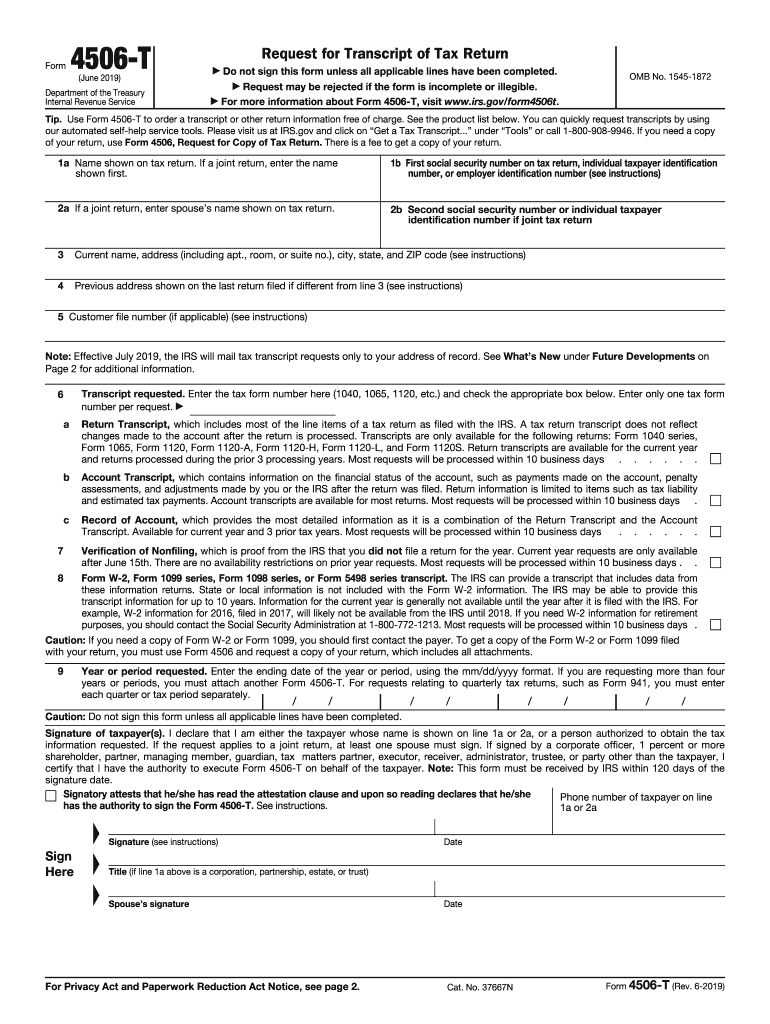

Definition and Purpose of the Form 4506-T

Form 4506-T, officially known as "Request for Transcript of Tax Return," is a document issued by the Internal Revenue Service (IRS) allowing taxpayers to obtain a transcript of their previous tax returns. The form is crucial for individuals and businesses that need proof of income, resolve tax disputes, or apply for a loan. Tax return transcripts include most of the line items from an original tax return and accompanying forms, making them instrumental in various financial and legal situations. By understanding its primary function, users can better appreciate its importance in ensuring accurate representation of past financial activity.

How to Use the 4506-T Form

Using the 4506-T form involves completing several fields to request a specific type of transcript from the IRS successfully. Key steps include:

- Entering Personal Information: Include your name, social security number, and street address. If you moved since your last return, it is crucial to provide your previous address.

- Select Type of Transcript: Specify the tax form number and tax years to receive information regarding that period.

- Designate a Third Party: If someone else needs access to your transcript, such as a lender, fill in section 5 with their details.

- Certification Signature: Sign and date the form to authorize the request.

Completing these steps correctly ensures prompt processing by the IRS, avoiding delays in obtaining critical tax information.

Obtaining the 4506-T Form

The 4506-T form can be obtained through multiple channels:

- IRS Website: You can download the form directly from the IRS website. This method is the fastest and ensures you have the most updated version.

- Local IRS Office: For those preferring a physical alternative, visiting an IRS office can provide paper copies.

- Third-Party Request: Certain financial institutions can supply the form or initiate the request process on your behalf during loan or verification procedures.

These methods ensure availability, whether online or offline, making it accessible for all taxpayers seeking past tax returns.

Steps to Complete the 4506-T Form

Filling out the 4506-T form requires careful attention to detail. The following steps illustrate the process:

- Personal Identification: Begin by inserting personal data, including full name(s) and SSN or EIN.

- Current and Previous Addresses: Accurately list current and any previous addresses to ensure past records correspond correctly.

- Transcript Type and Tax Form: Indicate which transcript type you need, such as a Tax Return Transcript, and relevant tax years.

- Delivery Method and Recipient: If someone else, like a mortgage broker, should receive the transcript, include their address.

- Authorization: Sign and date the form. If a joint return exists, both spouses must agree.

Following these structured steps thoroughly helps prevent common mistakes that could lead to delays or rejection of requests.

Why Use the 4506-T Form

The 4506-T form serves multiple functions beneficial to taxpayers:

- Verification: Confirm reported income for loans or financial aid.

- Corrections: Rectify errors in past fillings.

- Disputes: Resolve issues related to IRS assessments or audits.

- Applications: Support applications for mortgages, student loans, or public benefits.

These use cases highlight the form's versatility in financial and legal circumstances, allowing taxpayers to justify past income accurately and efficiently.

Important Terms Within the 4506-T Form

Several key terms are essential for understanding the 4506-T form's scope and application:

- Tax Return Transcript: A summary of the original filed tax return, showing most line items from the 1040.

- Tax Account Transcript: Details basic data like return type, filing status, taxable income, and any adjustments.

- Third Party: A designated recipient who can legally receive the transcript, often during a loan verification process.

- Filing Status: Necessary to verify correctly, as discrepancies can delay processing.

These terms are fundamental in navigating the form and understanding what information each transcript will provide when selected appropriately.

IRS Guidelines and Compliance

Following IRS guidelines for the 4506-T form ensures compliance and avoids processing errors:

- Accuracy: Ensure all entered data matches IRS records, especially names and addresses.

- Signatures: Forms require original signatures; digital or scanned copies are typically rejected.

- Submission: Follow specific instructions for mailing or faxing, as errors can prolong processing.

Adherence to these guidelines underscores the importance of diligence in preparation, ensuring efficiency and effectiveness in obtaining the necessary transcripts.

Required Documents for Submitting the 4506-T Form

Certain documents need to accompany or precede the submission of the 4506-T form to expedite the process:

- Photo Identification: Some circumstances, particularly third-party requests, may require ID verification.

- Taxpayer Identification Numbers: Both personal and business returns need accurate TIN or EIN information.

- Authorization for Third Parties: Written permission must be explicitly included when a third party receives the transcript.

These prerequisites ensure that the request is legitimate and reduce the potential for fraudulent access to sensitive tax data.