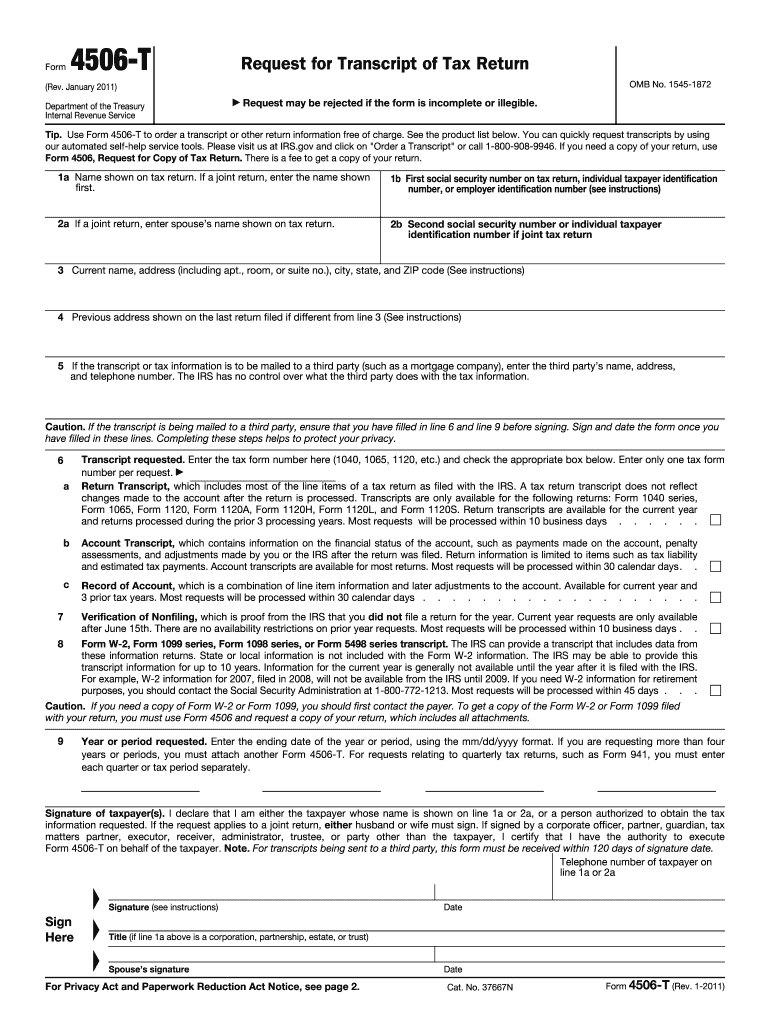

Definition and Purpose of the 2 Form

The 2 form, officially known as the Request for Copy of Tax Return, is a document utilized by individuals and businesses to request copies of their federal tax returns from the Internal Revenue Service (IRS). This form allows taxpayers to obtain copies of their previously filed tax returns, which can be essential for various financial activities such as applying for loans, verifying income for mortgage applications, or resolving any discrepancies with the IRS.

The significance of the 4506 form lies in its legal capacity to authorize the IRS to release confidential tax return information to the requestor or a designated third party. Understanding the proper usage and implications of this form is crucial for ensuring compliance with IRS regulations. The 2011 version specifically pertains to tax returns filed for the 2011 tax year, making it essential for taxpayers needing records from that particular year.

How to Use the 2 Form Effectively

Using the 2 form effectively requires understanding its sections and the information needed. Here are some key aspects:

- Designating Recipients: The form allows you to specify a third party who will receive your tax return copies, which can be beneficial for transactions like mortgage applications where lenders need verification of income.

- Current and Previous Addresses: You must provide both your current address and any previous addresses used in tax filings. This information helps the IRS locate your records accurately.

- Signature Requirement: Your signature is necessary, verifying that you authorize the IRS to release your tax information.

To maximize the benefits of using the form, ensure that all information is accurate and up to date. Submitting incorrect data can lead to delays or denials.

Steps to Complete the 2 Form

Completing the 2 form involves several clear steps. Follow these to ensure accuracy:

- Obtain the Form: Download the form from the IRS website or acquire it via tax preparation software.

- Provide Personal Information: Enter your name, Social Security number, and any joint filer information if applicable.

- Specify Tax Year: Clearly indicate that you are requesting copies of the 2011 tax return.

- Complete the Address Section: Fill in both your current and previous addresses if they differ.

- Designate Third Parties: If applicable, include the information of any third parties authorized to receive your tax documents.

- Signature and Date: Sign and date the form to validate it.

It is important to review the form for completeness and accuracy before submission, as any errors can lead to processing delays.

Filing Methods for the 2 Form

You can submit the 2 form using various methods, each with its own advantages:

- By Mail: Print the completed form and send it to the address specified in the IRS instructions. Ensure you use the appropriate postage.

- Online Submission: Depending on IRS updates, check if electronic submission is available for the 4506 form. This method can expedite processing and reduce physical paperwork.

- In-Person: Visit a local IRS office to submit the form directly if you prefer personal interaction. Bring identification and any relevant documents to assist in processing.

Choosing a submission method should be based on your needs for convenience and speed of receiving your tax return copies.

Who Typically Uses the 2 Form?

The 2 form is utilized by different categories of taxpayers, including:

- Individuals: People seeking documentation for personal economic transactions, such as loans or financial audits.

- Businesses: Companies that need to verify records for tax compliance or financial institution requests.

- Tax Preparers: Professionals assisting clients with tax documentation or corrections may request copies on behalf of their clients.

Understanding the primary users of the 2 form helps clarify its importance in financial transparency and compliance with IRS guidelines.

Legal Use of the 2 Form

The 2 form holds significant legal weight in ensuring compliance with IRS regulations regarding taxpayer information. Key legal aspects include:

- Privacy and Confidentiality: The form maintains strict adherence to privacy guidelines by allowing only authorized individuals to access tax information. Unauthorized use may lead to legal repercussions.

- IRS Compliance: Submitting the form properly ensures that you remain in compliance with federal requirements for record-keeping and transparency, especially in financial dealings.

- Record Authenticity: Copies obtained through the 4506 form are considered authentic and can be used for legal and financial transactions.

Taxpayers must understand these legal implications when utilizing the 4506 form to ensure their rights and responsibilities are met.

Important Terms Related to the 2 Form

Familiarizing yourself with relevant terminology associated with the 2 form can enhance your understanding and application:

- Requestor: The individual or entity requesting a copy of the tax return.

- Filing Status: The classification that indicates an individual's tax situation, such as single, married, or head of household.

- Confidential Information: Data protected by federal laws that restrict access to personal tax details without proper authorization.

- Signature Authorization: The requirement for the requestor to sign the form, granting the IRS permission to disclose tax information.

Understanding these terms can facilitate a smoother process in filling out and submitting the 4506 form.

Key Elements of the 2 Form

The 2 form comprises several critical sections that must be accurately filled out:

- Requestor’s Details: Includes personal information such as name, Social Security number, and filing status.

- Tax Year: A section specifically denoting the tax year for which records are requested.

- Third Party Release: Fields for designating one or more third parties authorized to receive the tax documents.

- Signature Section: A mandatory component requiring the requestor's signature to validate the request.

These elements play vital roles in processing and securing the requested tax information effectively. Understanding their importance ensures proper compliance and improves the request's success rate.