Definition and Purpose of the 2-T Form

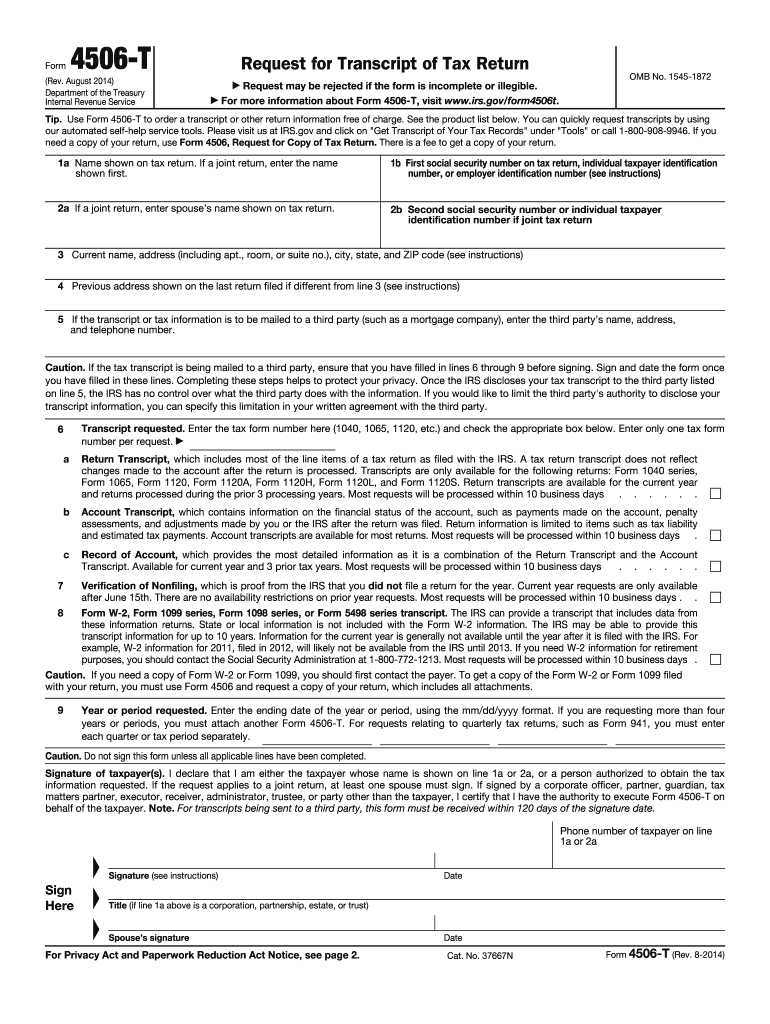

The 2-T form is a request for transcripts of tax returns, used primarily by individuals and businesses to obtain copies of their tax information from the Internal Revenue Service (IRS). This form allows taxpayers to request various types of transcripts, including:

- Return transcripts: Summarize tax return information and are available for the last three tax years.

- Account transcripts: Provide a record of the taxpayer's account, including any adjustments made by the IRS.

- Verification of non-filing: Confirms an individual did not file a tax return for the specified year.

The form is essential for a variety of purposes, including loan applications, mortgage approvals, or verifying income. Accurate completion is crucial, as it designates specific permissions regarding where the IRS should send the requested transcripts.

How to Complete the 2-T Form

Completing the 2-T form involves several key steps:

-

Download the form: You can obtain the 2-T form from the IRS website or trusted online platforms.

-

Fill in your personal information: This includes your name, address, Social Security Number (SSN) or Employer Identification Number (EIN), and the prior address if applicable.

-

Select the type of transcript requested: Indicate whether you need a return transcript, an account transcript, or verification of non-filing.

-

Specify the year or years for which the transcripts are needed: Provide the tax years for which you are requesting information.

-

Sign and date the form: As the taxpayer or the designated third party, ensure that you sign and date the request to validate it.

-

Send the form to the IRS: Mail or fax the completed form to the designated IRS office listed in the form’s instructions.

Filing electronically is not an option for the 4506-T form; submissions must be done by mail or fax.

Who Typically Uses the 2-T Form

The 2-T form is used by various individuals and entities, including:

- Individuals: Taxpayers needing their tax return information for various personal financial purposes, such as applying for student loans, mortgages, and refinancing.

- Businesses: Companies seeking to verify income for loan applications or financial reporting.

- Tax Professionals: Accountants or tax preparers who require transcripts on behalf of their clients for tax compliance or planning.

These groups often rely on the 4506-T form to obtain essential tax information while ensuring compliance with lender or governmental requirements.

Important Terms Related to the 2-T Form

Understanding key terminology can help navigate the 4506-T request process effectively:

- Transcript: A summary of tax return information or tax account status provided by the IRS.

- Third Party: An authorized individual or organization designated to receive the requested information.

- Filing Status: The designation that determines the tax rate applicable and must be accurately reflected on the form.

- Verification of Non-filing: A specific request for confirmation that no tax return was submitted for the selected years, which serves various verification purposes.

Familiarity with these terms helps to ensure the correct information is provided and facilitates efficient communication with the IRS.

Submission Methods for the 2-T Form

The 2-T form has specific submission methods that ensure the privacy and security of information. There are two primary methods for submitting the form:

-

Mail: Completed forms can be sent to the appropriate IRS address indicated on the instructions. This method may take longer for processing and receipt of transcripts.

-

Fax: For quicker processing, the completed form can be faxed to the IRS number specified for your state. This option typically results in faster receipt of the requested transcripts.

When sending the form, ensure that all the information is filled out accurately to prevent processing delays or rejections.