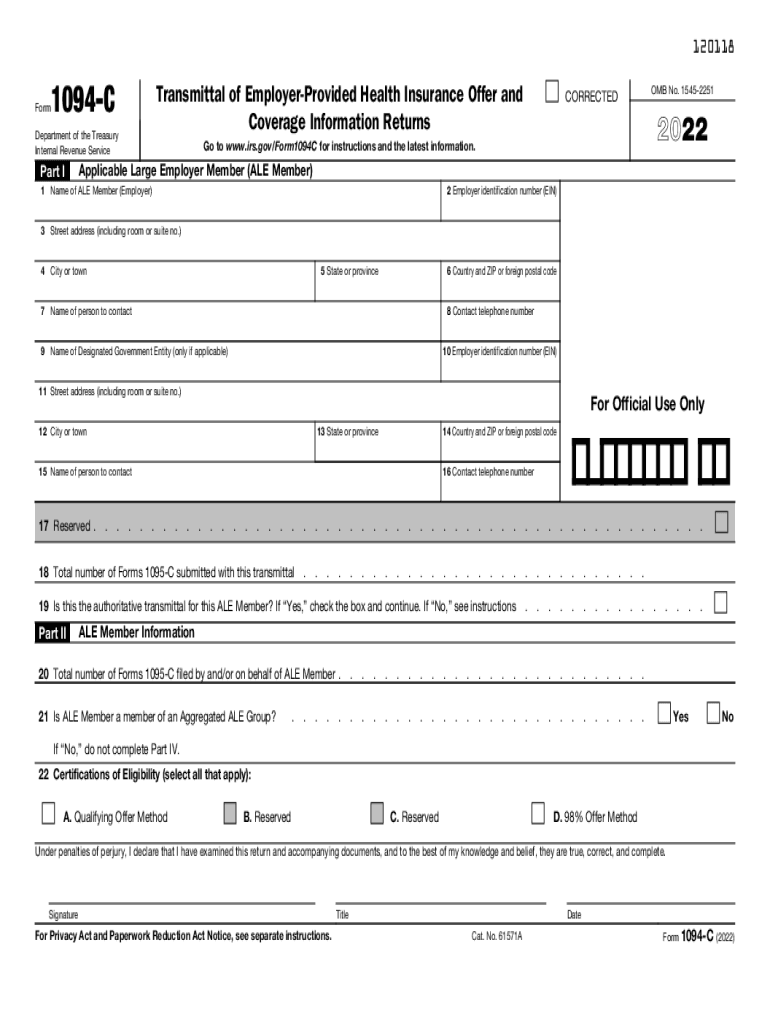

Definition and Purpose of Form 1094-C

Form 1094-C serves as the Transmittal of Employer-Provided Health Insurance Offer and Coverage information to the IRS. This form is specifically targeted at Applicable Large Employers (ALEs), which are defined as employers with fifty or more full-time employees, including equivalents. The primary purpose of Form 1094-C is to facilitate compliance with the Affordable Care Act (ACA) by enabling the reporting of health coverage offered to employees.

This form includes essential sections that capture the following information:

- Employer Identification Information: This includes the name, Employer Identification Number (EIN), and address of the employer.

- Contact Person Details: A designated contact person’s name and phone number must be provided for IRS correspondence.

- Coverage Information: Employers must report the types of health coverage offered to full-time employees, including health insurance plan details, employee counts, and any certifications of eligibility for the coverage.

Completing and submitting Form 1094-C is critical for ALEs, as it supports the IRS in administering ACA mandates regarding health insurance coverage.

Steps to Complete Form 1094-C

Completing the 2022 Form 1094-C involves several systematic steps to ensure accuracy and compliance with IRS guidelines.

-

Gather Necessary Documents: Collect relevant data about your employees and health coverage before starting. Documents might include employee counts, health insurance plan details, and previous tax forms, such as Form 1095-C.

-

Fill Out Employer Information: Begin by entering your employer identification information. Ensure accuracy in your EIN and the proper spelling of the business name to avoid processing delays.

