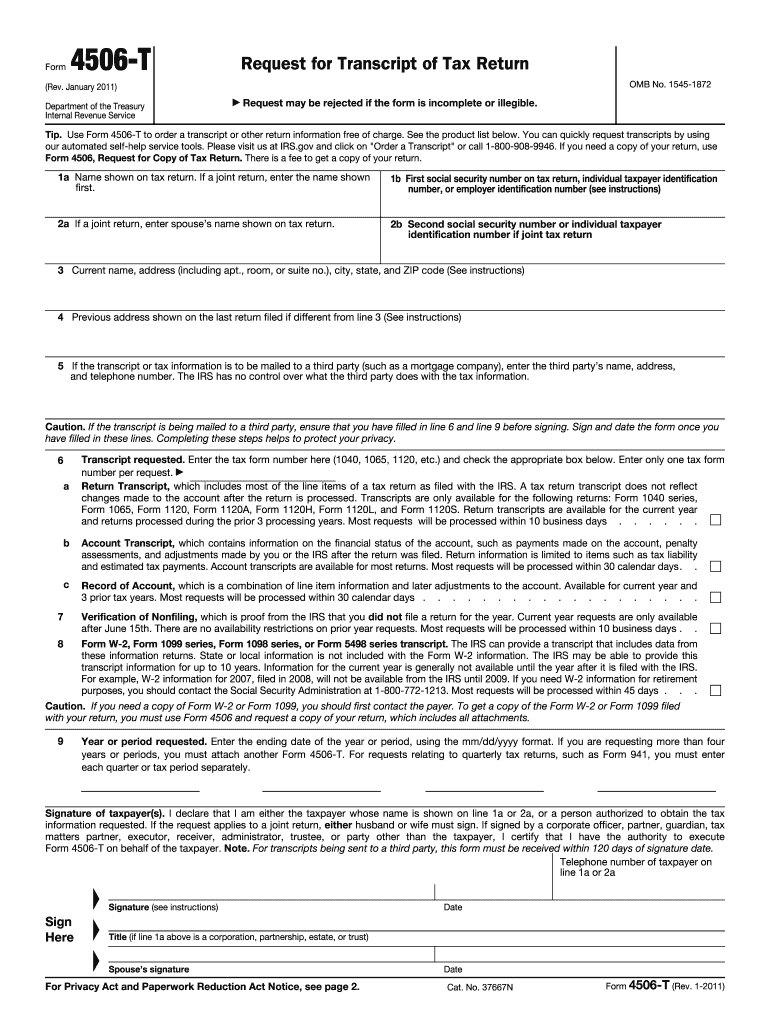

Definition and Meaning of the 2 Form

The 2 form, officially recognized by the IRS, is used by taxpayers to request a copy of their tax return transcript from a previous year. This form is particularly instrumental for financial audits, loan applications, or verification of past income details. The transcript requested can include various types of documents, such as the tax return transcript, which summarizes the return, and the account transcript, detailing financial transactions related to the taxpayer's account.

Types of Transcripts Available

- Tax Return Transcripts: A concise summary of the original tax return filed.

- Tax Account Transcripts: Includes key data such as type of return filed, marital status, adjusted gross income, and taxable income.

- Record of Account Transcripts: A combination of the tax return and tax account transcript.

- Wage and Income Transcripts: Shows data from forms like W-2, 1099, and 1098.

- Verification of Non-filing Letter: Verifies that the IRS has no record of a filed tax return for the year requested.

How to Use the 2 Form

The 2 form is utilized when individuals or businesses need documentation of their filed tax returns. This form is often used before taking out a mortgage or student loan, as lenders usually require evidence of income verification.

Step-by-Step Usage

- Gather Required Information: Collect your personal information, such as your Social Security Number and previous tax return details.

- Complete the Form: Fill out the necessary fields, including your name, address, and tax form number.

- Specify the Transcript Type: Indicate which type of transcript you need and the tax years required.

- Submit the Form: Send it via mail or online to the appropriate IRS address or portal.

How to Obtain the 2 Form

Acquiring the 2 form can be done through several methods, ensuring ease of access for taxpayers.

Methods of Acquisition

- Online Download: Access the IRS website to download a printable version of the form.

- Physical Collection: Visit an IRS office for a physical copy.

- Automatic Mail Requests: Contact the IRS by phone to have the form mailed.

Steps to Complete the 2 Form

Filling out the 2 form requires attention to detail to ensure accuracy and prevent processing delays.

Required Steps

- Fill Out Personal Information: Include the taxpayer's name, current and previous addresses, and Social Security Number.

- Identify the Requested Years: Clearly specify the tax years for which the transcripts are requested.

- Choose the Transcript Type: Indicate your desired type(s) of transcript on the form.

- Provide a Third-Party Designee: If applicable, enter the details of an individual or institution authorized to receive the information.

- Sign and Date the Form: Ensure that the taxpayer signs and dates the form for validity before submission.

Key Elements of the 2 Form

Understanding the essential components of the 2 form is crucial for accurate completion and submission.

Essential Sections

- Personal Identifiers: Name, SSN, and contact information of the taxpayer.

- Year(s) of Transcript: Specifies the tax years needed for financial verification.

- Third-Party Authorization: Details of any third-party recipient authorized to receive the transcript on behalf of the taxpayer.

Legal Use of the 2 Form

The 2 form is primarily designed to obtain official copies of tax filings, serving various legal and financial purposes.

Contexts for Use

- Loan Applications: Used by lenders to verify an applicant's stated income.

- Audits and Verifications: Essential for individuals undergoing financial audits.

- Income Verification: Supports applications where proof of income history is required.

IRS Guidelines for the 2 Form

IRS regulations and guidelines surrounding the use of the 2 form ensure standardized application and processing.

Compliance Directions

- Accurate Information: Providing precise and complete information is mandatory for successful processing.

- Submission Channels: Follow the IRS instructions for acceptable submission methods, whether online or via mail.

- Security Protocols: Ensuring the confidentiality of taxpayer information through proper form handling.

Filing Deadlines and Important Dates

While the 2 form does not have a strict filing deadline, understanding the timeframes associated with its processing is vital.

Processing Timeframes

- Standard Processing Time: Generally, allow for a 10 to 15-day window for form processing.

- Time-Sensitive Requests: It is advisable to submit the form well ahead of deadlines for related financial procedures, such as mortgage applications, to avoid complications.