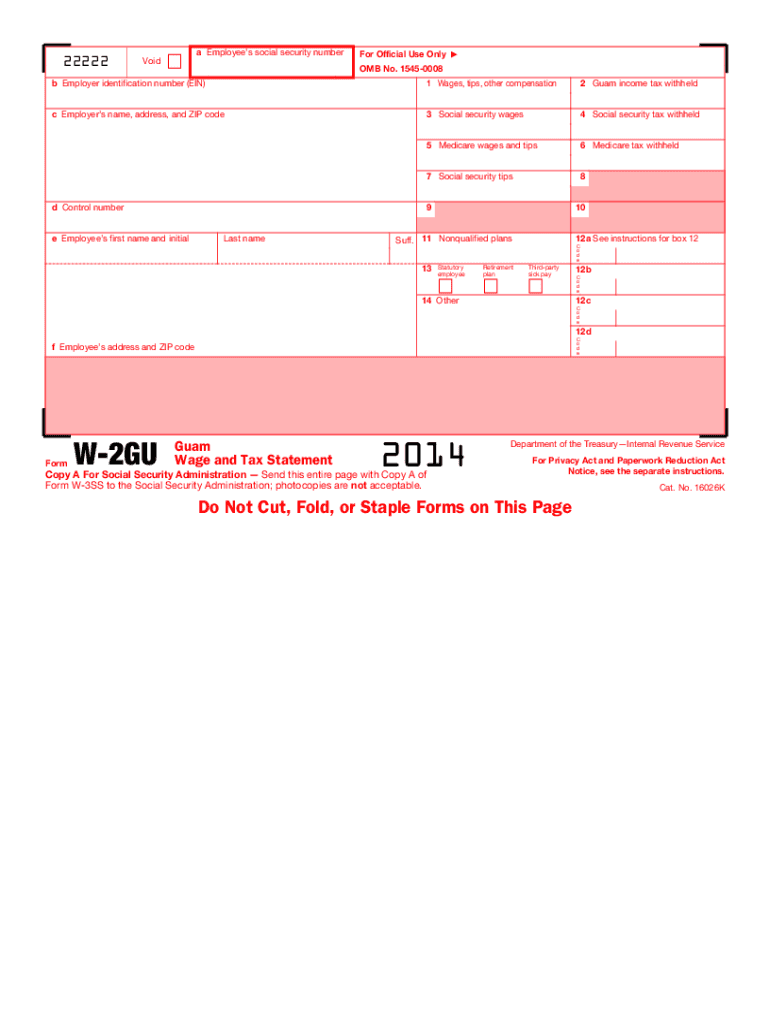

Definition and Purpose of the 2014 Form W-2GU: Guam Wage and Tax Statement

The 2014 Form W-2GU, officially known as the Guam Wage and Tax Statement, is a tax form used to report wages paid to employees and the taxes withheld from those wages for the tax year 2014. It is essential for employers operating in Guam to accurately complete this form to comply with federal and local tax laws. The details provided on the W-2GU allow employees to report their income correctly on their tax returns and determine the amount of tax owed or refunds due.

Key Features

- Reporting Income: The form summarizes the total income earned by an employee within Guam and must be distributed to employees and filed with the necessary tax authorities.

- Tax Withholding Information: The W-2GU includes details regarding the amount of income tax withheld, for both federal and local Guam taxes, aiding employees in their tax filing processes.

- Employee Identification: It includes identifying information such as the employer's and employee's names, addresses, and social security numbers, which are critical for tax identification purposes.

How to Use the 2014 Form W-2GU: Guam Wage and Tax Statement

Employers in Guam should use the 2014 Form W-2GU to document wages and taxes effectively during the annual tax reporting period. The process involves compiling necessary payroll data and ensuring the accuracy of information on the form to avoid penalties.

Step-by-Step Instructions

- Gather Employee Information: Collect names, addresses, and Social Security numbers for all employees who received wages.

- Calculate Wages and Withholdings: Determine total wages earned during 2014 and calculate federal and local taxes withheld.

- Complete the Form: Fill in appropriate boxes on the W-2GU, ensuring all information is precise and adheres to reporting requirements.

- Distribute Copies: Provide copies of the completed form to employees and submit the form to the Guam Department of Revenue and Taxation.

