes.

- Employee Information: This includes the full name, address, and Social Security number.

- Employer Information: The form includes the employer's name, address, and EIN, which identifies the business to the IRS.

- Wage Data: Box 1 reports the total wages, while Box 2 shows the total federal tax withheld; additional boxes detail specific local or other taxes.

- State and Local Tax Information: As Guam is a territory with its own tax regulations, the forms include fields for indicating local taxes withheld.

Understanding these components helps employees ensure their forms reflect accurate information for their tax filings.

Filing Deadlines and Important Dates for the 2023 Form W-2GU Guam Wage and Tax Statement

Timely filing of the 2023 Form W-2GU is essential for compliance with tax regulations. Key deadlines to remember include:

- Distribution Deadline: Employers must provide completed W-2GU forms to employees by January 31, 2024. This allows employees to prepare their tax returns in a timely manner.

- Filing with the IRS: Employers have until February 28, 2024, to submit their W-2GU forms to the IRS if filing by paper. If filing electronically, the deadline extends to March 31, 2024.

Failure to comply with these deadlines can result in penalties, emphasizing the importance of meticulous planning in managing payroll documentation.

Legal Use of the 2023 Form W-2GU Guam Wage and Tax Statement

The legal use of the 2023 Form W-2GU is governed by IRS and Guam territorial tax regulations. Understanding these legalities is essential for both employers and employees:

- Requirement for Employers: Businesses operating in Guam are legally obligated to provide a W-2GU form to any employee from whom they have withheld taxes during the year, as mandated by the IRS.

- Employee Filing Requirements: Employees must include their W-2GU information when submitting their income tax returns to ensure accurate reporting of income and taxes paid.

- Penalties for Non-Compliance: Failure to issue or report W-2GU forms accurately can lead to significant penalties for both employers and employees, reinforcing the need for adherence to filing regulations.

Understanding these legal implications ensures compliance with tax obligations and helps prevent unnecessary fines.

Important Terms Related to the 2023 Form W-2GU Guam Wage and Tax Statement

Familiarity with important terminology is crucial for understanding the 2023 Form W-2GU. Below are key terms relevant to the form:

- Employee Identification Number (EIN): A unique number assigned to businesses for tax reporting purposes.

- Federal Tax Withheld: The amount of federal income tax deducted from an employee’s gross pay.

- Local Tax: Taxes imposed on a local level, which may vary in Guam and are reported separately on the W-2GU.

- Gross Wages: Total earnings prior to any deductions, including taxes and other withholdings.

Understanding these terms is essential for correctly interpreting the data provided on the W-2GU form and ensuring accurate reporting during tax preparation.

Examples of Using the 2023 Form W-2GU Guam Wage and Tax Statement

Practical scenarios help illustrate the application of the 2023 Form W-2GU in real-world settings. Here are examples that show its utility:

- Employee Tax Filing: An employee receives their W-2GU form, which shows total earnings of $50,000 and federal tax withheld of $5,000. This information is used to report income correctly on their federal income tax return.

- Employer Reporting: A Guam-based employer issues W-2GU forms to 20 employees. Each form details their wages and contributions. The employer submits a summary of these forms to the IRS, ensuring compliance and accurate employee records.

- Tax Audit Situations: If an employee faces an audit, the W-2GU serves as necessary documentation, offering proof of income and federal tax withholding that align with their tax return.

These examples demonstrate how critical the W-2GU form is for financial reporting and compliance obligations for both employees and employers in Guam.