-

Contact Person: Designate a contact person for any inquiries from the IRS. Include their name and a reliable phone number for prompt communication.

-

Coverage Sections: Complete the sections that detail the health coverage provided. This includes specifying the minimum essential coverage and its affordability. You will also need to categorize employees based on their coverage status.

-

Final Review: Double-check all entries for accuracy. Ensure all necessary fields are filled out, especially if submitting electronically. Review specific instructions for any line items to minimize the risk of errors.

-

Submit the Form: Depending on your preference, you may submit the form electronically or via mail. Ensure it is sent to the correct IRS address listed for Form 1094-C submissions.

Following these steps will enable compliance and facilitate a smoother reporting process.

Who Typically Uses Form 1094-C?

Form 1094-C is primarily utilized by Applicable Large Employers (ALEs) as defined by the Affordable Care Act (ACA). An ALE is an employer with an average of fifty or more full-time employees, including full-time equivalents, during the previous calendar year. The following entities typically use this form:

-

Corporations: Large employers, including publicly traded and privately held corporations, are required to file Form 1094-C to report health insurance information.

-

Partnerships: Partnerships with sufficient employee counts also fall under the ALE definition, necessitating compliance with ACA reporting requirements.

-

Non-Profit Organizations: Non-profits that meet the ALE threshold must utilize Form 1094-C to submit required information to the IRS.

-

Government Entities: State and local government employers that provide health coverage to an eligible number of employees must also file this form.

Using Form 1094-C is crucial for these entities to ensure compliance with federal health care mandates and avoid potential penalties.

Key Elements of the 2022 Form 1094-C

Understanding the critical elements of the 2022 Form 1094-C is essential for accurate completion and compliance. The following elements are significant:

-

Part I: Employer Information: This section requires the employer's EIN, name, and address details. Accurate data entry ensures proper identification and reduces conflict with IRS records.

-

Part II: Employer Size and Coverage Information: This part inquires about the number of full-time employees, including those with health coverage. Employers must also categorize offered coverage types into designated codes that reflect the plan characteristics.

-

Part III: Certification of Eligibility: This section allows for certification regarding the health coverage offered, ensuring compliance with ACA standards. Employers must accurately report this information to avoid penalties.

-

Part IV: Contact Information: Including a contact person can expedite any questions or issues that the IRS may arise during processing.

-

Transmittal Information: The final sections of the form prepare data for IRS receipt. This includes noting counts of Forms 1095-C filed alongside this transmittal.

Failing to accurately report any of these key elements can result in penalties or complications regarding compliance.

Filing Deadlines for Form 1094-C

Form 1094-C has specific filing deadlines that must be adhered to in order to maintain compliance with ACA requirements. The following deadlines are relevant for the 2022 tax year:

-

Paper Filing Deadline: Employers must submit Form 1094-C by February 28, 2023, if filing by paper.

-

Electronic Filing Deadline: The deadline for submitting Form 1094-C electronically is extended to March 31, 2023. Employers are encouraged to file electronically due to the ease of tracking and minimizing errors.

-

Employee Notification: Employers must also ensure that each employee who was offered health coverage in the previous year receives their corresponding Form 1095-C by the same deadline as Form 1094-C.

Adhering to these deadlines is critical in avoiding penalties associated with late submissions.

Penalties for Non-Compliance with Form 1094-C

Non-compliance with filing Form 1094-C can lead to substantial penalties as enforced by the IRS. Employers should be aware of the following potential consequences:

-

Late Filing Penalties: If Form 1094-C is not filed by the deadline, the IRS can impose penalties that escalate based on how late the filing is. For example, if filed more than 30 days late, the penalty may reach $50 for each form.

-

Failure to Furnish Penalties: Employers are also required to furnish Form 1095-C to employees in a timely manner. Failure to do so can result in penalties, similar to those applied for late filing.

-

Corrective Actions: Should an employer identify errors in the submitted information, they must file corrections promptly; failing to do so can lead to additional financial ramifications.

In summary, ensuring timely and accurate submission of Form 1094-C is not only mandatory but also essential for maintaining compliance with ACA regulations while avoiding costly penalties.