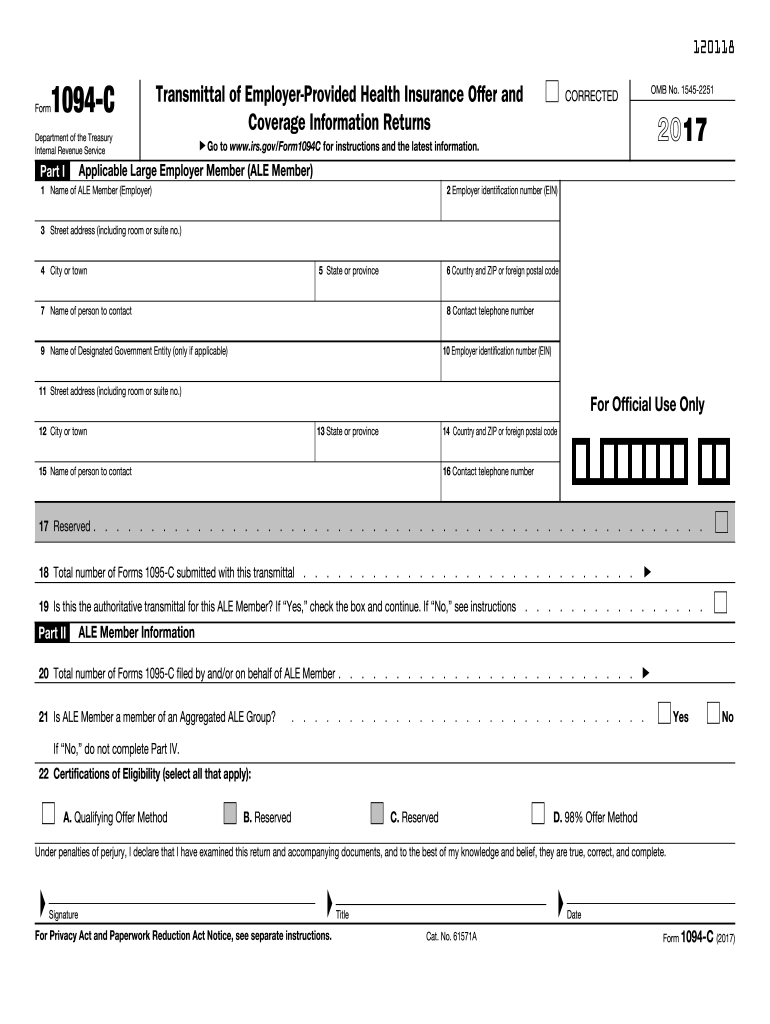

Definition and Purpose of the 1094-C 2017 Form

The 1094-C 2017 form is a transmittal form used by Applicable Large Employers (ALEs) to report information regarding their health insurance offerings to the Internal Revenue Service (IRS). This form serves as a cover sheet for the 1095-C forms, which provide detailed information about each employee's coverage and eligibility. The 1094-C is crucial in demonstrating compliance with the Affordable Care Act (ACA) employer shared responsibility provisions and it is essential for ALEs to accurately report their data to avoid potential penalties.

Key Functions of the 1094-C

- Summary Documentation: The 1094-C summarizes information from multiple 1095-C forms for all employees, making it easier for the IRS to assess compliance.

- Employer Identification: It collects key details such as the employer identification number (EIN), the number of full-time employees, and contact information.

- Compliance Certification: Employers certify their compliance with ACA regulations by completing this form, which helps determine whether they are subject to employer shared responsibility payments.

How to Obtain the 1094-C 2017 Form

Employers can obtain the 1094-C 2017 form from several sources to ensure they have the correct version for reporting.

- IRS Website: The form can be downloaded directly from the IRS website, where legitimate copies are available.

- Tax Preparation Software: Many tax software programs automatically generate the necessary forms, including the 1094-C and 1095-C.

- Professional Accountants or Tax Preparers: Consulting with tax professionals can provide guidance and direct access to the form and any related filing requirements.

Steps to Complete the 1094-C 2017 Form

Filling out the 1094-C involves several key steps to ensure that all information is accurate and compliant with IRS standards.

- Collect Necessary Information: Gather details about the employer, including EIN, address, and the total number of full-time employees for the year.

- Complete Section I: Fill in the employer's identifying information along with the applicable reporting year.

- Fill Section II: Complete the "Employer Shared Responsibility" section by indicating the number of full-time employees and the coverage offered.

- Complete Section III: This section covers the criteria for the employer's compliance with ACA regulations, including the methodology used to determine full-time status.

- Review and Submit: Carefully check all entries for accuracy, keep copies for records, and submit to the IRS by the specified due date.

Important Terms Related to the 1094-C 2017 Form

Understanding the terminology associated with the 1094-C is important for proper compliance:

- Applicable Large Employer (ALE): Generally, an employer with 50 or more full-time employees.

- Full-Time Employee: Defined as an employee who works an average of at least thirty hours per week or 130 hours per month.

- Health Coverage: Refers to the minimum essential coverage offered by the employer that meets ACA requirements.

IRS Guidelines and Reporting Requirements

The IRS provides detailed guidelines regarding the completion and submission of the 1094-C form to ensure compliance with federal health care laws.

- Filing Method: Employers must file the 1094-C electronically if they are submitting 250 forms or more, although they may choose to file on paper for fewer submissions.

- Deadline: The 1094-C must be filed annually by the end of February if submitting by paper or by March 31 if submitting electronically.

- Accuracy and Integrity: It's critical to ensure that the information reported accurately reflects the employer’s health insurance offerings to avoid penalties.

Penalties for Non-Compliance with the 1094-C 2017 Form

Failure to properly complete and file the 1094-C can result in significant penalties for employers.

- Failure to File Penalty: Employers may be subject to penalties for not filing the form by its due date or for filing incomplete or inaccurate forms.

- Employer Shared Responsibility Payment: If found non-compliant regarding the offer of coverage, ALEs may incur payments under the employer shared responsibility provisions of the ACA, which can be substantial.

Digital Entry and Software Compatibility

Utilizing tax software is a common and efficient method for managing the completion of the 1094-C 2017 form.

- Integration with Software: Most major tax preparation platforms like TurboTax or QuickBooks support the generation of the 1094-C form, allowing employers to input necessary data directly.

- Direct Filing Options: Many software solutions also facilitate electronic filing, ensuring compliance and simplifying submission processes.

Examples of Using the 1094-C 2017 Form in Practice

A real-world example can provide insight into how employers utilize the 1094-C form effectively:

- Business A: A retail company with 75 full-time employees reports their annual health insurance offerings using the 1094-C to demonstrate compliance. They ensure all 1095-Cs are accurately filled and submitted alongside the 1094-C to avoid any potential penalties.

- Business B: A mid-sized tech firm employs a professional tax service to prepare their 1094-C, ensuring that it meets all IRS guidelines, thus minimizing the risk of errors and non-compliance.

These practices illustrate how understanding the requirements and emphasis on accuracy in reporting underpins successful compliance with the ACA.