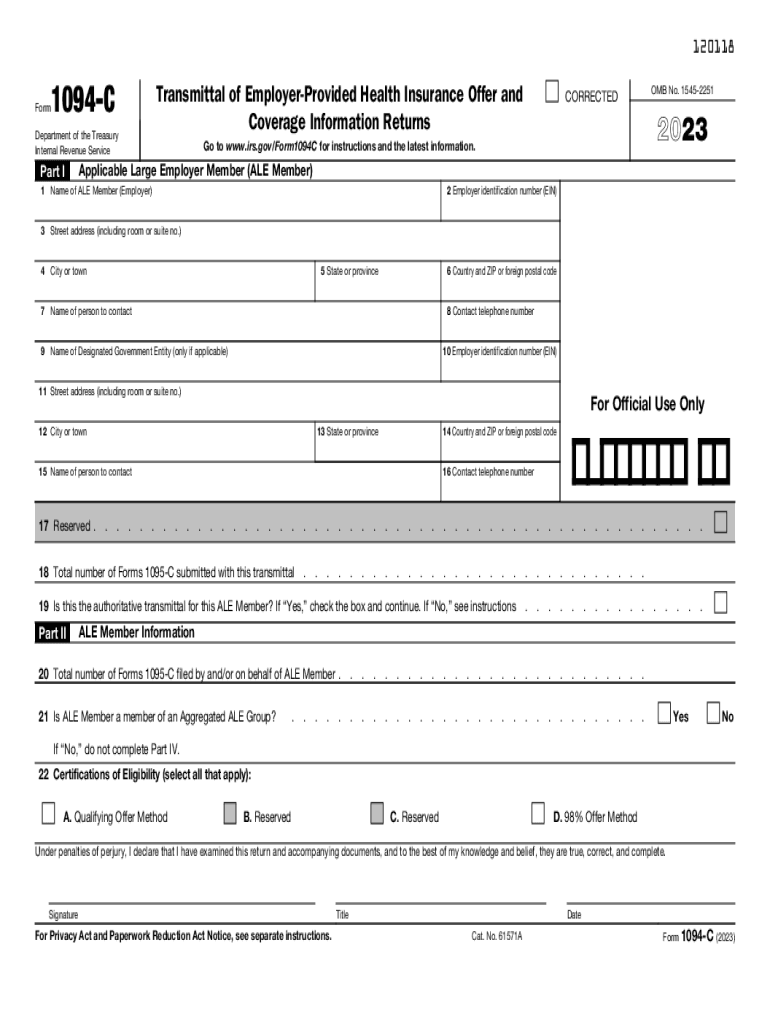

Definition and Purpose of Form 1094-C

Form 1094-C is a crucial document used by Applicable Large Employers (ALEs) to transmit information regarding health insurance offers and coverage to the Internal Revenue Service (IRS). Specifically designed for the Affordable Care Act (ACA) reporting, this form provides a comprehensive overview of an employer's health coverage offerings to their full-time employees, aiding the IRS in assessing compliance with the ACA mandates.

The form encompasses various sections that gather necessary data such as:

- Employer Identification Information: This includes the official name, address, and Employer Identification Number (EIN) of the ALE.

- Contact Information: Relevant contact details for the person responsible for the form’s preparation.

- Health Coverage Details: Information about the types of health insurance offered, including which employees are covered and the months for which coverage was available.

Understanding Form 1094-C's purpose helps employers fulfill their obligations to report accurately, thereby avoiding potential penalties for non-compliance.

How to Use Form 1094-C

Using Form 1094-C involves a systematic process that ensures compliance with IRS requirements. Employers must prepare and submit this form annually.

-

Determine Eligibility: First, verify that your organization qualifies as an Applicable Large Employer. This status is determined by having an average of 50 or more full-time employees, including full-time equivalent employees, during the previous calendar year.

-

Prepare the Form: Collect all necessary data, including employee coverage details, which may require input from your HR department and benefits administrators to ensure accuracy.

-

Filing Process: Form 1094-C must be filed along with the employee-specific Form 1095-C for each applicable employee. These documents can either be submitted electronically or via paper forms.

-

Deadlines: Be mindful of the filing deadlines. For the 2023 tax year, the form is typically due by March 31st if filed electronically, or by February 28th for paper submissions.

Effective use of Form 1094-C assists employers in maintaining compliance and minimizing the risk of IRS penalties.

Steps to Complete Form 1094-C

Completing Form 1094-C requires careful attention to detail to ensure all necessary information is accurately reported. Here is a step-by-step guide:

- Start with Employer Information: Fill in the basic details, including the legal name, trade name (if applicable), address, and EIN.

- Select the Reporting Method: Indicate whether you are reporting as a single employer or part of an aggregated ALE group.

- Provide Contact Information: Enter the name and phone number of the individual who can answer questions about the form.

- Health Coverage Information: Document each month of the year to indicate the months during which health coverage was offered to full-time employees.

- Complete Section for ALE Members: If your organization is part of a controlled group or an aggregated group, include the required information for each member of that group.

Each section of the form contains specific checkboxes and fields for data entry, ensuring employers have a clear path to completing their reporting responsibilities.

Who Typically Uses Form 1094-C

Form 1094-C is predominantly used by Applicable Large Employers (ALEs), defined as those with at least fifty full-time employees or full-time equivalent employees. Its primary users include:

- Corporations: Large corporations that offer health insurance to their employees must accurately report their coverage offerings.

- Nonprofits: Many nonprofit organizations that meet the ALE threshold also utilize this form to comply with ACA regulations.

- Government Entities: State and local governmental bodies providing healthcare benefits to employees use Form 1094-C.

In addition, small businesses that may be members of an ALE group are also required to comply by reporting their coverage using Form 1094-C alongside their 1095-C forms.

Important Terms Related to Form 1094-C

Familiarity with specific terminology associated with Form 1094-C is essential for accurate reporting. Some key terms include:

- Applicable Large Employer (ALE): A business entity that employs an average of 50 or more full-time employees during the preceding calendar year.

- Form 1095-C: A related form that provides detailed information about health insurance coverage offered to each full-time employee by the employer.

- Minimum Essential Coverage: A standard of health coverage that meets ACA requirements, which employers must offer to avoid penalties.

Understanding these terms not only aids in the correct completion of Form 1094-C but also helps employers navigate additional regulatory requirements effectively.

IRS Guidelines on Form 1094-C

The IRS provides comprehensive guidelines for completing and filing Form 1094-C. Key aspects of these guidelines include:

- Filing Requirements: Employers must file a Form 1094-C even if they had no full-time employees during the year, which necessitates reporting zeros in relevant sections.

- Correcting Errors: Should employers identify errors after submission, they are advised to submit a corrected Form 1094-C, marking it explicitly as corrected to avoid confusion.

- Retention of Records: Employers are required to keep copies of Form 1094-C and related documents for at least three years in case of an IRS audit or inquiry.

Familiarity with these guidelines is crucial to ensure compliance and mitigate potential penalties related to incorrect reporting.

Filing Deadlines for Form 1094-C

Understanding the filing deadlines for Form 1094-C is essential for compliance. The timelines for submission are as follows:

- Electronic Filing Deadline: For the 2023 tax year, the deadline for submitting Form 1094-C electronically is typically March 31st.

- Paper Filing Deadline: If opting to file a paper version, submissions are generally due by February 28th.

- Postmarked Deadline: When filing via mail, ensure that the form is postmarked by the respective due date to avoid penalties.

Being aware of these critical deadlines allows employers to maintain compliance and avoid fines for late submissions.