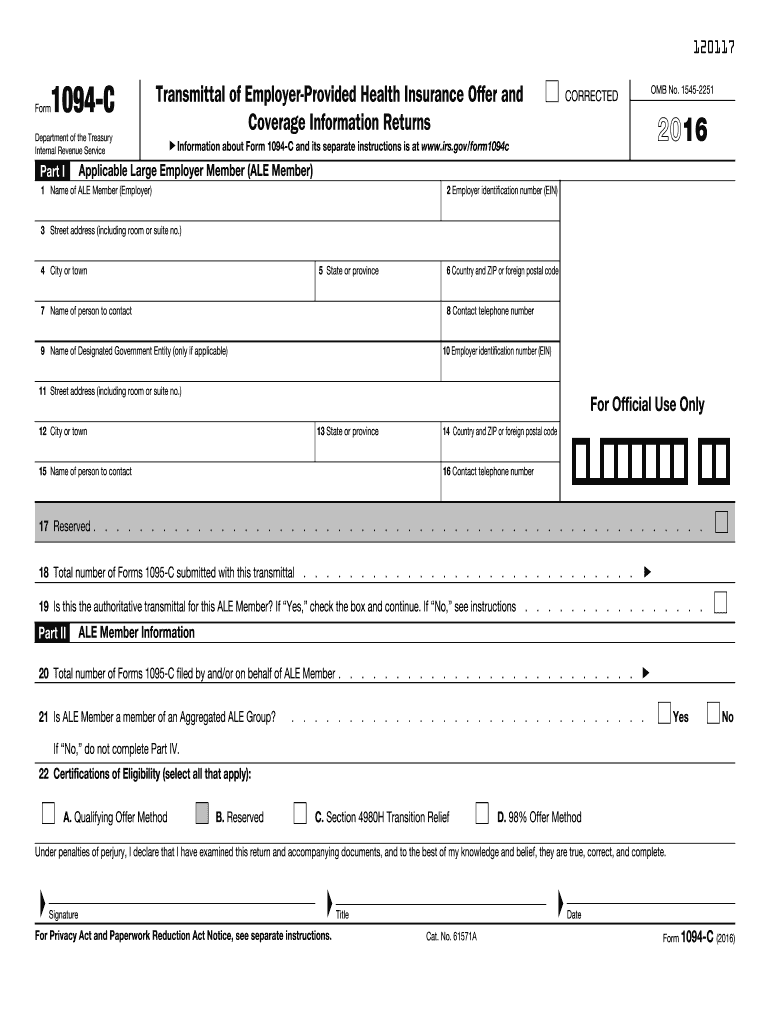

Definition and Meaning of the 2016 Form 1094-C

The 2016 Form 1094-C is a crucial IRS document designed for Applicable Large Employers (ALEs) to report information about health insurance offerings to their full-time employees. This form serves as a transmittal document, summarizing the coverage provided under the Affordable Care Act (ACA). Specifically, it facilitates the reporting of health coverage data to the IRS, ensuring compliance with ACA mandates.

Key Aspects of Form 1094-C

- Reporting Responsibility: Form 1094-C must be completed by employers meeting the ALE threshold, typically those employing an average of at least fifty full-time employees, including full-time equivalent employees.

- Purpose: The overarching goal of the form is to attest to the provision of affordable health insurance coverage and to provide data necessary for the IRS to determine compliance with the ACA's employer mandate.

Steps to Complete the 2016 Form 1094-C

Filing the 2016 Form 1094-C requires careful attention to detail and adherence to IRS guidelines. The completion process is systematic and can be broken down into several key steps:

-

Gather Required Information:

- Collect your Employer Identification Number (EIN).

- Compile employee data, including number of full-time employees, coverage details, and the months during which coverage was offered.

-

Fill Out Essential Sections of the Form:

- Part I: Enter basic information about the employer, including name, address, and contact details.

