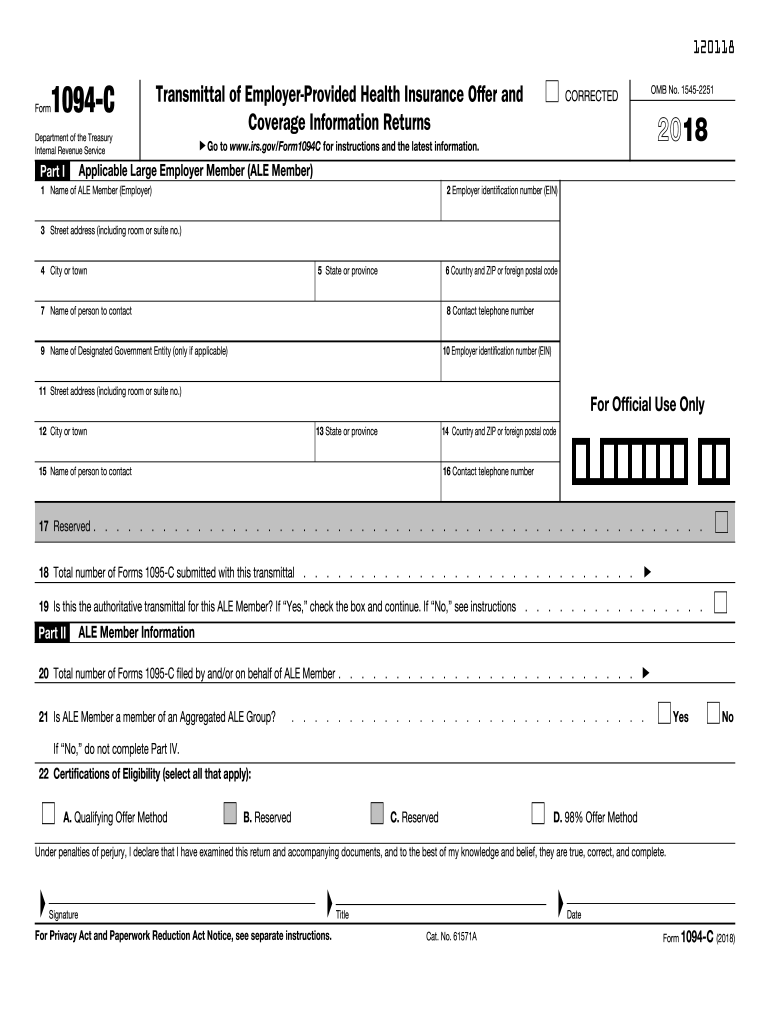

Definition and Purpose of the 2-C

The 2-C is a key tax form used by Applicable Large Employers (ALEs) under the Affordable Care Act (ACA) regulations to report health insurance coverage information to the Internal Revenue Service (IRS). This form serves as a transmittal document that accompanies other forms, specifically the 1095-C, which provides details about the health coverage offered to employees. It is essential for ALEs because it allows them to demonstrate compliance with the ACA’s employer mandate, ensuring that they provide adequate health insurance to their full-time employees.

Key Reporting Requirements

- Employer Information: It requires the ALE to provide its name, address, and Employer Identification Number (EIN).

- Contact Information: The form includes sections for the name and contact details of the person responsible for the form’s completion.

- Coverage Information: The employer must report the total number of employees and the months during which health coverage was offered.

How to Use the 2-C Effectively

Using the 2-C form effectively involves understanding its structure and the information required. Employers should familiarize themselves with the different sections of the form to ensure accurate reporting.

Filing Process Overview

- Collect Information: Gather data related to employee health coverage, including details from the 1095-C forms.

- Complete the Form: Accurately fill in all required fields, ensuring that both the employer’s information and employee coverage details are correctly reported.

- Submit to the IRS: After completion, the 1094-C must be submitted electronically or by mail, depending on the number of returns filed.

Important Considerations

- Ensure accurate counting of full-time employees to avoid penalties.

- Double-check the EIN and contact details to prevent submission rejections.

Steps to Complete the 2-C Form

Completing the 2-C requires careful attention to detail. Follow these structured steps to ensure the form is filled out correctly.

Step-by-Step Guide

- Employer Information

- Enter the legal name, address, and EIN of the ALE.

- Contact Person

- Provide the name and phone number of the person responsible for the form’s completion.

- Number of Employees

- Input the total number of full-time employees for the reporting year.

- Coverage Reporting

- Indicate whether the employer offered health coverage and the months it was available.

Verification and Submission

- Review all entries for accuracy.

- Submit the filed 1094-C along with the corresponding 1095-C forms to the IRS.

Important Terminology Related to the 2-C

Understanding the terminology surrounding the 2-C is essential for proper utilization and compliance.

Key Terms Explained

- Applicable Large Employer (ALE): An employer with fifty or more full-time employees or full-time equivalent employees.

- Full-Time Employee: An employee who works thirty or more hours a week, or one hundred thirty hours a month.

- 1095-C Form: The form that provides details about the health coverage offered to employees, which must be issued to individual employees and submitted to the IRS alongside the 1094-C.

IRS Guidelines for the 2-C

The IRS provides specific guidelines for completing and submitting the 2-C, ensuring compliance with ACA requirements.

Compliance Standards

- Timely Submission: The form must generally be filed by the deadlines established by the IRS, which typically occur in the early months of the following tax year.

- Accuracy: Any discrepancies can trigger penalties, so it’s critical to verify all information before submission.

- Penalties for Non-Compliance: ALEs that fail to file the 1094-C or provide incorrect information may face significant penalties, reinforcing the importance of proper completion and timely submission.

Common Mistakes to Avoid When Filing the 2-C

Understanding common errors can help in ensuring accurate filing of the 2-C.

Frequent Filing Errors

- Incorrect EIN: Filing with an incorrect Employer Identification Number can lead to rejection.

- Missing Employee Data: Failing to report on all full-time employees can result in non-compliance.

- Inaccurate Coverage Codes: Using incorrect codes to report health coverage offers can also lead to penalties.

Best Practices

- Double-check all information against payroll records.

- Stay informed about annual changes to IRS guidelines regarding the 1094-C filing process.