- Retain Records: Keep copies of the form and any additional documentation for your records, as these may be necessary in the event of an audit.

Steps to Complete the 2014 Form W-2GU: Guam Wage and Tax Statement

Completing the 2014 Form W-2GU accurately is crucial for compliance with Guam's tax regulations. This process involves specific information collection and form-filling protocols.

Detailed Breakdown of Steps

- Employee Data: Input the employee’s name, address, and Social Security number accurately. Ensure that this matches official documents to avoid discrepancies.

- Wage Reporting: Enter gross wages, tips, and other compensation in the designated boxes. This includes any incentives or bonuses that qualify as taxable income.

- Withholdings: Provide accurate amounts for federal income tax withheld, Social Security tax withheld, and local Guam tax withheld in their respective boxes.

- Additional Information: If applicable, include any additional amounts such as deferred compensation or contributions to retirement plans, as required.

- Review and Transmit: Double-check all entries for accuracy. Print or electronically submit the form to comply with submission methods.

Important Dates and Deadlines for the 2014 Form W-2GU

Timely filing of the 2014 Form W-2GU is critical for compliance. Employers must remain mindful of specific submission dates relevant to this form.

Critical Dates

- Form Distribution: Employers must distribute the Form W-2GU to employees by January 31, 2015, ensuring employees have sufficient time to prepare their tax returns.

- Filing Deadline with Authorities: The completed W-2GU forms must be submitted to the Guam Department of Revenue and Taxation by the final tax filing deadline in 2015, typically around the end of February.

- Extensions: Employers requesting a filing extension must adhere to established deadlines for their extension applications and communicate revisions to their employees.

Key Elements of the 2014 Form W-2GU: Guam Wage and Tax Statement

Understanding the individual components of the 2014 Form W-2GU helps ensure accurate completion and compliance with tax obligations.

Essential Components

- Boxes for Wages: Specific fields are designated for reporting total wages, tips, and other compensations, categorized into gross incomes for clear communication.

- Tax Withholding Sections: Separate boxes are included for reporting federal and local tax withholdings, which are crucial for both employers and employees when filing local and federal tax returns.

- Employer Identification: The employer’s information, including the Employer Identification Number (EIN) and business name, must be included to verify reporting and facilitate internal revenue processing.

Penalties for Non-Compliance with the 2014 Form W-2GU

Failure to comply with the guidelines established for the 2014 Form W-2GU can lead to significant penalties for employers. Understanding the implications of non-compliance is essential for responsible reporting.

Possible Consequences

- Fines and Penalties: Employers may face fines for late submissions, incomplete forms, or failure to issue the necessary copies to employees.

- Liability for Taxes: Inaccurate reporting of wages or withholdings can lead to miscalculations of tax liabilities for both employers and employees, resulting in further complications or audits.

- Reputational Risk: Continuous non-compliance can affect an employer's reputation, making it harder to retain employees or attract new business in the local community.

Eligibility Criteria for Filling the 2014 Form W-2GU: Guam Wage and Tax Statement

Employers are required to adhere to specific eligibility criteria regarding whom they report on the 2014 Form W-2GU.

Who Should be Reported

- Employees: All employees who received wages, including part-time, full-time, and seasonal workers, must be reported on the form, regardless of the amount earned.

- Tax Exceptions: Certain exemptions may apply for independent contractors or non-employee compensation, requiring a different reporting method such as the Form 1099.

Digital vs. Paper Version of the 2014 Form W-2GU

Employers may have the option to choose between submitting a digital or paper version of the 2014 Form W-2GU, each with unique considerations.

Comparison of Formats

- Paper Version: While traditionally used, paper forms can be cumbersome to manage and are susceptible to loss or damage. They must be printed, signed, and mailed to the designated authorities.

- Digital Version: Online submission facilitates rapid processing and reduces delays. However, digital versions must comply with electronic filing protocols to meet regulatory standards. Proper encryption and data security measures should be implemented.

By adhering to these comprehensive guidelines and understanding the intricacies of the 2014 Form W-2GU, employers can ensure accurate tax reporting and compliance with tax obligations. This form plays a critical role in the timely and correct reporting of income, reinforcing the importance of thoroughness in its completion.