- Part II: Complete details about the months during which the employer offered health coverage to employees.

- Part III: Provide information on each full-time employee, including their names, social security numbers, and information on health coverage provided.

-

Ensure All Fields are Completed:

- Double-check all entries for accuracy, submitting the form or electronic filing according to guidelines.

-

Review and Submit:

- Reassess the filled form against IRS instructions before submission. Choose between electronic submission or mailing the form to ensure compliance.

-

Maintain Records:

- Keep copies of the submitted Form 1094-C and relevant employee data for at least three years for potential audits or verifications.

Important Terms Related to the 2016 Form 1094-C

Understanding terminology associated with the 2016 Form 1094-C is vital for accurate completion and compliance:

- Applicable Large Employer (ALE): Defined as an employer with fifty or more full-time employees, including equivalents, who must comply with the ACA's employer mandate.

- Full-Time Employee: An employee who works an average of thirty hours or more per week, used in calculating whether an employer is an ALE.

- Minimum Essential Coverage (MEC): The type of health insurance coverage that satisfies the ACA's coverage mandate, which ALEs must offer to full-time employees.

- Shared Responsibility Payment: A penalty imposed on ALEs that do not provide qualifying health coverage to eligible employees.

IRS Guidelines for the 2016 Form 1094-C

The IRS provides specific guidelines to facilitate the accurate completion and filing of the Form 1094-C. Understanding these guidelines is essential for compliance:

- Submission Method: Form 1094-C can be filed electronically using the IRS's Affordable Care Act Information Returns (AIR) program. Paper submissions are also permitted but may result in longer processing times.

- Filing Deadlines: Employers must submit Form 1094-C to the IRS by February 28th for paper submissions or March 31st for electronic submissions each year. Timely filing helps avoid penalties.

- Reporting Multiple Employers: If an ALE operates as part of a controlled group, it must report combined information for the entire group on a single Form 1094-C.

- Accuracy and Completeness: The IRS mandates strict adherence to reporting accuracy. Employers should confirm the information aligns with prior submissions to avoid inconsistencies that could trigger audits.

Filing Deadlines and Important Dates for the 2016 Form 1094-C

Employers must be aware of important filing deadlines associated with the 2016 Form 1094-C to ensure compliance and avoid penalties:

- February 28, 2017: Deadline for filing paper forms with the IRS.

- March 31, 2017: Deadline for electronically filing the form.

- March 15, 2017: Deadline for distributing copies of Form 1095-C to employees. This allows employees to prepare their individual tax filings accurately.

Being attentive to these dates is vital, as failure to file timely can result in financial penalties imposed on the employer.

Who Typically Uses the 2016 Form 1094-C?

The primary users of the 2016 Form 1094-C are employers who meet the criteria of Applicable Large Employers (ALEs). Understanding who falls into this category helps clarify responsibilities and reporting requirements:

- Employers with 50 or More Full-Time Employees: This includes businesses of various types, from corporations to non-profits, that meet the employee threshold.

- Businesses Seeking Compliance with ACA: Organizations aiming to adhere to the ACA's employer mandate must report on employee health insurance offerings through this form.

- Government Entities: Some governmental organizations also fall under the ALE classification, thereby requiring the completion of the form.

These key user profiles help ensure health coverage is offered and reported properly, aligning with regulatory requirements.

Key Elements of the 2016 Form 1094-C

Understanding the integral components of the 2016 Form 1094-C is crucial for effective completion and compliance:

- Part I - Employer Information:

- Essential identification details such as the employer's name, address, and EIN.

- Part II - Monthly Coverage Offerings:

- Summary of health coverage offers during the reporting year, detailing the months each type of coverage was available.

- Part III - Employee Details:

- Comprehensive listing of full-time employees, including names, Social Security numbers, and details on the coverage they received.

These elements collectively ensure that the form accurately reflects the health insurance coverage landscape within the organization, providing critical data for IRS review.