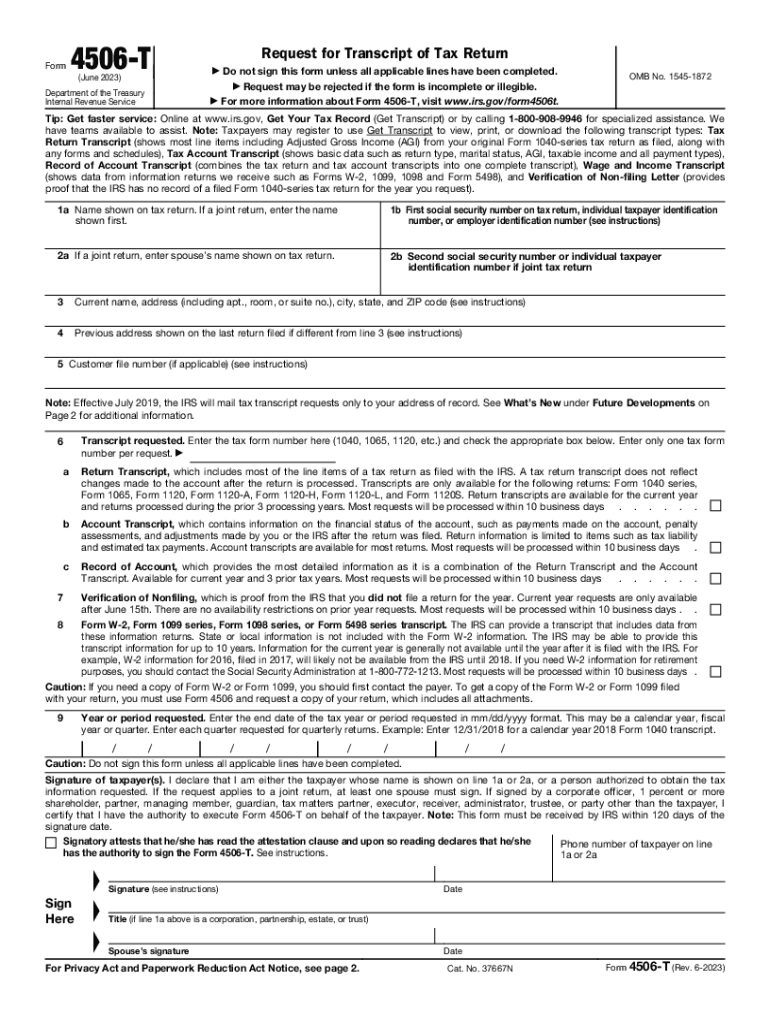

Definition & Meaning of Form 4506-T (Rev 6-2023)

Form 4506-T (Rev 6-2023) is an official document provided by the Internal Revenue Service (IRS) that allows taxpayers to request a copy of their tax return transcripts. Unlike the full tax return, a transcript summarizes the tax information from a specific year and is often sufficient for lenders, financial institutions, and other entities needing proof of income or filing status. Commonly used for verification purposes, this form is crucial for non-filers, individuals seeking verification of non-filing status, and those needing to obtain key financial records.

The primary types of transcripts available through Form 4506-T include:

- Return Transcript: Contains most line items from the original tax return.

- Wage and Income Transcript: Details income reported to the IRS, such as W-2 and 1099 information.

- Verification of Non-Filing Letter: Indicates that no tax return was filed for a particular year, which is particularly important for non-filers.

Understanding the purpose and usage of Form 4506-T is essential for anyone needing to prove or verify tax-related information quickly and efficiently.

How to Use the Form 4506-T (Rev 6-2023)

Using the Form 4506-T (Rev 6-2023) involves several steps that enable taxpayers to officially request their tax transcripts. The process starts with identifying the type of transcript that best suits your needs, whether it's a return transcript or wage and income transcript.

- Download the Form: Obtain a copy of Form 4506-T from the IRS website or other official resources.

- Fill Out the Form: Complete the required fields, including personal identification information and the years for which transcripts are being requested.

- Select the Transcript Type: Clearly indicate which types of transcripts are needed.

- Signature Requirement: Ensure all persons listed on the tax return sign the form, as all parties need to authorize the release of the requested information.

- Submission Methods: Choose how to submit the form, whether online, by mail, or in person, based on what is most convenient.

Using the Form 4506-T accurately helps ensure that requests are processed without delay.

Steps to Complete the Form 4506-T (Rev 6-2023)

Completing the Form 4506-T involves a clear methodology to guarantee all necessary sections are addressed correctly. Follow these steps for a successful submission:

-

Personal Information Section:

- Enter your name and the name of any other taxpayers associated with the request.

- Add your Social Security Number (SSN) or Employer Identification Number (EIN), as applicable.

-

Address Information:

- Include the last address used when filing taxes. If this address differs from current address information, provide it in the specified area.

-

Transcript Types and Years:

- Select the transcript type(s) needed. Indicate the years for which you require the transcripts by checking the appropriate boxes.

-

Signature:

- Ensure that all individuals listed on the form sign. This requirement is crucial for processing the request.

-

Submission Instructions:

- Finally, review the completed form for accuracy before submitting it according to the chosen method (by mail, electronically, etc.).

By carefully following these steps, you can assure that your transcript request will be fulfilled efficiently.

Who Typically Uses the Form 4506-T (Rev 6-2023)

A range of individuals and organizations utilize Form 4506-T for various purposes. Understanding who commonly accesses this form can help identify its importance in financial dealings:

-

Taxpayers Seeking Transcripts:

- Individuals filing for loans, mortgages, or seeking financial aid often request tax transcripts to verify income.

-

Non-Filers:

- Those who did not file tax returns and need to confirm their non-filing status can obtain the verification of non-filing letter through this form.

-

Lenders and Financial Institutions:

- Banks and lenders frequently request tax transcripts directly from applicants to assess creditworthiness or loan eligibility.

-

Tax Professionals:

- Accountants and tax preparers use the form to acquire necessary documentation to support their clients' filings or audits.

Each of these users benefits from the Form 4506-T in various scenarios, further emphasizing its role in accurate and timely financial verification.

Important Terms Related to Form 4506-T (Rev 6-2023)

Understanding relevant terminology associated with Form 4506-T can facilitate clearer communication and comprehension during the process:

- IRS Transcript: A summary of key tax information, which can vary in detail depending on the type requested.

- Transcripts Types:

- Return Transcript: Summarizes your filed tax return for a specific year.

- Wage and Income Transcript: Shows income details per year, including W-2 earnings.

- Verification of Non-Filing: Indicates that a tax return wasn’t filed in a given year.

- E-Signature: An electronic signature that may be required in digital submissions.

- Authorized Agent: A representative who is given permission to request tax transcripts on your behalf.

Familiarity with these terms will support effective communication with tax professionals, lenders, and IRS personnel throughout the process of utilizing Form 4506-T.