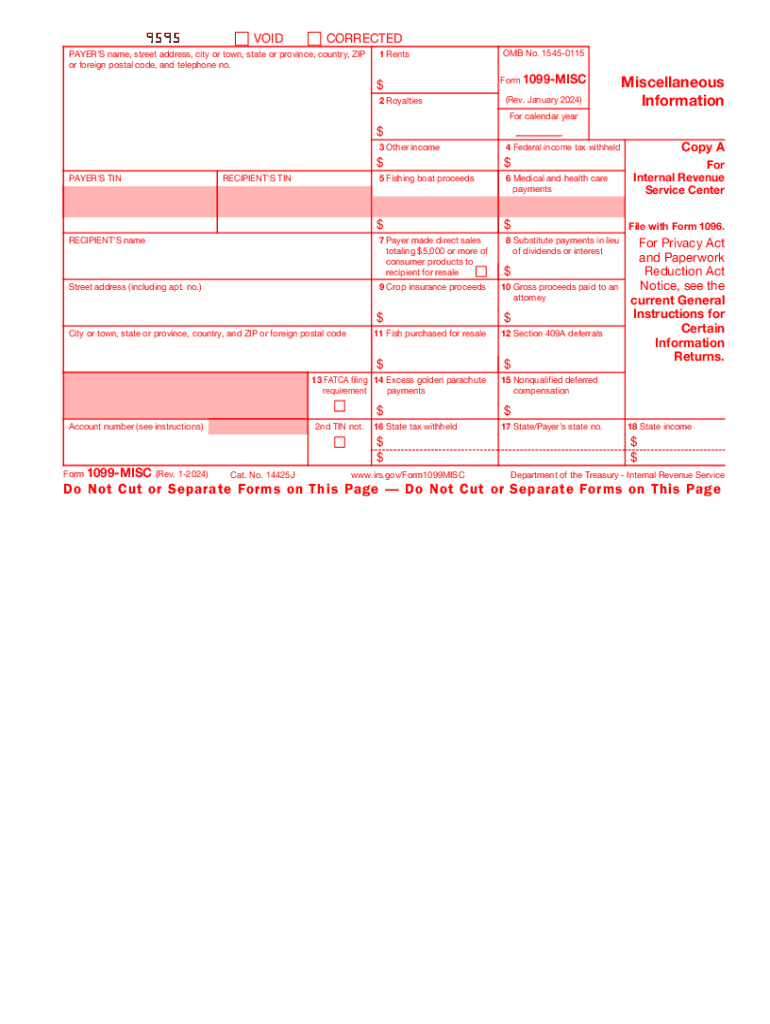

Definition and Meaning of the 1099 Form

The 1099 form is an official IRS document used primarily for reporting various types of non-employment income, such as freelance earnings, interest, dividends, and other miscellaneous income sources. This form becomes essential for taxpayers who receive income from sources other than their regular employment. It's crucial for independent contractors, freelancers, and small business owners to understand this form, as it aids in accurately assessing and reporting income to the IRS. The 1099 form acts as a financial record, submitted annually, to detail payments received that may influence tax filings.

Obtaining the 1099 Form PDF

Obtaining the 1099 form PDF is straightforward, as it is widely accessible through multiple official channels. The IRS website provides downloadable versions of the form that can be filled out electronically or printed. Tax software platforms like TurboTax and QuickBooks also offer the form, often with integrated tools to complete it as part of the tax filing process. In addition, one can request physical copies from the IRS if needed. Employers or clients who issue the 1099 form typically provide a copy directly to the recipient for their records, ensuring the recipient has all necessary documentation for accurate reporting.

Steps to Complete the 1099 Form PDF

- Gather Required Information: Assemble all necessary information, such as the payee's legal name, address, and taxpayer identification number (TIN).

- Fill Out the Form: Enter precise payment details, including the total amount paid during the fiscal year in appropriate boxes matching the payment type (e.g., rents, royalties).

- Double-Check Entries: Verify all entries for accuracy, ensuring that totals match records from payers or clients to avoid discrepancies.

- Distribute Copies: Provide required copies to all entities—Copy A to the IRS, Copy B to the recipient, and retain Copy C for personal records.

- Submit the Form: Depending on volume, submit to the IRS through mail or electronically. E-filing is recommended for those filing numerous forms for efficiency.

Legal Use of the 1099 Form PDF

The legal use of the 1099 form PDF revolves around compliance with IRS regulations for reporting income. This form ensures accurate and comprehensive reporting of compensation that is not subject to employment withholding. The 1099 form is legally required for payments over $600 in a calendar year for services rendered to independent contractors and freelancers. Adherence to these requirements is critical to avoid penalties and legal repercussions. Ensure thorough documentation practices, maintain records, and verify receipt acknowledgment from all parties involved in the transaction.

Key Elements of the 1099 Form PDF

The 1099 form PDF contains several key elements that must be correctly filled out. These include:

- Payer and Recipient Information: Legal names, addresses, and TINs.

- Total Payments Made: The total amount paid to the recipient during the year.

- Specific Income Fields: Designated boxes for specifying income types, such as payments for contract work or dividends.

- Federal and State Tax Withholding: If applicable, any amounts withheld for taxes.

- Signature and Date: An authorized signature, if required, and the date of completion.

Accuracy in each of these fields is critical for both compliance and effective communication between parties.

IRS Guidelines for the 1099 Form PDF

IRS guidelines stipulate the correct usage and timely filing of the 1099 form PDF. The IRS mandates that the form must be submitted for payments made as part of a trade or business over established thresholds. It also details the method of submission, whether electronically or by mail, and stipulates corrective actions in the event of discrepancies. Understanding these guidelines is essential for avoiding penalties. Additionally, the IRS provides instructions for amendments or corrections if errors are discovered after the submission.

Filing Deadlines and Important Dates

Timely submission of the 1099 form is crucial. The deadline for distributing the 1099 form to recipients is typically January 31 following the end of the tax year. The IRS requires submission of Copy A by February 28 if filing by paper, or by March 31 if filing electronically. Employers and contractors must note these deadlines to ensure compliance and minimize risks of fines or penalties for late submission. Adhering to these dates allows for sufficient time to address any inconsistencies or required amendments before IRS deadlines.

Penalties for Non-Compliance

Non-compliance with the 1099 filing requirements can result in significant penalties. The IRS imposes fines based on the degree of negligence or failure-to-file status, which can increase over time if unaddressed. For example:

- Late Filing Penalties: Fines increase incrementally based on the number of days past the deadline.

- Inaccuracies or Errors: Errors in reporting or missing information can also result in monetary penalties.

- Intentional Disregard: Severe non-compliance, marked by disregard for filing requirements, faces the steepest fines.

Proper understanding and execution of all steps ensure compliance and safeguard against penalties associated with the 1099 form.