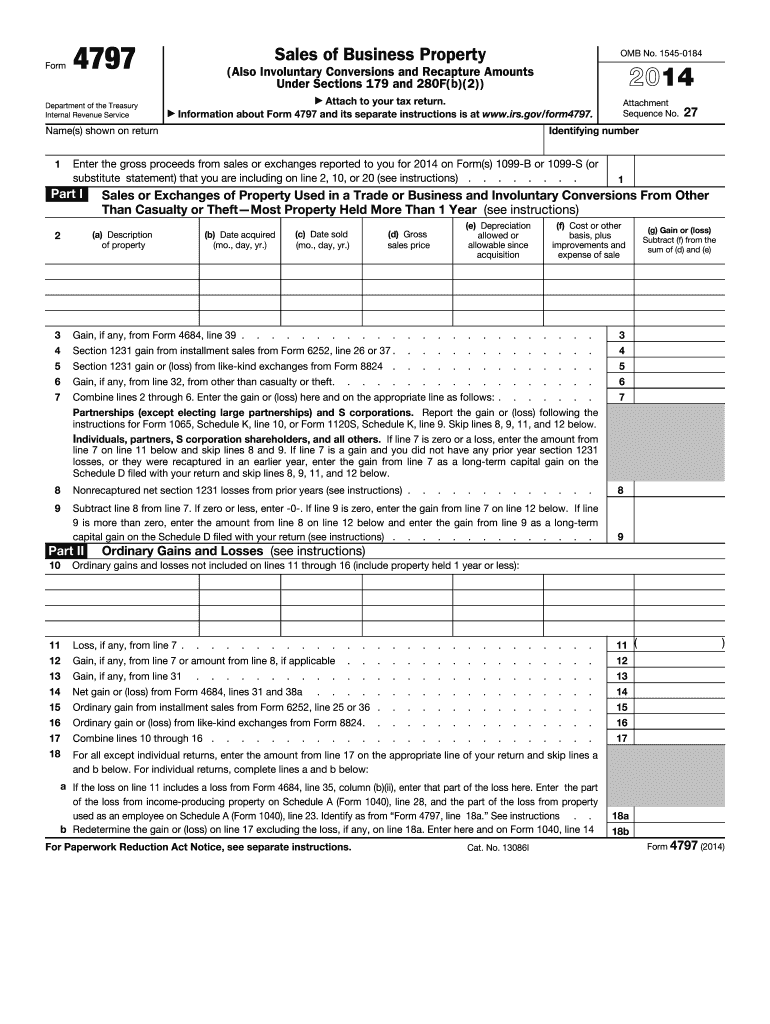

Definition & Purpose of Form 4797

Form 4797 is utilized by taxpayers to report the sale or exchange of business properties, involuntary conversions, and recapture amounts under sections 1245, 1250, 1252, 1254, and 1255. It's crucial for calculating gains or losses related to assets used in trade or business and certain involuntary conversions.

- Business Property Types: This includes property used for business, depreciable or amortizable property, and any property involuntarily converted.

- Recapture Amounts: Specific sections require recapture of depreciation and section 179 deduction. Understanding these sections is crucial to correctly fill out the form.

How to Obtain the 2014 Form 4797

Obtaining the 2014 Form 4797 is straightforward and can be done through multiple channels:

- IRS Website: Visit the official IRS website where you can download the form directly in PDF format.

- Tax Professionals: Consulting with a tax professional can also provide access, especially if they handle your tax filings.

- Mail: You can request a physical copy from the IRS by calling their service line.

Steps to Complete the 2014 Form 4797

Completing the 2014 Form 4797 involves several critical steps:

- Identify the Type of Property: Make sure to categorize the property correctly as business or trade property, and determine the applicable section for depreciation recapture.

- Calculate Gains or Losses: Use the form to compute the difference between the sales price and the adjusted basis of the property.

- Fill Out the Sections: Accurately complete each relevant section, focusing on sales price, cost, depreciation amount, and net gain or loss.

- Attach to Form 1040: Once completed, attach Form 4797 to your Form 1040 when filing tax returns.

Subsections for Completion

- Sales and Exchanges: Report the sale and exchanges of business property.

- Involuntary Conversions: Handle situations involving involuntary conversion where Gain from condemnations or thefts is addressed.

IRS Guidelines for Form 4797

The IRS provides detailed instructions to ensure accuracy in reporting:

- Guidelines for Part I: Concerns gains or losses of property held for more than one year.

- Guidelines for Part II: Focuses on property held for one year or less along with recapture amounts.

Follow the IRS's detailed step-by-step guidance to ensure compliance.

Important Terms Related to Form 4797

Understanding key terminology aids in accurate form completion:

- Adjusted Basis: Original cost of the property plus improvements minus depreciation.

- Depreciation Recapture: Reclaiming deductions previously taken, taxed as ordinary income.

Clarifying these terms can significantly influence the correct reporting on the form.

Legal Use of the 2014 Form 4797

Legally, this form is essential for properly documenting transactions involving business property. Here's why it matters:

- Compliance: Ensures your reporting aligns with tax regulations, avoiding legal penalties.

- Documentation: Provides a clear record of asset sales and recapture amounts for audit purposes.

Examples of Using Form 4797

Real-world examples illuminate the form's application:

- Example 1: A business sells a piece of machinery used in its operations, reporting the transaction on Form 4797.

- Example 2: An involuntary conversion occurs due to natural disaster, leading to correct gains reporting via this form.

These examples help underscore the form's versatility and necessity.

Filing Deadlines and Submission Methods

To prevent penalties, adhere to these timelines and methods for submission:

- Filing Deadline: Aligns with the regular tax return deadlines, usually April 15th.

- Submission Methods: Can be filed electronically through tax software or by mailing a printed form to the IRS.

Late submissions may incur penalties, so timely filing is crucial.

Penalties for Non-Compliance

Failing to comply with requirements for Form 4797 can result in:

- Monetary Penalties: Potential fines for late submission or incorrect reporting.

- Interest Charges: Accrued on unpaid amounts due to inaccuracies or delays.

Ensuring accuracy and timeliness can mitigate these risks, safeguarding against unnecessary expenses.