Definition and Meaning

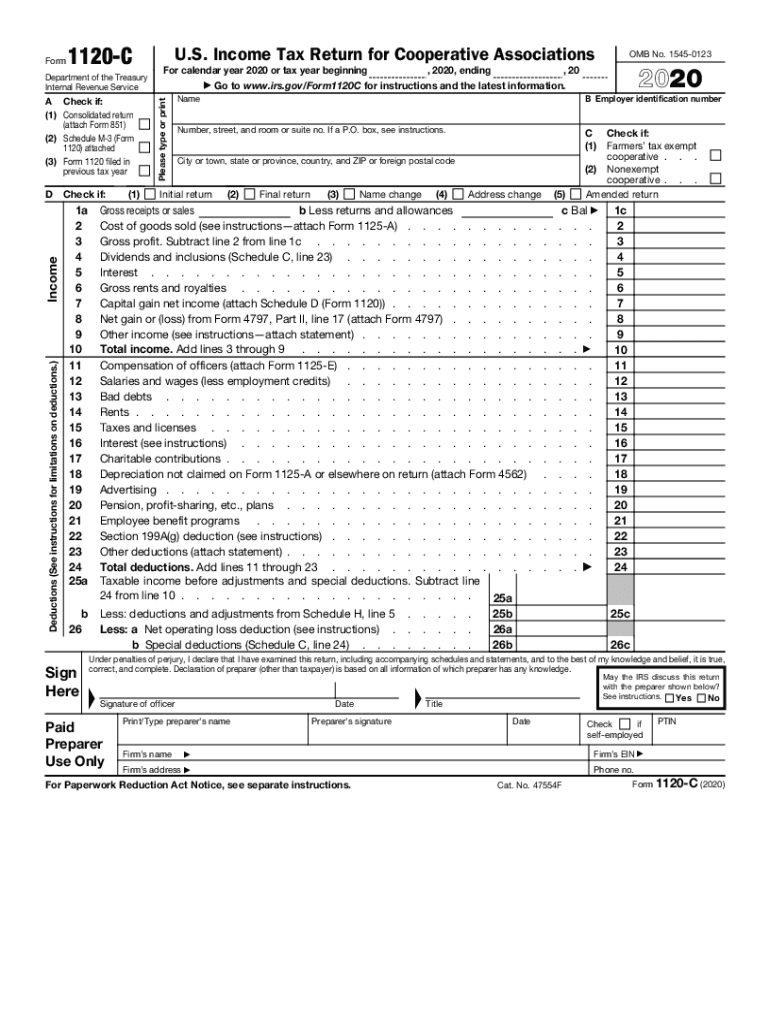

An IRS Form 1120 is primarily used by corporations in the United States to report their income, gains, losses, deductions, and credits, allowing the IRS to assess the corporation's tax obligations. This form is specifically tailored for C corporations, which are separate legal entities subject to corporate tax rates. Unlike pass-through entities, C corporations are taxed at the corporate level, and Form 1120 serves as the necessary document for fulfilling this requirement. Key sections of the form include details on gross receipts, income, deductions, and tax computations, offering a comprehensive view of the corporation's financial performance over the tax year.

Key Elements of Form 1120

Form 1120 consists of several critical sections that need to be accurately completed:

- Gross Receipts or Sales: Corporations must report their total income from all business activities.

- Deductions: Allowable business expenses that can be subtracted from total income to determine taxable income.

- Tax and Payments: Calculations related to the corporation's tax liability after applying credits and estimating payments.

- Balance Sheet and Schedule M-1: A reconciliation of income (loss) per books with income (loss) per return.

These sections require precise data entry to ensure compliance and avoid potential discrepancies in the corporation's financial reporting.

Steps to Complete Form 1120

Completing an IRS Form 1120 involves several meticulous steps:

- Gather Necessary Financial Records: Collect all income statements, balance sheets, and receipts from the tax period.

- Report Gross Income: Enter total income from operations, sales, or services rendered.

- List Deductions and Credits: Include eligible expenses such as salaries, rent, and utilities.

- Calculate Tax Liability: Use the tax tables provided by the IRS to determine the corporation's tax obligations.

- Review Supplementary Schedules: Complete additional schedules that pertain to specific tax circumstances, like Schedule J for tax computation.

A detailed and careful approach to each of these steps helps ensure accuracy and compliance with IRS regulations.

Important Terms Related to Form 1120

Understanding key terms associated with Form 1120 is crucial for accuracy:

- C Corporation: A corporation taxed separately from its owners.

- Taxable Income: The income subject to tax after deductions and credits.

- Deductions: Business expenses that reduce taxable income.

- Credits: Incentives that directly reduce tax liabilities.

Knowledge of these terms aids in accurately completing the form and optimizing tax responsibilities.

Filing Deadlines and Important Dates

Corporations are required to file Form 1120 by the fifteenth day of the fourth month following the end of their fiscal year, typically April 15 for calendar-year filers. Extensions may be requested if the corporation needs additional time to gather information, albeit without postponing tax payment deadlines. Staying aware of these critical dates ensures timely submission and avoids penalties.

Who Typically Uses Form 1120

Form 1120 is primarily used by C corporations across different industries, ranging from small businesses to large multinational corporations. These entities use the form to comply with federal tax requirements and report their financial position. Furthermore, entities such as foreign corporations doing business in the United States may also have to file specific versions of Form 1120.

IRS Guidelines for Form 1120

The IRS provides comprehensive guidelines to help corporations complete Form 1120 accurately:

- Instruction Manual: Detailed instructions are available that break down each section of the form.

- Supplementary Schedules: Specific forms like Schedule C for dividends and Schedule J for tax computation are essential.

Adhering to these guidelines minimizes errors and ensures a smooth filing process.

Penalties for Non-Compliance

Failing to file Form 1120 on time or inaccurately reporting information can result in significant penalties:

- Late Filing Penalties: Charges based on the amount of unpaid tax.

- Inaccuracy Penalties: Additional fees for errors or fraudulent reporting.

Understanding these risks emphasizes the importance of accurate, timely filing, motivating diligent completion of the form.

Software Compatibility

Many tax software platforms, like TurboTax and QuickBooks, support the completion and electronic filing of Form 1120. These platforms simplify the process by providing automated calculations and error-checking features. Compatibility with various software options ensures flexibility for corporations to choose the most suitable tool for their needs.