Definition and Purpose of IRS Form 4797

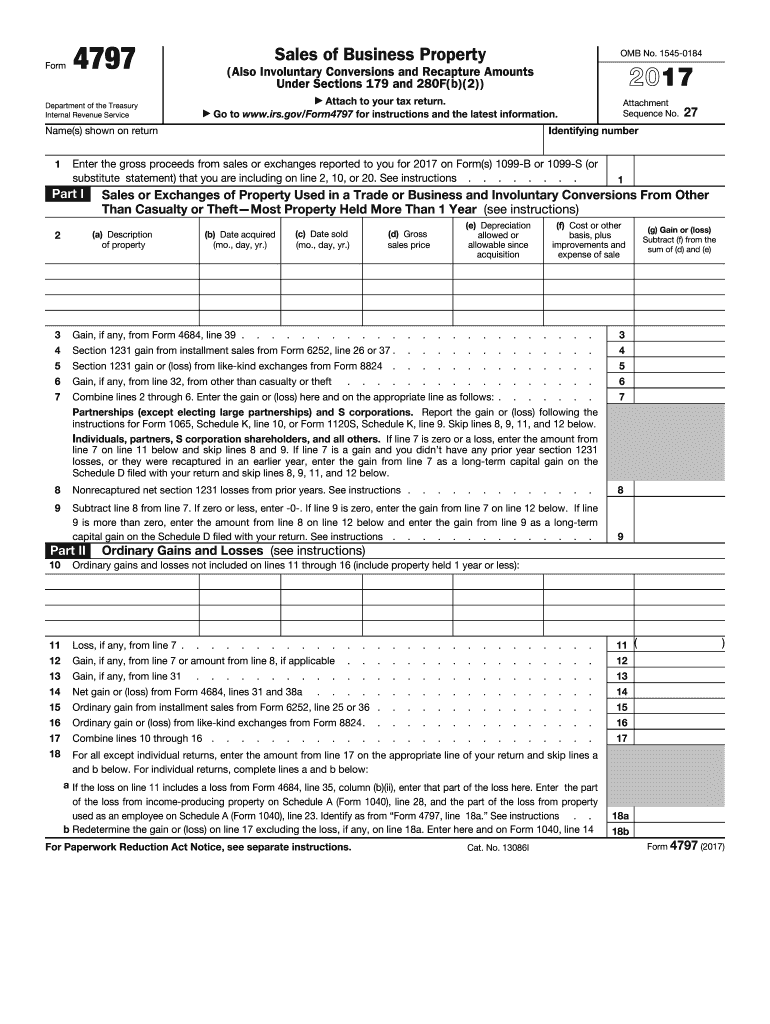

IRS Form 4797 is a tax document designed for reporting the sale or exchange of business property. This includes both real property and other types of business assets that may have been involuntarily converted or adjusted for depreciation. Key components of this form include:

- Sales Proceeds: Taxpayers must report the gross proceeds from the sale or exchange of property, ensuring accurate calculation of gains or losses.

- Depreciation Recapture: Taxpayers must account for any depreciation claimed on the assets, which can affect taxable income upon sale.

- Asset Types: The form encompasses various asset categories, including but not limited to machinery, buildings, and land.

Accurate completion of Form 4797 is crucial for individuals, partnerships, and corporations, as it directly influences tax obligations related to capital assets.

How to Use IRS Form 4797 in 2017

Using IRS Form 4797 involves several steps to ensure compliance with IRS regulations. Here’s how to effectively utilize the form:

- Prepare Documentation: Gather documents that outline the sale details, including purchase price, selling price, depreciation records, and any costs incurred during the sale.

- Fill Out the Form: Input details in the appropriate sections, including identifying information and specifics of the transaction.

- Calculate Gains or Losses: Determine whether the transaction resulted in a gain or loss by comparing the adjusted basis of the property to the selling price.

- Report on Tax Return: Include the completed IRS Form 4797 with your income tax return to report any gain or loss from the sale of business property.

This structured approach helps taxpayers ensure they fulfill all requirements when reporting asset sales.

Steps to Complete IRS Form 4797

Completing IRS Form 4797 requires careful attention to detail. Follow these steps:

- Gather Necessary Documents: Compile all pertinent records related to the asset, including purchase, sale agreements, and depreciation schedules.

- Identify the Type of Property: Determine the category of the property sold, as this influences how gains or losses are reported.

- Calculate Adjusted Basis: Assess the adjusted basis of the property by accounting for original purchase price, improvements, and depreciation claimed.

- Report Proceeds: Fill in the gross proceeds from the sale in the designated section of the form.

- Calculate Gains or Losses: Use the formula ( \text{Selling Price} - \text{Adjusted Basis} ) to identify any gain or loss.

- Complete Additional Schedules if Necessary: Depending on the nature of the transaction, additional schedules or forms may need completion, such as Schedule D for capital gains.

By following these steps, taxpayers can systematically address all necessary elements while preparing Form 4797.

Who Typically Uses IRS Form 4797

IRS Form 4797 is commonly utilized by a variety of taxpayers, including:

- Business Owners: Individuals or entities selling business assets must report these transactions accurately.

- Partnerships and Corporations: Businesses operating through partnerships or corporate structures are required to report gains or losses on property transactions.

- Real Estate Transactions: Those involved in selling real estate must report these transactions using the form if they qualify as business property.

- Tax Professionals: Accountants and tax advisors often assist clients in accurately completing this form to ensure compliance with tax regulations.

Awareness of who uses the form can help streamline the documentation process for those involved in property transactions.

Important Terms Related to IRS Form 4797

Several key terms are essential for understanding the implications of IRS Form 4797, including:

- Involuntary Conversion: When property is converted to cash due to events like theft, seizure, or condemnation, significant reporting is required.

- Depreciation Recapture: This refers to the process of reporting previously deducted depreciation as income when the asset is sold.

- Gross Proceeds: The total revenue earned from the sale of the asset, before deducting costs or expenses related to the sale.

- Adjusted Basis: The original cost of the property adjusted for improvements and depreciation taken, used to calculate gains or losses.

Familiarity with these terms enhances comprehension of the form's requirements and implications.

State-Specific Rules for IRS Form 4797

In addition to federal requirements, certain states may impose additional rules when filing IRS Form 4797. Notable aspects include:

- State Tax Laws: Taxpayers should consult state regulations that may dictate different reporting requirements or tax rates on capital gains.

- Local Regulations: Some states may have specific forms or supplementary documents required alongside the IRS Form 4797 for state tax compliance.

- Filing Practices: Variations in filing deadlines or additional penalties for late submissions can differ based on state laws, necessitating due diligence.

Taxpayers should remain informed about their state’s rules to ensure comprehensive compliance and avoid potential penalties.