Definition and Purpose of the 2003 Form

The "2003 form" typically refers to a document used for specific reporting or regulatory requirements, often linked to financial, legal, or tax-related obligations. This form is crucial for compliance and documentation in various scenarios. Understanding its specific function and context is essential for accurate usage. The "2003 form," depending on its application, might differ in requirements and importance based on its issuance authority, such as federal or state agencies.

Steps to Obtain the 2003 Form

-

Identify the Issuing Authority: Determine the regulatory body or organization that issues the form. This could be the IRS, a state agency, or another governmental entity.

-

Visit Official Websites: Access the official website of the issuing authority to find and download the form. Ensure you are using the most current version available.

-

Contact Relevant Departments: If the form is not available online, contact the relevant department by phone or email to request a physical copy.

-

Consult Professionals: If unsure about the acquisition process, consult with legal or tax professionals for guidance.

Steps to Complete the 2003 Form

-

Review Form Instructions: Begin by reading any included instructions or guidelines to understand each section's requirements.

-

Gather Necessary Information: Ensure you have all the required information and documentation readily available, such as financial records, identification details, and any supporting documents.

-

Fill Out the Form: Use clear handwriting if completing by hand, or type directly into a fillable PDF to ensure legibility. Complete each section thoroughly and accurately.

-

Double-Check Entries: Verify all entered details for accuracy and completeness to avoid processing delays.

-

Consult an Expert: If any section of the form is unclear, consider consulting with a professional, such as a tax advisor or attorney, for clarification.

Importance of the 2003 Form

The "2003 form" serves as a vital tool for compliance with specific regulatory or legal requirements. It often acts as a record for financial transactions, legal agreements, or tax filings. Proper use of the form helps prevent legal issues, financial discrepancies, and ensures adherence to statutory obligations. Its importance cannot be understated in processes where precise documentation is mandatory.

Key Elements of the 2003 Form

-

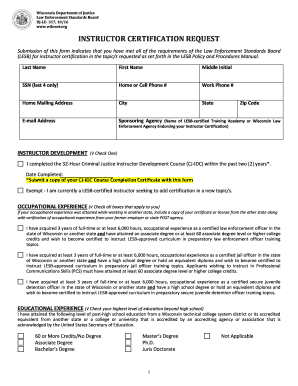

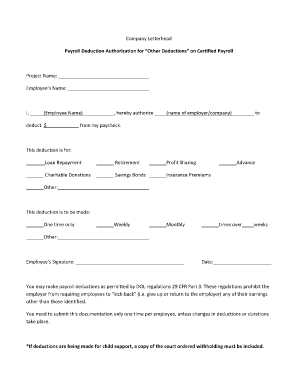

Identification Section: Typically includes spaces for personal or business identification, such as name, address, and taxpayer identification number.

-

Financial Details: Sections dedicated to specific monetary figures, such as income amounts, deductions, or credits.

-

Signature and Certification: A mandatory part of the form where the filer certifies the accuracy of the information provided, often under penalty of perjury.

-

Supplementary Information: Additional pages or sections for detailed explanations, schedules, or disclosures.

Legal Use of the 2003 Form

Utilizing the "2003 form" in adherence to legal stipulations is crucial to maintaining compliance. Falsifying information or incorrect usage can result in penalties, both financial and legal. Understanding the form's intended legal context ensures that it fulfills regulatory obligations effectively. Agencies use these forms to audit compliance and enforce laws, so accuracy is paramount.

Filing Deadlines and Important Dates

-

Annual Deadlines: Many forms have specific deadlines coinciding with fiscal year-end or tax filing dates, often requiring submission by April 15 annually for tax-related forms.

-

Quarterly Dates: Some forms necessitate quarterly submissions, aligning with financial quarter ends.

-

State-Specific Deadlines: Dates may vary depending on state requirements or local regulations.

-

Extensions: Procedures to request extensions, if applicable, including needed documentation and submission process.

Required Documents for the 2003 Form

-

Identification Proof: Valid identification such as a social security number, employer identification number (EIN), or other legal identity proofs.

-

Financial Statements: Recent income statements, expense records, or transaction logs that support claimed figures on the form.

-

Previous Forms: Copies of previous filings that relate to or support current form details.

-

Supporting Documents: Any additional paperwork required for specific claims or deductions mentioned on the form.

Digital vs. Paper Versions of the 2003 Form

-

Online Accessibility: Digital forms allow for easier access and submission, often featuring fillable PDF formats.

-

Paper Submissions: Physical forms may still be required for certain submissions, especially if original signatures or notarization is needed.

-

Software Integration: Some forms can be integrated with software solutions like TurboTax or QuickBooks for seamless data entry and submission.

-

Recordkeeping: Both digital and paper versions should be retained for personal records to facilitate audits or future filings.